The ₹500 SIP Revolution: How Young Indians Are Building Wealth Small

Imagine starting your wealth journey with just the cost of a coffee and two samosas. That's the magic of a ₹500 SIP—Systematic Investment Plans in mutual funds that let young Indians dip their toes into the stock market without needing lakhs in the bank. As a finance enthusiast who's seen friends turn pocket money into real growth, I've watched this low-barrier revolution democratize investing across India.

No more waiting for that first salary bonus. Apps like Groww, Zerodha Coin, and Paytm Money have slashed entry points, making financial planning accessible to Gen Z and millennials in Mumbai chawls or Tier-2 towns.

My First ₹500 SIP: A Relatable Wake-Up Call

Picture this: Three years ago, I was a fresh grad in Mumbai, juggling freelance gigs and math tutoring. Rent ate half my income, but I craved financial freedom. Behavioral finance tells us most young folks fall into the “present bias” trap—spending now, saving later. I broke it by automating a ₹500 SIP into a large-cap equity fund.

Fast-forward: With rupee-cost averaging (buying more units when markets dip), my modest investment grew at ~12% annually (historical average, past performance no guarantee). Today, it's ₹22,000—enough for a solid emergency fund starter. It's not “get rich quick”; it's patient compounding, like sipping chai while your money brews.

Why ₹500 SIPs Are Changing India's Investing Landscape

India's mutual fund industry hit ₹67 lakh crore AUM by 2025 (AMFI data), with SIPs driving 70% inflows. Young investors (under 30) now contribute 40%—up from 10% a decade ago. Why? Low entry barriers via digital platforms.

- Democratization in action: No demat account hassles; start via UPI.

- Risk management baked in: Diversified funds spread bets across stocks.

- Indian twist: Fits our “jugaad” mindset—small, smart steps to big goals, like saving for Diwali or a wedding.

This shift counters our cultural saver-spender divide. Remember the joint family ethos? ₹500 SIPs modernize it for solo millennials building their own nests.

Real Case Study: Priya's Journey from Barista to Investor

Meet Priya, 24, from Bengaluru—a barista earning ₹25,000/month. She started a ₹500 SIP in a flexi-cap fund in 2023 amid market dips.

- Month 1: Invested ₹500, bought 10 units at ₹50 each.

- Market crash: Next month, same ₹500 snagged 16 units at ₹31.

- By 2026: Portfolio at ₹20,500 (assuming 11% CAGR; markets vary).

Priya's hack? Treating SIPs like a “forced savings jar.” She now has three ₹500 SIPs—one for goals, one for learning (index funds), one for fun (themed sectoral). No stock-picking stress; mutual fund managers handle it.

Disclaimer: Mutual fund investments are subject to market risks. Read scheme documents carefully. Past performance isn't indicative of future results. Consult a SEBI-registered advisor.

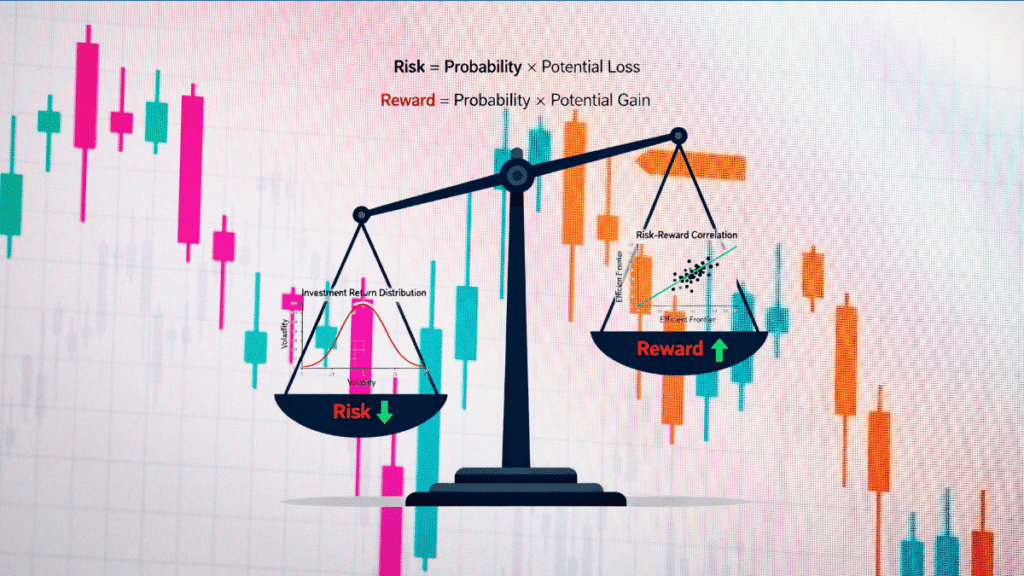

Behavioral Finance: Why Small Starts Beat Big Dreams

Our brains love instant gratification—think Zomato swipes over SIPs. But ₹500 SIPs use “nudges” from behavioral finance: Automation kills decision fatigue, small amounts dodge “loss aversion.”

Analogy: Like planting a neem tree sapling. Water it ₹500/month, and in 20 years, it's shade for your retirement. Rupee math: ₹500/month at 12% for 20 years = ~₹4.3 lakhs (use online SIP calculators for your numbers).

How to Start Your ₹500 SIP Today: Simple 5-Step Framework

Ready to join the revolution? Here's your beginner-friendly roadmap:

- Choose a platform: Apps like Groww or Kuvera—zero fees for direct plans.

- Pick a fund: Start with equity for growth (e.g., Nifty 50 index) or hybrid for balance. Match your 5+ year horizon.

- KYC & link bank: Aadhaar + PAN = done in 5 minutes.

- Set ₹500 SIP: Auto-debit on payday; pause anytime.

- Track & tweak: Review yearly, not daily—avoid emotional trades.

Pro tip: Ladder two ₹500 SIPs—one aggressive, one conservative—for risk management.

SEBI Note: We're not recommending specific funds. Investments in securities are market-linked and may go down in value.

The Cultural Shift: From Gold to SIPs

In India, gold was grandma's wealth weapon. Now, young Indians blend tradition with tech—₹500 SIPs as modern mangalsutras for financial security. It's philosophical: Wealth isn't hoarding; it's growing steadily, aligning with “karma yoga”—effort without attachment to outcomes.

Wrap-Up: Your Small Step to Big Wealth

The ₹500 SIP revolution proves anyone can enter the stock market arena. Start small, stay consistent, and let compounding work its magic. Track your progress on moniwise.in tools, and explore our free SIP calculator.

What's stopping you? Download an app today and invest your first ₹500. Share your story in comments—let's build wealth together!

All data from AMFI/SEBI public sources as of Feb 2026. Not investment advice.