Hedging Strategies Using Options in the Indian Market: A Beginner's Guide

If you've invested in stocks or equity mutual funds, you've probably wondered: “What if the market suddenly crashes?” The good news is that you don't have to sell your holdings or sit nervously watching red candles. This is where hedging strategies using options come into play—a smart way to protect your portfolio from unexpected downturns while staying invested.

In simple terms, hedging is like buying insurance for your investments. Just as you insure your car or home against damage, you can use options contracts to insure your stock portfolio against losses. This article will walk you through beginner-friendly hedging strategies, real-life examples, and actionable tips designed specifically for Indian investors trading on NSE and BSE.

What Is Hedging in the Stock Market?

Hedging is a risk management strategy where you take a position in the derivatives market to offset potential losses in your existing investments. Think of it as a safety net—when your stock portfolio falls, your hedge position gains value, cushioning the blow.

Why use options for hedging?

Options are financial contracts that give you the right (but not the obligation) to buy or sell an underlying asset at a predetermined price within a specific timeframe. Unlike futures, options have limited downside risk, making them ideal for retail investors who want protection without unlimited exposure.

The two main types of options used in hedging are:

- Put Options: Give you the right to sell a stock at a fixed price, protecting you if the stock falls.

- Call Options: Give you the right to buy a stock at a fixed price; used in strategies like covered calls to generate income.

Why Hedging Strategies Using Options Matter for Investors

Indian equity markets can be highly volatile, especially during uncertain times like elections, policy changes, RBI rate decisions, or global economic shocks. Without protection, your portfolio could suffer significant short-term losses even if you're a long-term investor.

Here's why hedging matters:

1. Protects Against Market Downturns

A protective put or collar strategy can cap your maximum loss at a predefined level, ensuring you don't lose more than you're comfortable with.

2. Reduces Emotional Decision-Making

When markets crash, panic selling is common. Hedging gives you peace of mind, allowing you to stick to your long-term investment plan without fear.

3. Maintains Upside Potential

Unlike selling your stocks, hedging lets you participate in future gains while limiting downside risk.

4. Cost-Effective Portfolio Insurance

Compared to liquidating positions and missing out on rallies, hedging with options is often more affordable, especially when implied volatility is low.

5. Flexibility for Different Market Conditions

You can tailor hedging strategies based on your risk tolerance, market outlook, and investment horizon.

Real-Life Example: Protecting Your Portfolio During Volatility

Imagine you own 100 shares of Reliance Industries trading at ₹2,000 per share. You're worried about short-term volatility but don't want to sell.

Solution: You buy a put option with a strike price of ₹1,900, expiring in one month, for a premium of ₹50 per share.

- If Reliance falls to ₹1,700: Your put option allows you to sell at ₹1,900. Your net loss = (₹2,000 – ₹1,900) + ₹50 premium = ₹150 per share instead of ₹300.

- If Reliance rises to ₹2,200: You lose only the ₹50 premium but enjoy the stock's upside of ₹200 per share.

This strategy, called a protective put, acts as insurance against sharp declines.

Top Hedging Strategies Using Options for Indian Investors

Let's explore the most popular and beginner-friendly hedging strategies you can implement in the Indian market:

1. Protective Put Strategy

What it is: You buy put options for stocks you already own.

How it works: The put option increases in value when the stock price falls, offsetting losses in your portfolio.

When to use it: During periods of anticipated short-term volatility, earnings season, or before major policy announcements.

Example: You hold 100 shares of HDFC Bank at ₹1,500. You buy a put option with a strike price of ₹1,400 at a premium of ₹50 per share.

- Maximum loss: ₹150 per share (₹100 + ₹50 premium)

- Upside potential: Unlimited minus the ₹50 premium

Pros:

- Simple to understand and execute

- Protects against severe downturns

- Preserves long-term holdings

Cons:

- Premium paid reduces overall returns if the stock remains stable or rises

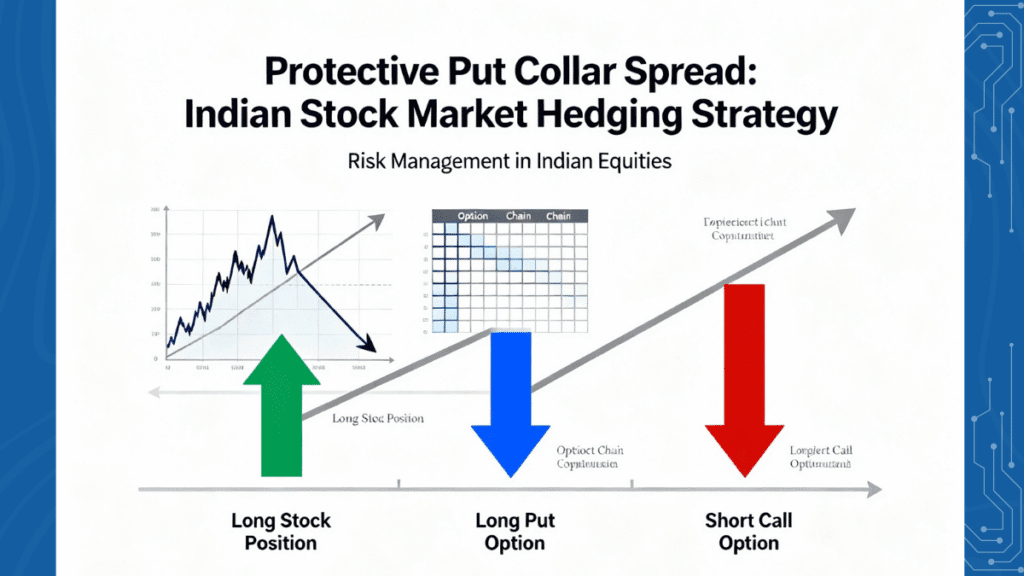

2. Collar Strategy

What it is: A combination of a protective put and a covered call—buy a put option and sell a call option simultaneously.

How it works: The premium received from selling the call offsets the cost of buying the put, reducing your net expense (sometimes to zero). In exchange, you cap your maximum profit.

When to use it: When you want low-cost or zero-cost protection and are willing to limit upside gains.

Example: You own Infosys shares at ₹1,400.

- Buy a ₹1,350 put @ ₹20 premium

- Sell a ₹1,500 call @ ₹22 premium

- Net credit: ₹2 per share

Outcome scenarios:

- Stock falls to ₹1,300: Put protects you; loss limited to around ₹50 per share

- Stock rises to ₹1,600: Profit capped at ₹100 per share (₹1,500 strike minus ₹1,400 cost)

- Stock stays around ₹1,400: You keep the net premium as profit

Pros:

- Cost-effective or even profitable upfront

- Defines both maximum loss and maximum gain

- Ideal for volatile markets

Cons:

- Upside gains are capped

- Requires monitoring two positions

3. Bull Put Spread

What it is: Sell an out-of-the-money (OTM) put and buy a further OTM put to limit risk.

How it works: You collect premium from selling the put. If the market stays above your sold put strike, you keep the premium. The bought put protects you if the market crashes.

When to use it: In mildly bullish or range-bound markets with moderate volatility.

Example: Bank Nifty at 48,000.

- Sell 48,000 put @ ₹180

- Buy 47,800 put @ ₹80

- Net credit: ₹100 per lot

Maximum profit: ₹100 × lot size

Maximum loss: (48,000 – 47,800) – 100 = ₹100 × lot size

Pros:

- Generates income while hedging

- Defined risk from the start

- Works well in sideways markets

Cons:

- Profit potential is limited

- Requires margin

4. Bear Call Spread

What it is: Sell an OTM call and buy a further OTM call to hedge upside risk.

How it works: Similar to bull put spread but used when you expect the market to remain flat or decline slightly.

When to use it: When resistance levels are being tested or in bearish-to-neutral conditions.

Example: Nifty at 22,000.

- Sell 22,200 call @ ₹100

- Buy 22,400 call @ ₹50

- Net credit: ₹50 per lot

Pros:

- Income generation

- Capped risk and reward

- Useful in declining markets

Cons:

- Limited profit

- Risk if market rallies sharply

5. Iron Condor Strategy

What it is: A combination of a bull put spread and a bear call spread—four options with different strikes, all with the same expiry.

How it works: You profit when the underlying asset stays within a defined range. Best for low-volatility, sideways markets.

When to use it: When India VIX is low and markets are range-bound.

Example: Nifty trading between 21,800 and 22,200.

- Buy 21,600 put

- Sell 21,800 put

- Sell 22,200 call

- Buy 22,400 call

Pros:

- High probability of profit in stable markets

- Defined risk and reward

- Lower margin requirements than naked positions

Cons:

- Requires precision in strike selection

- Limited profit potential

- Complex for beginners

Pro Tips: How to Choose the Right Hedging Strategy

- Start simple: Begin with protective puts before moving to multi-leg strategies like collars or iron condors.

- Match expiry to your risk horizon: Use monthly expiries for long-term protection; weekly options are cheaper but riskier.

- Check implied volatility (IV): Buy options when IV is low (cheaper premiums); avoid buying during high IV periods.

- Don't over-hedge: Hedge 50% to 80% of your portfolio value to balance cost and protection.

- Use liquid contracts: Stick to Nifty, Bank Nifty, or large-cap stocks with tight bid-ask spreads.

- Set stop-losses on hedges: Exit hedges when markets stabilize to avoid holding costs.

- Monitor Open Interest (OI): High OI at strike prices indicates strong support or resistance levels.

Common Mistakes to Avoid When Hedging with Options

1. Ignoring Time Decay (Theta)

Options lose value as expiry approaches. Buying far OTM options close to expiry often results in total loss.

2. Choosing Wrong Strike Prices

Avoid chasing cheap, far OTM options with low probability of profit. Focus on at-the-money (ATM) or slightly ITM options for better odds.

3. Neglecting Costs

Premium paid, brokerage, and taxes can add up. Calculate the break-even before entering any hedge.

4. Over-Hedging

Excessive hedging reduces potential gains and increases costs. Balance protection with profit potential.

5. Lack of Exit Plan

Define your profit target and maximum loss before entering a trade. Stick to your plan.

6. Trading Without Understanding Greeks

Delta, theta, and vega influence option prices. Learn basics before implementing complex strategies.

Expert Insights: When to Hedge Your Portfolio

Hedging isn't needed all the time. Here are situations when it makes sense:

- Before known events: Union Budget, RBI policy meetings, election results, or global economic announcements.

- After substantial gains: Protect profits in stocks that have rallied 30% or more.

- During low volatility: When option premiums are cheap, it's the best time to buy protection.

- Technical weakness signs: Breaking support levels, bearish chart patterns, or rising India VIX.

- Overconcentration risk: If a few stocks dominate your portfolio, hedging reduces exposure.

According to NSE data, spread strategies (which include hedging) reduced average trading losses by 23% compared to naked options positions. Hedging effectiveness in Indian equity futures markets is around 90% for Nifty contracts.

Cost-Benefit Analysis: Is Hedging Worth It?

Benefits:

- Protects against sharp market declines

- Reduces emotional stress and panic selling

- Allows long-term wealth creation without fear

- Cost-effective compared to liquidating positions

Costs:

- Premium paid reduces overall returns

- Requires market knowledge and monitoring

- May limit upside gains (especially in collar strategies)

- Transaction costs add up over time

Verdict: Hedging is worthwhile for investors with significant portfolio value, low risk tolerance, or those expecting short-term volatility. For small portfolios or long-term buy-and-hold investors, simple diversification may be more cost-effective.

Related Topics You Can Explore

- Read also: Understanding Options Greeks: Delta, Theta, and Vega

- Read also: How to Trade Nifty Options for Beginners

- Read also: Best Stock Market Strategies for Risk Management

How to Start with Hedging Strategies Using Options

Step 1: Open a Trading Account

Ensure your demat and trading account is enabled for F&O (Futures and Options) trading on NSE or BSE.

Step 2: Learn the Basics

Understand call and put options, strike prices, expiry dates, and premiums before trading.

Step 3: Start with Paper Trading

Practice hedging strategies on demo platforms to build confidence without risking real money.

Step 4: Choose Liquid Contracts

Begin with Nifty or Bank Nifty options, which have high liquidity and tight spreads.

Step 5: Implement Simple Strategies First

Start with protective puts, then move to collars and spreads as you gain experience.

Step 6: Monitor and Adjust

Track your hedges regularly. Exit when markets stabilize or your protection period ends.

Final Tip: Allocate only 1% to 3% of your portfolio capital per hedge to manage risk effectively.

Conclusion: Protect Your Wealth with Smart Hedging

Hedging strategies using options are powerful tools for Indian investors who want to protect their portfolios from market volatility without sacrificing long-term growth potential. Whether you choose a simple protective put, a cost-effective collar, or an advanced iron condor, the key is to match your strategy to your risk tolerance, market outlook, and investment horizon.

Remember, hedging is not about eliminating all risk—it's about managing it intelligently. By understanding when to hedge, how much to hedge, and which strategies to use, you can navigate volatile markets with confidence and preserve your hard-earned wealth.

Start small, learn continuously, and always prioritize risk management over chasing quick profits. The Indian derivatives market offers tremendous opportunities for those who approach it with discipline and knowledge.

Take Action Today: Review your portfolio, identify positions at risk, and explore hedging strategies that align with your financial goals. Your future self will thank you for the protection you put in place today.

FAQs About Hedging Strategies Using Options

Q1. What is the minimum amount needed to start hedging with options in India?

A1. You can start with as little as ₹10,000 to ₹20,000, depending on the option premium and lot size. Nifty and Bank Nifty options are popular for retail investors due to liquidity and affordability.

Q2. Is hedging safe for beginners in the Indian stock market?

A2. Hedging reduces risk but requires understanding of options basics, Greeks, and market conditions. Start with simple strategies like protective puts and paper trading before using real money.

Q3. How much does it cost to hedge a stock portfolio with options?

A3. The cost depends on option premium, which varies based on strike price, expiry, and implied volatility. Typically, protective put premiums range from 1% to 5% of stock value. Collar strategies can reduce or eliminate this cost.

Q4. What is the best time to hedge a portfolio using options?

A4. Hedge during low volatility periods when premiums are cheap, before major events (Budget, RBI meetings), after substantial portfolio gains, or when technical indicators suggest weakness.