THE ART OF JUGAAD FINANCE: INDIAN INNOVATION IN MONEY MANAGEMENT

What Is Jugaad, Really?

Picture this: You're trying to watch your favorite cricket match, but the TV signal keeps cutting out. What do you do? If you're Indian, you probably wrapped an old coat hanger around the antenna and suddenly—crystal clear reception. That's Jugaad.

Jugaad (जुगाड़) is far more than just a Hindi word or a life hack. It's a mindset deeply woven into Indian culture—one that celebrates resourcefulness, creative problem-solving, and making the best out of limited resources. But here's where it gets interesting: this same spirit can revolutionize how you manage your money.

Unlike the Western philosophy of “having more money to solve problems,” Jugaad finance asks a different question: “How can I solve this problem with what I already have?”

When tech entrepreneur Bryan Johnson visited India recently, he observed, “I like jugaad; most innovation comes from frugality.” He wasn't wrong. Our Indian Space Research Organisation (ISRO) launched Asia's first spacecraft to Mars on a budget smaller than the Hollywood film “Gravity”—a feat accomplished through pure Jugaad thinking and creative cost-cutting.

Why Jugaad Finance Matters Now More Than Ever

We're living in an age of infinite consumption. Every scroll on your phone presents a new product to buy, a new subscription to add, a new reason to spend. Credit card companies make borrowing feel effortless. EMI schemes make expensive purchases seem affordable. In this environment, Jugaad finance is not just about saving money—it's about reclaiming control of your financial destiny.

The art of Jugaad finance teaches us that wealth isn't built by earning more; it's built by keeping more of what you earn.

Financial planning in India faces unique challenges. Many of us juggle multiple financial responsibilities simultaneously—supporting parents, investing in children's education, managing EMIs, and saving for retirement. A Jugaad mindset helps you navigate these complexities without feeling financially suffocated. It's about being intentional with every rupee, not deprivative.

The Three Pillars of Jugaad Finance

Pillar 1: Resourcefulness Over Resources

The first principle of Jugaad finance is this: your financial limitations are not permanent obstacles; they're creative constraints.

During India's economic challenges in the 1990s, many entrepreneurs couldn't afford fancy office setups or expensive marketing. So what did they do? They innovated. They built low-cost solutions that eventually became world-class companies. Today's startup ecosystem thrives on this exact mentality.

Apply this to your personal finances. You don't need a ₹50,000 personal trainer; you can follow free YouTube fitness channels. You don't need expensive nutritionists; you can learn meal planning through community groups. You don't need premium financial apps; many free budgeting tools work just as well.

The question isn't “What do I need to buy to solve this problem?” It's “What do I already have that can solve this?”

Pillar 2: Mindful Spending, Not Deprivation

Here's a crucial distinction: Jugaad finance isn't about cutting corners or living miserably. It's about conscious, intentional spending.

Think about your monthly subscriptions—Netflix, Amazon Prime, Spotify, Gym membership, multiple OTT platforms. You probably don't actively use all of them. These “convenience costs” silently drain ₹2,000-5,000 monthly without adding real value.

A ₹200 monthly Netflix subscription doesn't seem like much, right? But over 40 years (assuming consistent pricing), that's ₹96,000. Now imagine if you invested that in a monthly SIP instead. At a modest 12% annual return, that same amount becomes ₹1,47,89,000.

This is where behavioral finance comes in. Your brain is wired for immediate gratification (what psychologists call System 1 thinking), not long-term wealth. Jugaad finance trains your brain to pause before spending and ask: “Is this a want or a need? Does this align with my financial goals?”

Pillar 3: Innovation in Ordinary Life

The most beautiful aspect of Jugaad is its creativity. Indians have transformed everyday challenges into innovative solutions:

- Mitticool refrigerator – An electricity-free cooling device made from clay (no electricity costs, purely Jugaad)

- Affordable healthcare startups – Telemedicine platforms disrupting expensive hospital visits

- SIP investing – Making stock market investing accessible to even small savers

- Community buying groups – Bulk purchasing without fancy wholesale clubs

These aren't Fortune 500 innovations. These are regular people solving problems creatively. Your financial journey deserves the same approach.

Real-Life Jugaad: Meet Priya's Budget Transformation

Priya, a 28-year-old marketing professional in Mumbai, was struggling with a ₹95,000 monthly salary that somehow never lasted till month-end. Despite earning well above average, her savings account rarely crossed ₹5,000.

“Where was my money going?” she wondered.

Instead of taking on extra work (the typical “earn more” advice), Priya applied Jugaad thinking:

Her Jugaad Finance Journey:

- Audit Phase – She listed every recurring expense for three months. The shock: ₹8,500 on subscriptions she barely used, ₹4,200 on daily coffee and lunch deliveries, ₹3,000 on impulse online shopping.

- Cut Phase – Not drastically, but smartly. She cancelled three streaming subscriptions and kept only one shared family account (saved ₹400/month). She prepared lunch at home four days a week (saved ₹2,800/month). She implemented a 7-day waiting period before online purchases (saved ₹900/month average).

- Redirect Phase – Those monthly savings of ₹4,100 were automatically transferred to her investment account every salary day.

Result: In 18 months, Priya accumulated ₹73,800. Combined with 11% returns from her equity SIP, her investment portfolio grew to ₹85,000. She wasn't earning more, but she was keeping more. That's Jugaad finance in action.

Behavioral Finance Meets Indian Frugal Wisdom

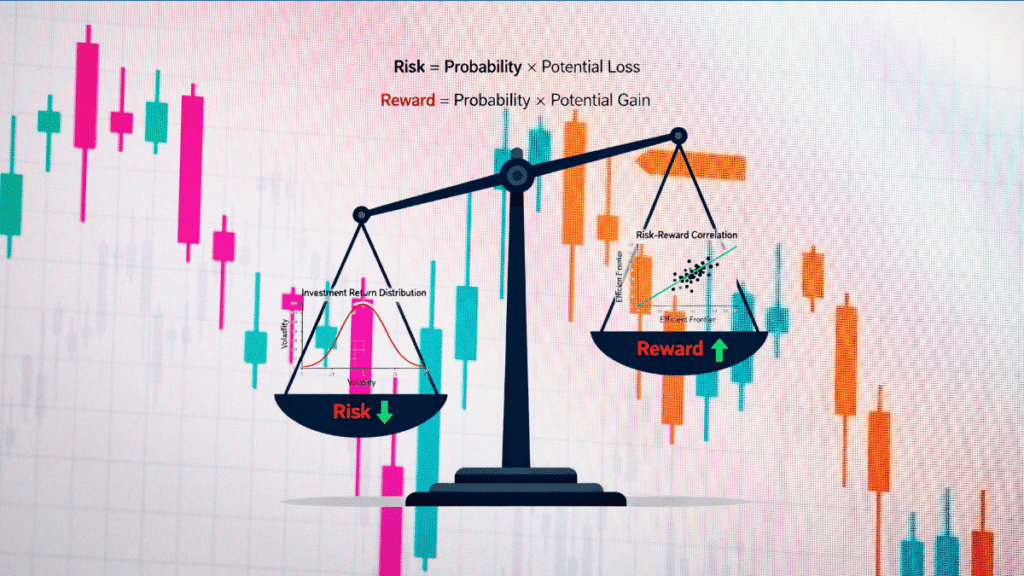

Traditional finance assumes we're rational decision-makers. We're not. Our brains are riddled with cognitive biases that sabotage financial health.

The Anchoring Effect

Remember when your real estate agent quoted ₹65 lakhs for a property, and suddenly ₹58 lakhs felt like a bargain? That first number (the anchor) permanently distorted your judgment. This is why credit card companies always show the “minimum payment” – it anchors you to affordability bias.

Jugaad antidote: Before any major purchase, establish your own number first. Research market rates, talk to multiple vendors, and avoid letting others set your anchor.

Loss Aversion Bias

Indians have a complicated relationship with loss. We hold losing stocks hoping to “break even,” keep expensive gym memberships we don't use (sunk cost fallacy), and maintain financial relationships that drain us.

Jugaad antidote: Regularly audit your financial life. If something isn't serving you, let it go. The ₹5,000 you're losing monthly on an unused subscription won't “come back” if you keep paying. Cut it now.

The Availability Heuristic

After hearing about a bank fraud, you avoid banks entirely and keep cash at home—despite the statistical impossibility of such events affecting you. After seeing a stock market crash news, you avoid equities despite long-term growth potential.

Jugaad antidote: Separate emotions from decisions. Make financial choices based on probability and data, not headlines.

The 50-30-20 Framework: Jugaad Edition

Traditional budgeting suggests 50-30-20 (necessities-discretionary-savings). But Indian financial realities are different. Many of us have complex family structures, medical emergencies, and unexpected responsibilities.

Here's the Jugaad adaptation:

- 40% Necessities – Rent, food, utilities, insurance (lower than Western models due to lower Indian costs)

- 20% Responsibilities – Family support, loans, debt repayment

- 20% Growth – Investments, skill development, emergency buffer

- 20% Living – Entertainment, hobbies, celebrations (you need joy, not just savings)

The beauty of this framework is flexibility. If one category swells unexpectedly, you adjust others creatively—not by cutting quality of life, but by finding Jugaad solutions.

Practical Jugaad Finance Strategies

Strategy 1: The Seasonal Sabzi Market Approach

Food typically consumes 25-30% of Indian household budgets. Jugaad here means seasonal eating.

In summer, buy mangoes and chikus in bulk (₹40-50/kg) instead of winter prices (₹80-100/kg). Preserve them, freeze them, or make chutneys. Visit sabzi mandis early morning for better prices. Grow your own microgreens on the windowsill.

A family implementing this saves ₹2,000-3,500 monthly on groceries without reducing nutrition.

Strategy 2: The DIY-First Rule

Before buying anything, ask: “Can I make this or find a free alternative?”

- Home maintenance: Learn basic plumbing from YouTube; save ₹1,500-2,000 on service calls

- Digital services: Use Canva (free) instead of expensive design agencies

- Fitness: Home workout apps instead of ₹2,000/month gym memberships

- Car washing: DIY wash vs. ₹500 professional service, done twice monthly = ₹12,000/year saved

Strategy 3: The 30-Day Rule

Impulse spending destroys budgets. Before any discretionary purchase above ₹2,000, wait 30 days. Write down the item, date, and reason for buying it.

Most often, you'll forget about it entirely. The occasional items you still want after 30 days were genuine needs.

Strategy 4: The Jugaad Investment Approach

You don't need ₹1 lakh to start investing. SIPs allow you to start with ₹500/month. This is pure Jugaad—accessing wealth-building tools with minimal resources.

Instead of trying to time the market (impossible, even for professionals), commit to consistent, small investments. ₹5,000/month at 12% returns compounds to ₹1.24 crore in 30 years.

Strategy 5: Community Over Consumption

Indian communities have historically solved problems collectively—buying groups, shared resources, skill exchanges.

Modern Jugaad revives this:

- Bulk buying groups – Share wholesale purchases with neighbors, divide savings

- Tool libraries – Share expensive equipment; you don't need to own a drill you use twice yearly

- Skill exchanges – Your cousin's accounting knowledge for your carpentry skills

- Bulk cooking – Coordinate with friends; cook in batches, share portions, reduce individual cooking time and costs

Must Read : - How to Start SIP with ₹1000 – Complete Beginner’s Guide

The Psychology of Jugaad: Why It Works

Jugaad finance works because it aligns with deep Indian cultural values. We're raised on “simple living, high thinking” (साधारण जीवन, उच्च विचार). We know that true wealth isn't just money in the bank; it's freedom, relationships, and peace of mind.

When you practice Jugaad finance, you're not fighting your cultural instincts; you're honoring them. This makes the practice sustainable rather than a temporary diet-like fad.

Additionally, Jugaad creates psychological wins. When you successfully navigate a problem creatively instead of throwing money at it, your confidence grows. You stop feeling victimized by expenses and start feeling empowered by your resourcefulness.

Common Jugaad Finance Myths Debunked

Myth 1: “Jugaad Finance = Poor and Struggling”

Reality: Jugaad is practiced by millionaires and billionaires. Warren Buffett, India's Dr. Arokiaswamy Velumani, and countless successful entrepreneurs practice extreme frugality. It's not about poverty; it's about principle.

Myth 2: “You Have to Sacrifice Quality of Life”

Reality: Jugaad eliminates wasteful spending, not joyful experiences. Cooking at home doesn't eliminate dining out; it makes eating out occasional and special. Cancelling unused subscriptions doesn't eliminate entertainment; it optimizes it.

Myth 3: “Jugaad Only Works for Small Expenses”

Reality: Some of the biggest Jugaad wins come from major expenses. Buying a used car instead of new (saves ₹2-3 lakhs, works just as well), refinancing your home loan (saves ₹50,000+ annually), or negotiating a salary increase (permanent monthly raise) represent massive Jugaad opportunities.

Building Your Jugaad Finance System

Month 1: Audit

- Track every expense for 30 days

- Identify wasteful subscriptions, impulse purchases, and unnecessary services

- Calculate annual waste (monthly waste × 12)

Month 2: Cut and Redirect

- Cancel wasteful subscriptions

- Implement the 30-day rule for purchases

- Automate transfers to savings/investment accounts

- Redirect monthly savings to growth

Month 3: Innovate

- Test DIY approaches in one area (cooking, fitness, learning)

- Join or create a community buying group

- Explore one new money-saving strategy

- Track results

Month 4+: Optimize and Evolve

- Review what worked; expand those strategies

- Look for larger Jugaad opportunities (career development, major purchases)

- Share your journey; inspire others

- Continuously ask: “What am I paying for that I can solve creatively?”

Must Read :- How to Invest 1000 Rupees in Share Market – Beginner Guide

The Math Behind Jugaad

Let's quantify what Jugaad finance can do for you:

| Strategy | Monthly Savings | Annual Savings | 30-Year Value (12% returns) |

|---|---|---|---|

| Eliminate ₹3,000 monthly waste | ₹3,000 | ₹36,000 | ₹88.5 lakhs |

| Reduce food costs by ₹2,000 | ₹2,000 | ₹24,000 | ₹59 lakhs |

| Cancel unused subscriptions (₹1,500) | ₹1,500 | ₹18,000 | ₹44.2 lakhs |

| DIY savings (repairs, services) | ₹1,000 | ₹12,000 | ₹29.5 lakhs |

| Total Combined Impact | ₹7,500 | ₹90,000 | ₹2.21 crore |

That ₹7,500 monthly saving—achievable through pure Jugaad thinking without lifestyle sacrifice—becomes ₹2.21 crore in 30 years. That's financial freedom. That's generational wealth. That's the power of Indian resourcefulness applied to modern money management.

The ₹7,500 you save monthly through Jugaad isn't just money; it's your ticket to financial freedom. It's your insurance against uncertain times. It's the legacy of Indian wisdom applied to modern challenges.

Jugaad finance isn't a poverty mindset; it's an abundance mindset masquerading as frugality. It's the recognition that true wealth isn't about earning more—it's about keeping more and channeling that toward meaningful growth.

SEBI Compliance & Investment Disclaimer

While Jugaad finance focuses on savings and frugal living, combining it with investment strategies requires caution. Any investment decisions should be made after consulting qualified financial advisors and considering your risk profile, investment horizon, and financial goals.

Historical returns shown are illustrative and based on long-term market averages. Past performance doesn't guarantee future results. Investments in securities are subject to market risks. Please read all related documents before investing.