The Priya, Kavitha, Amina Story: Three Friends, One Market Crash, Three Different Fates

March 2020 changed everything. As COVID-19 spread across India, the stock market collapsed with terrifying speed. On March 23, 2020, the Sensex crashed 3,935 points—a 13.15% fall in a single day. Within weeks, ₹13.95 lakh crore in market value vanished.

Three friends—Priya, Kavitha, and Amina—watched their portfolios bleed red. All three were beginner investors with similar portfolios worth around ₹5 lakh each. They had invested in blue-chip stocks like HDFC Bank, Reliance, and TCS, along with equity mutual funds.

But their reactions to the crash couldn't have been more different. And those reactions would determine their financial futures for years to come.

Meet the Three Friends

Priya was a 28-year-old software engineer from Bengaluru. Logical, analytical, but also anxious about losses. She checked her portfolio daily and read every financial news update.

Kavitha was a 30-year-old marketing manager from Chennai. Optimistic by nature, she often made decisions based on gut feelings rather than research. She believed in timing the market perfectly.

Amina was a 29-year-old teacher from Mumbai. Social and well-connected, she loved discussing investments with friends and colleagues. She trusted crowd wisdom and believed safety lay in numbers.

When the market crashed, each friend's personality became their investment destiny.

Act One: The Crash (March 2020)

Priya's Panic

The morning of March 23, 2020, Priya woke up to a flood of notifications. Her portfolio was down 35% from its peak. HDFC Bank had fallen from ₹1,200 to around ₹750. Reliance had dropped to ₹1,061. TCS was bleeding too.

Her heart raced. She saw news headlines screaming about economic collapse, lockdowns, and recession. Fear gripped her throat. “What if it falls further? What if I lose everything?”

Within two hours of market opening, Priya sold everything. She converted her entire portfolio to cash, locking in a loss of nearly ₹1.75 lakh. Her ₹5 lakh investment became ₹3.25 lakh.

She told herself she made the smart choice. “I'll wait for the market to stabilize, then buy back in,” she reasoned. But this was loss aversion bias at work—the psychological principle that makes losses feel twice as painful as equivalent gains. Research shows this emotional pain causes investors to make irrational decisions during downturns.

Priya had fallen victim to panic selling—one of the most wealth-destroying behaviors in investing.

Kavitha's Lucky Bet

Kavitha watched the same crash with different eyes. Yes, her portfolio was down 35% too. But she saw an opportunity.

“This is the bottom! Time to buy!” she thought. On March 24, she transferred an additional ₹2 lakh from her savings and bought more shares of IT stocks and pharma companies. She had no deep analysis—just a strong feeling that these sectors would bounce back quickly.

She was right, but for the wrong reasons.

IT and pharma stocks recovered faster than most sectors. Her timing was purely accidental. Kavitha didn't know about stimulus packages, Federal Reserve policies, or sector fundamentals. She just got lucky.

This was overconfidence bias at play. Kavitha's success would later convince her that she had a special talent for timing markets—a dangerous belief that would cost her dearly in future investments.

Amina's Herd Mentality

Amina didn't know what to do. So she did what felt natural—she asked everyone around her.

Her colleague Rajesh had sold everything. Her neighbor's brother worked in finance and said, “Everyone is pulling out. This is just the beginning of the crash.” Her WhatsApp investment group was filled with panic. Out of 15 members, 12 had either sold or were planning to sell.

The pressure was immense. “If everyone is selling, they must know something I don't,” Amina thought. By March 25, she had sold 70% of her holdings, keeping only her SIP mutual funds running because she'd forgotten to stop them.

This was classic herd mentality bias—the tendency to follow the crowd's actions rather than one's own analysis. Research shows that during the 2020 crash, investors who followed the herd locked in massive losses while those who stayed disciplined recovered their wealth.

Amina felt safe because she wasn't alone in her decision. But safety in numbers doesn't apply to stock markets.

Act Two: The Recovery (April 2020 – February 2021)

What happened next shocked everyone.

By April 2, 2020, the Nifty 50 started climbing. The government announced a ₹20 lakh crore stimulus package. The Reserve Bank of India slashed interest rates to nearly zero. Global central banks pumped liquidity into markets.

The recovery was breathtakingly fast—the fastest in 150 years of stock market history.

By August 2020, the S&P 500 had surged 27% from its lows and hit new records. Indian markets followed. By February 2021, the Sensex had climbed 68% from its March 2020 lows. Many stocks reached all-time highs.

Blue-chip stocks that had crashed bounced back strongly. TCS recovered to pre-COVID levels within 6 months. HDFC Bank doubled within a year. Reliance raised ₹1.68 lakh crore during the crisis and emerged even stronger.

Priya's Regret

Priya watched from the sidelines. She had cash, but fear paralyzed her.

“What if this is a temporary bounce? What if it crashes again?” she kept asking herself. She waited for the “perfect” entry point that never came. Every time she thought about buying back in, the market had already climbed higher.

By February 2021, the Sensex was at record highs. Her ₹3.25 lakh remained ₹3.25 lakh. Meanwhile, if she had simply held her original portfolio, it would have recovered to ₹6 lakh—a 20% gain over her initial ₹5 lakh investment.

Priya lost twice—once when she sold at the bottom, and again when she missed the recovery. This is the brutal mathematics of panic selling.

Kavitha's Windfall

Kavitha's portfolio exploded. Her IT and pharma bets paid off spectacularly. By February 2021, her total investment of ₹7 lakh (₹5 lakh original + ₹2 lakh additional) had grown to approximately ₹11 lakh.

She felt like a genius. She started giving investment advice to friends. She day-traded more frequently, convinced she had cracked the market code.

But here's what Kavitha didn't understand: her success was mostly luck, not skill. She had accidentally bought at the bottom without proper analysis. Her overconfidence was growing dangerously, setting her up for massive losses in future market corrections.

Research shows that investors who attribute luck to skill tend to take excessive risks, leading to eventual portfolio destruction.

Amina's Bitter Lesson

Amina's story fell somewhere in between. Her 70% sale locked in significant losses. But her forgotten SIP mutual funds continued running throughout the crash.

Those SIP investments—which she'd started at ₹10,000 per month—bought units at rock-bottom prices during March-May 2020. This was rupee cost averaging at work. By buying consistently at low prices, her average purchase cost dropped dramatically.

By February 2021, her SIP portfolio had grown 40% from its low point. But her manually sold stocks never recovered because she'd exited them.

Her final portfolio value: approximately ₹3.8 lakh. Better than Priya's, but far worse than if she'd just done nothing and held on.

Amina learned the hard way that herd mentality protects neither your capital nor your returns.

Act Three: The Lessons (2021 – Present)

Fast forward to 2024. The three friends meet for coffee to discuss their investment journeys.

What Priya Learned

Priya's panic cost her dearly, but it taught her crucial lessons about loss aversion and emotional investing.

She now understands that her brain is hardwired to feel losses twice as strongly as gains. This psychological quirk—documented in Nobel Prize-winning research—explains why she panicked.

Today, Priya has rebuilt her portfolio with a different approach:

- Asset allocation planning – She maintains 70% equity and 30% debt, rebalancing regularly

- SIP discipline – She invests ₹15,000 monthly regardless of market conditions

- Limited market checking – She reviews her portfolio quarterly, not daily

- Written investment plan – Before any decision, she checks if it aligns with her long-term goals

Her portfolio has recovered, though it took years to rebuild. As of 2024, her total investments are worth ₹8.5 lakh—respectable, but she'd have ₹15+ lakh if she'd never panicked.

What Kavitha Discovered

Kavitha's overconfidence eventually caught up with her. In 2021, she tried to time the crypto market and lost ₹3 lakh in speculative bets. Her 2020 success had convinced her she could consistently predict market movements—a dangerous illusion.

By 2023, she'd given up day trading and hired a financial advisor. She learned that timing the market is nearly impossible, even for professionals.

Her key realizations:

- Luck isn't skill – One successful bet doesn't make you Warren Buffett

- Time in market beats timing the market – Consistent long-term investing outperforms speculation

- Risk management matters – Her gains were wiped out by subsequent losses due to poor risk control

Today, Kavitha invests conservatively. Her current portfolio value: ₹9.2 lakh. Still ahead of Priya, but far below where she could have been with disciplined investing from the start.

What Amina Understood

Amina's experience with herd mentality transformed her investment philosophy.

She realized that following the crowd feels safe but often leads to poor outcomes. During the 2020 crash, 80% of investors who panic-sold based on herd behavior missed the subsequent recovery.

Her turning point came when she analyzed her forgotten SIP investments. Those automated investments—made without emotion or group consultation—had outperformed her manually managed portfolio by 35%.

Today, Amina's investment strategy focuses on:

- Independent research – She makes decisions based on data, not WhatsApp groups

- Systematic investing – She runs multiple SIPs totaling ₹25,000 monthly

- Ignoring market noise – She unsubscribed from panic-inducing news channels

- Long-term perspective – Her investment horizon is 15+ years for retirement planning

Her portfolio has grown steadily. Current value: ₹10.5 lakh—the best performer among the three friends because she learned to invest independently.

The Psychology Behind the Outcomes

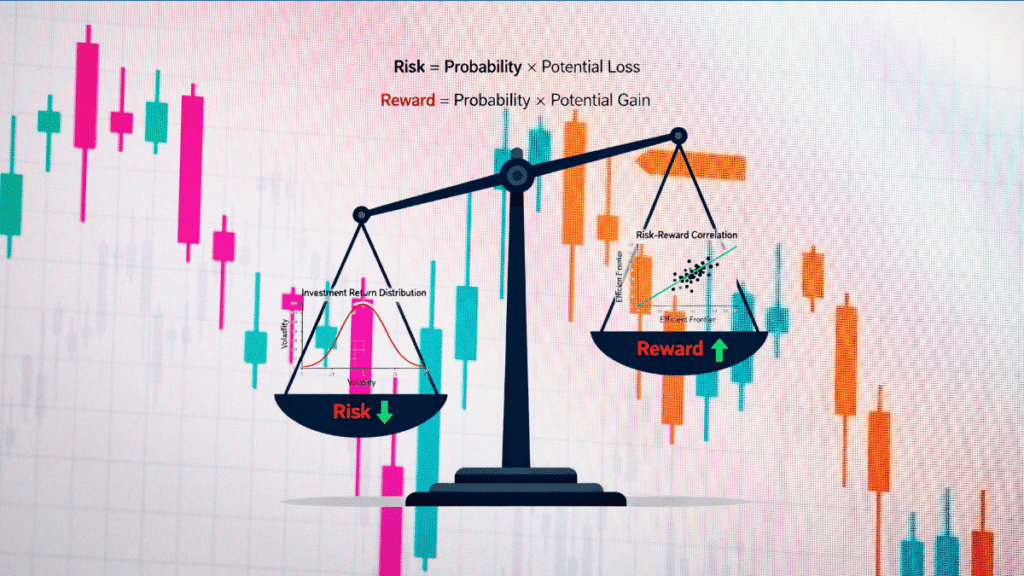

Why did three similar people have such different fates? Behavioral finance provides the answers.

Fear and Greed Cycle

Markets are driven by two powerful emotions—fear and greed. During bull markets, greed pushes investors to buy aggressively at peaks. During crashes, fear triggers panic selling at bottoms.

Both emotions destroy wealth. Priya fell victim to fear. Kavitha got caught in greed. Amina experienced both through herd pressure.

Loss Aversion in Action

Research proves that humans experience losses 2-3 times more painfully than equivalent gains. This explains why a ₹1 lakh loss feels devastating while a ₹1 lakh gain feels merely satisfying.

Loss aversion causes investors to:

- Sell winning investments too early (fear of losing gains)

- Hold losing investments too long (hope for recovery)

- Make impulsive decisions during volatility (panic to avoid further losses)

All three friends experienced these behaviors.

Herd Behavior and Information Cascades

Herd mentality isn't stupidity—it's evolutionary hardwiring. For thousands of years, following the group kept humans safe from predators. But in financial markets, this instinct backfires.

Studies of the 2020 crash showed that investors who followed the crowd had 40% worse outcomes than those who stuck to their plans. The herd is usually wrong at critical turning points.

Overconfidence Bias

Overconfident investors believe they can outperform the market through superior timing or stock picking. Research shows that 95% of active traders underperform simple buy-and-hold strategies over 10 years.

Kavitha's lucky 2020 bet fed her overconfidence, leading to costly mistakes later.

Practical Lessons for Indian Investors

What can you learn from Priya, Kavitha, and Amina's journeys?

1. Build a Written Investment Policy

Write down your goals, risk tolerance, asset allocation, and investment horizon. When markets crash, refer to this document instead of making emotional decisions.

2. Embrace SIP Discipline

Systematic Investment Plans automate investing and remove emotion from the equation. During market crashes, SIPs buy more units at lower prices, improving long-term returns dramatically.

As of March 2025, SIP inflows in India reached ₹25,926 crore monthly—showing growing investor trust in this disciplined approach.

3. Understand Market Cycles Are Normal

The stock market crashes every few years. Since 1987, India has experienced 8 major crashes. All of them recovered eventually.

If you invest for 20+ years, you will experience at least one 50% crash. That's not failure—that's normal investing reality.

4. Diversify and Rebalance

Spread investments across asset classes—equity, debt, gold. Rebalance annually to maintain your target allocation. This mechanical process books profits and controls risk without emotional interference.

5. Limit Market Exposure

Checking your portfolio daily increases anxiety and triggers emotional decisions. Review investments quarterly or annually instead. Constant monitoring adds stress without adding returns.

6. Educate Yourself About Biases

SEBI has launched multiple investor education initiatives to help Indians recognize and overcome behavioral biases. Research shows that investors who complete financial education programs reduce impulsive trading by 20%.

Understanding your psychological biases is as important as understanding financial fundamentals.

The Math That Changes Everything

Let's see what would have happened if all three friends had simply done nothing and held their investments:

Original investment (March 2020): ₹5 lakh

Portfolio value after crash (March 23, 2020): ₹3.25 lakh (35% loss)

Portfolio value after recovery (February 2021): ₹6 lakh (20% gain from original)

Portfolio value (November 2024): Approximately ₹12-14 lakh (assuming 12% annual returns)

By doing absolutely nothing—no panic, no timing, no herd following—they could have nearly tripled their money in 4.5 years.

Instead, their actual outcomes were:

- Priya: ₹8.5 lakh (panic selling penalty: ₹3.5-5.5 lakh lost)

- Kavitha: ₹9.2 lakh (overconfidence penalty: ₹2.8-4.8 lakh lost)

- Amina: ₹10.5 lakh (herd mentality penalty: ₹1.5-3.5 lakh lost)

The cost of emotional investing? Lakhs of rupees in lost wealth.

Start Trading with Zero Brokerage!

Join 950,000+ traders on India's fastest trading platform

Join Dhan Now →The Surprising Truth About Market Crashes

Here's what most investors don't realize: crashes are wealth creation opportunities, not wealth destruction events.

When markets crash 30-40%, quality businesses don't suddenly become worthless. Their fundamental value remains largely intact. Only the price falls—temporarily.

Investors who bought blue-chip stocks during the March 2020 crash saw extraordinary returns:

- TCS: Recovered to pre-COVID levels in 6 months, then gained another 50%+ by 2024

- HDFC Bank: Doubled within a year of the crash

- Reliance: Raised massive capital and grew stronger during the crisis

The fastest wealth creation happens during and immediately after crashes—but only if you have the emotional discipline to invest when everyone else is panicking.

Where Are They Now?

Today, all three friends continue investing, but with transformed mindsets.

Priya has become an advocate for emotional discipline. She runs a small YouTube channel teaching others about behavioral biases in investing. Her portfolio grows steadily through disciplined SIPs.

Kavitha admits her 2020 success was luck, not genius. She's studying for CFP certification to become a financial planner—learning proper investment principles instead of relying on gut feelings.

Amina helps other teachers in her school understand the dangers of herd mentality. She's started a financial literacy club where members make independent, research-based investment decisions.

All three are doing better financially than in 2020. But they'll never forget March 23, 2020—the day that taught them that psychology, not intelligence, determines investment success.

Your Turn: What Would You Have Done?

Imagine yourself in March 2020. Your portfolio is down 35% in days. News headlines scream doom. Friends are panic-selling. Market “experts” predict further crashes.

What would you do?

Option A: Sell everything to “preserve capital” (Priya's choice)

Option B: Buy more because “it's the bottom” (Kavitha's choice)

Option C: Follow what everyone else is doing (Amina's choice)

Option D: Do nothing, stick to your plan, keep your SIPs running

Most investors would choose A, B, or C. But wealth compounds through Option D.

The hardest—and most profitable—thing to do during a crash is nothing at all.

Final Thoughts: Psychology Is Everything

Warren Buffett famously said, “Be fearful when others are greedy, and be greedy when others are fearful.”

Easy to quote. Impossibly hard to practice.

The 2020 crash proved that your investment success depends less on your financial knowledge and more on your emotional control. Priya knew about compound interest. Kavitha understood PE ratios. Amina had read investment books.

None of that knowledge saved them from their psychological biases.

What would have saved them? Three simple things:

- A written plan created before the crisis

- Automated investments that continue regardless of emotions

- Understanding their own psychological weaknesses

The next market crash is coming. We don't know when, but it's inevitable.

When it arrives, will you be Priya, Kavitha, or Amina? Or will you be the investor who stays calm, sticks to their plan, and builds lasting wealth while others panic?

Your psychology will decide. Choose wisely.

Key Takeaways

✓ Market crashes are normal—expect one every few years in your investing lifetime

✓ Panic selling locks in losses and misses recovery opportunities

✓ Getting lucky once doesn't make you a market-timing expert

✓ Following the herd feels safe but often leads to poor outcomes

✓ SIPs and automated investing remove emotion from investment decisions

✓ Loss aversion makes us feel losses twice as painfully as gains

✓ Quality blue-chip stocks recover faster from crashes than smaller companies

✓ The fastest wealth creation happens during and after crashes—if you stay invested

✓ Your psychology matters more than your IQ in investing success

✓ A written investment plan is your best defense against emotional decisions

Disclaimer: This article is for educational purposes only and should not be considered investment advice. Past performance doesn't guarantee future results. The scenarios described are illustrative. Market investments carry risks. Please consult a SEBI-registered financial advisor before making investment decisions. Do your own research before investing.

FAQ

Q1: What should I do if the stock market crashes?

A: Stay calm and stick to your written investment plan. Avoid panic selling, which locks in losses. Continue your SIPs to buy units at lower prices. Review your asset allocation and rebalance if needed. Don't make emotional decisions based on news headlines or what others are doing. Remember that all major market crashes in history have eventually recovered.

Q2: How long does it take for the stock market to recover after a crash?

A: Recovery time varies. The 2020 COVID crash recovered in just 4 months—the fastest in history. The 2008 financial crisis took about 5 years. On average, major crashes recover within 1-3 years if you stay invested. Panic selling extends your personal recovery time indefinitely because you miss the rebound.

Q3: What is loss aversion bias in investing?

A: Loss aversion is a psychological bias where people feel the pain of losing money about twice as strongly as the pleasure of gaining the same amount. This causes investors to make irrational decisions during market downturns, like panic selling at the worst possible time or holding losing investments too long hoping they'll recover.

Q4: Are SIPs better than lump sum investment during market crashes?

A: SIPs (Systematic Investment Plans) offer emotional advantages during volatility. They automate investing, removing the need to time markets. During crashes, SIPs buy more units at lower prices through rupee cost averaging. This disciplined approach typically outperforms attempts to time market bottoms, which even experts struggle to do consistently.

Q5: How can I avoid herd mentality when investing?

A: Make investment decisions based on your own research and written financial plan, not what friends or WhatsApp groups recommend. Limit exposure to market noise and panic-inducing news. Focus on long-term goals rather than short-term market movements. Remember that the crowd is usually wrong at major market turning points. Independent thinking and discipline build wealth.

Q6: What are the most common psychological biases that hurt investors?

A: The main biases are: (1) Loss aversion—feeling losses more painfully than gains; (2) Herd mentality—following the crowd instead of your plan; (3) Overconfidence—believing you can consistently time markets; (4) Recency bias—overweighting recent events; (5) Panic selling—exiting at bottoms during crashes. Understanding these biases is crucial for investment success.

Q7: Should I sell my investments when the market is falling?

A: Generally no, unless your personal circumstances have fundamentally changed. Selling during crashes locks in losses and causes you to miss recoveries. Quality businesses don't lose their fundamental value just because stock prices temporarily fall. Review your asset allocation and risk tolerance, but avoid impulsive decisions driven by fear. Most wealth destruction happens through panic selling, not market crashes themselves.

Q8: How much did Indian stocks recover after the March 2020 crash?

A: The recovery was remarkable. By February 2021, the Sensex had climbed 68% from its March 2020 lows. Blue-chip stocks like TCS recovered in 6 months, HDFC Bank doubled within a year, and many stocks reached all-time highs. Investors who stayed invested or continued their SIPs during the crash saw significant wealth creation.

Must Read : – Hedging Strategies Using Options in the Indian Market

Must Read : – You’re Losing Money Without Knowing It — Here’s How to Stop

Step 1: Create a Written Investment Plan Before the Crash

Document your goals, risk tolerance, asset allocation (example: 70% equity, 30% debt), investment horizon, and rebalancing schedule. Update this plan annually. During a crash, refer to this document instead of making emotional decisions based on fear or market panic.

Step 2: Set Up Automated SIPs

Start Systematic Investment Plans in diversified equity mutual funds. Automate monthly investments of an amount you can sustain for 10+ years. SIPs continue buying during market lows, reducing your average purchase cost through rupee cost averaging.

Step 3: Diversify Across Asset Classes

Spread investments across equity (large-cap, mid-cap, small-cap), debt funds, gold, and international funds. Proper diversification reduces portfolio volatility and prevents emotional reactions when one asset class underperforms.

Step 4: When the Crash Happens, Do Nothing

This is the hardest but most important step. Don't check your portfolio daily. Don't read panic-inducing news constantly. Don't follow what others are doing. Trust your written plan and let your automated SIPs continue running.

Step 5: Review and Rebalance (Don't React)

After major market movements, check if your asset allocation has shifted significantly. If your 70% equity target has become 60% due to the crash, rebalance by moving some debt to equity. This mechanical process removes emotion from decision-making.

Step 6: Avoid These Fatal Mistakes

Don't panic sell at market bottoms. Don't try to time the perfect entry or exit. Don't follow herd mentality or WhatsApp investment groups. Don't let overconfidence from one lucky bet convince you that you can consistently beat the market. Don't make major changes based on short-term volatility.

Step 7: Educate Yourself on Behavioral Biases

Learn about loss aversion, herd mentality, overconfidence, and recency bias. Recognizing these psychological traps in yourself is half the battle. SEBI offers free investor education programs—take advantage of them.

Step 8: Focus on Time in Market, Not Timing

Stay invested for 15+ years through multiple market cycles. Historical data shows that investors who remained invested through crashes dramatically outperformed those who tried to time entries and exits. Patience and discipline create lasting wealth.