Why Living with Parents in Your 20s is Financial Wisdom, Not Failure

“Might get me cancelled but: Living with parents in your mid-20s isn't a ‘failure'—it's financial wisdom in a world where rent eats 50% of your income.”

This viral post by Aryan Kochhar, co-founder of fintech platform FinFloww, sparked a massive debate online in early 2025. Some called it lazy. Others called it brilliant. But the numbers? They tell an undeniable story.

If you're a young Indian professional feeling guilty about staying at home while your friends post Instagram stories from their “independent” rented flats, this article is for you. We're going to flip the script on Western independence norms and show you exactly how joint living can be your greatest wealth-building superpower.

The Uncomfortable Truth: Rent is Eating Your Future

Let's start with some sobering statistics. In Mumbai, a modest 1BHK apartment in the suburbs now costs ₹35,000-₹60,000 per month. In Bengaluru, average rent has jumped to ₹36,772 from ₹31,787 in just one quarter. Even “affordable” cities like Noida have seen a 63.3% rent increase since 2019.

Now here's where it gets painful.

If you're a fresher earning ₹3-6 lakh per year (the typical range for most graduates), that's roughly ₹25,000-₹50,000 per month in-hand. A basic 1BHK in any metro city will consume 50-83% of your income just in rent.

Think about that. Before you've bought groceries, paid electricity bills, or had a single meal, half your salary has vanished into your landlord's pocket.

As Kochhar put it bluntly: “Keep chasing ‘independence' while you're broke, lonely, and eating ramen for dinner”.

The ₹56 Lakh Calculation That Changes Everything

Let me show you the real mathematics of “independence” versus staying home. Let's take a 25-year-old professional earning ₹50,000 per month.

Scenario A: Living Independently

| Expense | Monthly Amount |

|---|---|

| Rent (1BHK, suburbs) | ₹25,000 |

| Utilities | ₹3,000 |

| Food & Groceries | ₹8,000 |

| Transport | ₹3,000 |

| Entertainment | ₹3,000 |

| Miscellaneous | ₹3,000 |

| Total Expenses | ₹45,000 |

| Monthly Savings | ₹5,000 |

Scenario B: Living with Parents

| Expense | Monthly Amount |

|---|---|

| Contribution to home | ₹10,000 |

| Food expenses | ₹3,000 |

| Transport | ₹2,000 |

| Entertainment | ₹3,000 |

| Miscellaneous | ₹2,000 |

| Total Expenses | ₹20,000 |

| Monthly Savings | ₹30,000 |

The difference? A whopping ₹25,000 extra savings every single month—that's 6x more money working for your future.

When Compound Interest Becomes Your Best Friend

Here's where the magic happens. Let's say both individuals invest their savings in equity mutual funds through SIPs, earning an average 12% annual return (historical average for diversified equity funds).

| Timeline | Living Independently | Living with Parents | Wealth Advantage |

|---|---|---|---|

| 5 Years | ₹4.05 Lakhs | ₹24.33 Lakhs | ₹20.28 Lakhs |

| 7 Years | ₹6.44 Lakhs | ₹38.64 Lakhs | ₹32.20 Lakhs |

| 10 Years | ₹11.20 Lakhs | ₹67.21 Lakhs | ₹56.01 Lakhs |

Read that last number again. By age 35, the person who lived with parents has built nearly ₹67 lakhs in investments—almost enough for a down payment on a house in many cities. Meanwhile, their “independent” friend has just ₹11 lakhs.

This isn't about deprivation. It's about strategic delayed gratification.

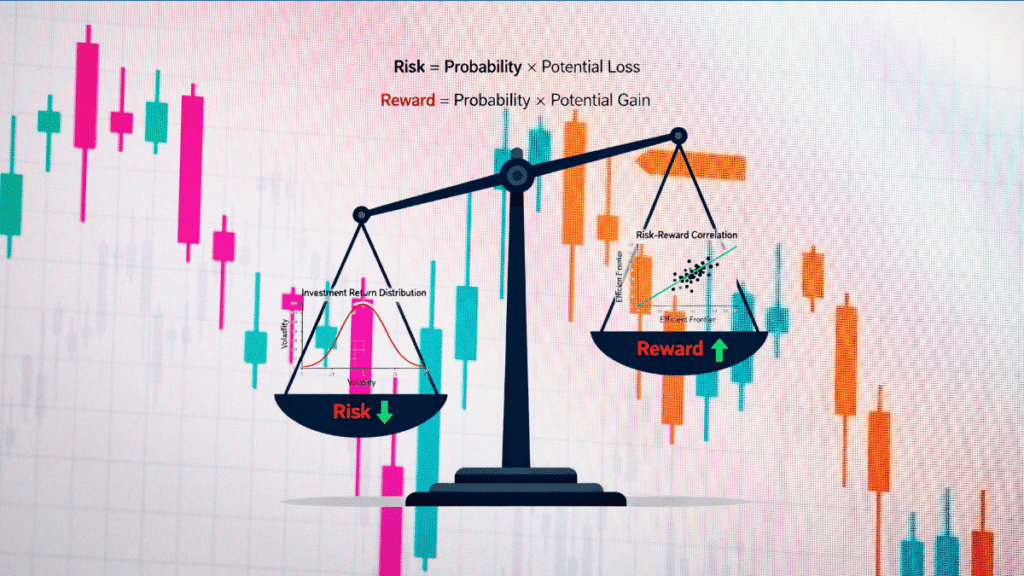

The True Cost of “Independence”

Let's flip the perspective. Over 10 years, if you pay ₹25,000 monthly rent, you'll have handed over ₹30 lakhs to landlords. That money is gone forever—no equity, no returns, no appreciation.

But here's the real kicker: if that same ₹25,000 was invested monthly in SIPs at 12% returns, it would grow to approximately ₹56 lakhs.

The opportunity cost of renting isn't just the rent itself—it's the compounded wealth you could have built. As one financial expert noted, property rental yields in India hover around just 2-3%, while equity mutual funds historically deliver 10-12% annually.

Why India's Joint Family System is a Financial Superpower

Here's what Western financial advice completely misses: the Indian joint family system isn't a sign of failure—it's an evolved economic collective that has survived for centuries.

Economic Advantages of Joint Living:

- Pooled resources reduce per-person costs for housing, utilities, and household management

- Shared responsibilities mean lower spending on domestic help, childcare, and eldercare

- Emergency resilience—when one family member faces a job loss, the collective provides support

- Intergenerational wealth transfer happens more efficiently when families live together

As a study on Indian family systems notes: “Joint families provide economic stability, emotional security, and strong cultural identity”. These aren't just abstract benefits—they translate directly into rupees saved.

The FIRE Movement's Open Secret

Here's something most FIRE (Financial Independence, Retire Early) enthusiasts won't advertise: many of them achieved their goals by living with family.

A recent survey shows 67% of Indians are contemplating early retirement, with some targeting age 33. The FIRE formula requires saving 50-75% of your income and accumulating 25 times your annual expenses.

Now ask yourself: How can someone saving ₹5,000 monthly ever achieve FIRE? But someone saving ₹30,000 monthly? That's a different story entirely.

As Kochhar himself noted: “Most founder friends I have live at home, have dal chawal, and have more net worth than most people in their 20s. No generational wealth btw. It's a simple mindset shift”.

Check SIP Calculator : – SIP Calculator India 2025 – Calculate Mutual Fund Returns Online

The Strategic 5-Year Plan: Best of Both Worlds

If you're uncomfortable with the idea of living with parents indefinitely, here's a strategic approach that maximises wealth while still achieving eventual independence.

Phase 1 (Age 23-28): Live with Parents

- Save 60% of your income (₹30,000 on ₹50,000 salary)

- Invest aggressively in equity SIPs

- Build emergency fund, health insurance, term insurance

- Focus on career growth and skill development

Phase 2 (Age 28+): Strategic Independence

- Move out with a solid financial foundation

- Your Phase 1 corpus continues compounding

- Continue investing 10-15% of (now higher) salary

The Result? After 10 years, this strategic approach creates a corpus of approximately ₹59 lakhs—compared to just ₹16 lakhs if you moved out immediately. That's 261% more wealth through smart sequencing.

But What About Personal Growth?

This is the most common counter-argument: “Living alone teaches you responsibility and independence.”

It's a valid point. Living independently does build certain life skills. But let's be honest about what it really teaches you:

- How to cook instant noodles at 11 PM

- How to negotiate with demanding landlords

- How to survive on a budget that leaves no room for error

- How to feel financially stressed constantly

Compare that to what strategic joint living teaches:

- How to manage family relationships and navigate differences

- How to contribute meaningfully to a household

- How to invest and build wealth systematically

- How to delay gratification for bigger goals

As Reddit user sparoc3 shared: “I was living with my parents and had to move out for a job change. Even after making almost double on paper, my standard of living is nowhere near what I had at home. I would gladly take a 20-30% pay cut to go back home”.

The Global Perspective: India Isn't the Exception—The West Is

Here's a reality check on “Western independence norms”:

- In Italy, 71% of young adults (18-34) live with parents

- In Greece, it's 73%

- In Spain, 77%

- In the UK, the share of 25-34 year-olds living with parents has increased from 13% to 18% since 2006

- Even in the US, 39% of 20-29 year-olds live with parents

The idea that “real adults” must live alone is a relatively recent Western phenomenon—one that even Western countries are abandoning as housing costs soar.

Meanwhile, in India, approximately 50% of adults in their late 20s live at home. This isn't cultural backwardness. It's economic wisdom that the West is slowly rediscovering.

A Framework for Making This Work

Living with parents isn't automatically beneficial. It requires intentionality. Here's how to make it a wealth-building strategy rather than just extended adolescence:

1. Contribute Financially

Don't be a freeloader. Contributing ₹10,000-15,000 monthly to household expenses shows respect and maintains your self-worth. You're still saving 2-3x what you would independently.

2. Maintain Clear Boundaries

Have adult conversations about privacy, decision-making, and personal space. You're not a child anymore—act accordingly.

3. Invest the Difference Aggressively

This is non-negotiable. The only justification for living at home is that you're building wealth. Set up automatic SIPs on salary day—before you can spend it.

4. Set a Timeline

Having a clear plan (e.g., “I'll stay for 5 years until I have ₹30 lakhs saved”) gives purpose to your choice and helps family members understand your goals.

5. Track Your Progress

Maintain a spreadsheet showing your growing corpus. On days when you feel embarrassed about living at home, look at those numbers and remember why you're doing this.

The Emotional Intelligence of Staying Home

Beyond finances, there's something profound about choosing family over societal expectations.

55% of Gen Z in India live paycheck to paycheck. They're stressed, financially insecure, and constantly worried about rising costs. Many are juggling side hustles just to stay afloat.

Meanwhile, families provide what no rented apartment ever can:

- Emotional support during career setbacks and personal challenges

- Health security—someone to care for you when you're sick

- Nutritious home-cooked meals instead of Zomato dependency

- Wisdom and guidance from experienced family members

As one FIRE community member wisely noted: “Living with parents can work if all of you go into it knowingly, with intent, commitment, and never forgetting what you mean to one another”.

When Moving Out Makes Sense

To be fair, living with parents isn't right for everyone. Consider moving out if:

- Your workplace is in a different city with no feasible commute

- Your home environment is genuinely toxic or abusive

- Your parents live in a location with limited career opportunities

- You have a partner and need privacy for your relationship

The key is making this decision based on actual circumstances, not social pressure or Instagram-induced FOMO.

Practical Investment Strategy for the Home-Stayer

If you've decided to stay home and build wealth, here's how to deploy that extra ₹25,000 monthly:

Month 1-6: Build Foundation

- Emergency fund: 6 months expenses (₹1.2-1.5 lakhs)

- Health insurance: ₹15,000-20,000 annually

- Term insurance: ₹500-1,000 monthly for ₹1 crore cover

Month 7+: Aggressive Growth

- 60% in diversified equity mutual funds (via SIP)

- 20% in PPF/EPF (tax benefits + safety)

- 20% in NPS (additional tax benefits under 80CCD)

At 12% average returns, this strategy can build approximately ₹24 lakhs in just 5 years—a solid foundation for either a house down payment or continued wealth accumulation.

The Mindset Shift That Changes Everything

The fundamental question isn't “What will people think if I live with my parents?”

It's: “Do I want to look financially successful at 25, or actually BE financially successful at 35?”

As middle-class families across India demonstrate, disciplined habits can build wealth exceeding ₹1.2 crore in 10 years—through patience, consistent investing, and making prudent choices even on average salaries.

Those families aren't buying designer clothes or taking Goa trips every quarter. They're playing a longer game. And the joint family structure gives them the runway to play it well.

Summary: Your Wealth-Building Checklist

Living with parents in your 20s can be a powerful financial strategy when done intentionally:

- Save ₹25,000+ extra monthly compared to independent living

- Build ₹56+ lakhs more wealth over 10 years through compounding

- Contribute to household expenses—you're an adult, not a dependent

- Invest the difference aggressively in equity SIPs and tax-saving instruments

- Set clear boundaries and timelines for a healthy family dynamic

- Ignore Western norms that even Western countries are abandoning

The choice isn't between independence and dependence. It's between strategic patience and premature sacrifice.

Your future self—with a fully-funded emergency fund, a growing investment portfolio, and the option to buy a home without crippling debt—will thank you.

What's your take? Are you living with parents and building wealth, or did moving out work better for you? The best financial decision is always the one that fits your unique situation.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Investment decisions should be made after consulting a SEBI-registered financial advisor. Mutual fund investments are subject to market risks. Past performance does not guarantee future returns. The calculations presented use assumed returns of 12% annually, which may vary in actual market conditions.

FAQ Schema Content

Q: Is it okay to live with parents in your 20s?

A: Absolutely. Living with parents in your 20s can be a smart financial decision. In India, approximately 50% of adults in their late 20s live with family. This arrangement can help you save 50-60% of your income, build an investment corpus, and achieve financial independence faster than peers who move out early.

Q: How much money can I save by living with parents?

A: Depending on your city and salary, you could save ₹20,000-30,000 extra per month compared to living independently. Over 10 years, this translates to approximately ₹56 lakhs more wealth when invested in equity mutual funds at 12% average returns.

Q: What percentage of young adults live with parents globally?

A: The numbers vary significantly: Italy (71%), Greece (73%), Spain (77%), UK (18% for ages 25-34), and US (39% for ages 20-29). India's rate of approximately 50% is neither unusual nor a sign of cultural backwardness.

Q: Should I contribute to household expenses if I live with parents?

A: Yes, contributing ₹10,000-15,000 monthly to household expenses is recommended. This maintains your self-respect, helps your family, and you'll still save 2-3 times more than if you were living independently.

Q: How do I make living with parents work as an adult?

A: Set clear boundaries about privacy and decision-making, contribute financially to the household, invest your savings aggressively, have a clear timeline for your goals, and maintain open communication with family members about your plans.

Q: What is the opportunity cost of paying rent?

A: If you pay ₹25,000 monthly rent for 10 years, you'll spend ₹30 lakhs with zero returns. The same amount invested in SIPs at 12% returns would grow to approximately ₹56 lakhs—creating an opportunity cost of ₹26 lakhs in lost wealth.

HowTo Schema Content

How to Build Wealth While Living with Parents

Step 1: Calculate Your Savings Potential

Compare your expenses when living independently versus with parents. Factor in rent, utilities, food, and other costs. Most young professionals can save ₹20,000-30,000 extra monthly by staying home.

Step 2: Set Up Automatic Investments

On salary day, set up automatic SIP deductions before you can spend the money. Allocate 60% to equity mutual funds, 20% to PPF/EPF, and 20% to NPS for tax benefits.

Step 3: Build Your Emergency Fund First

Before aggressive investing, save 6 months of expenses (₹1.2-1.5 lakhs) in a liquid fund or savings account. This protects you from unexpected job losses or emergencies.

Step 4: Contribute to Household Expenses

Offer ₹10,000-15,000 monthly to your family for household expenses. This maintains your dignity, helps your parents, and keeps you accountable.

Step 5: Set Clear Boundaries and Timeline

Have open conversations about privacy, decision-making, and your financial goals. Set a target (e.g., “Stay for 5 years until I save ₹30 lakhs”) to give purpose to your choice.

Step 6: Track Progress Monthly

Maintain a spreadsheet tracking your growing corpus. Review quarterly and adjust your strategy if needed. Celebrate milestones to stay motivated.