The Investment Decision Journal: How I Track and Learn from Every Choice

Have you ever bought a stock because a friend recommended it, watched it go down, and then completely forgot why you bought it in the first place? Or maybe you sold a mutual fund in a panic during a market correction, only to regret it six months later?

If you nodded yes, you aren’t alone. I’ve been there too.

In the world of finance, we obsess over P&L statements, CAGR, and XIRR. But we rarely track the most volatile asset in our portfolio: our own psychology.

This is where an investment journal becomes your most powerful tool. It isn't just about recording numbers; it's about recording your mindset. Here is how keeping a simple journal transformed the way I invest, and how you can build one to secure your financial future.

Why Your Memory is a Liar (The Behavioral Science)

Let’s get a bit technical, but keep it simple. In behavioral finance, there is a concept called Hindsight Bias.

When a stock price goes up, we tell ourselves, “I knew that was going to happen!” When it goes down, we say, “I had a bad feeling about that one.”

The truth? We are rewriting history to make ourselves feel smarter.

Without an investment journal, you cannot objectively review your decisions. You only review the outcome. And in the stock market, you can make a terrible decision (like betting your emergency fund on a penny stock) and get a lucky good outcome. That doesn't make you a genius; it makes you lucky. Eventually, luck runs out.

A journal forces you to be honest with your future self. It separates process from outcome.

Confessions of a Recovering Panic-Seller

Let me share a quick story from my early days.

Years ago, during a market dip, I sold a large chunk of a blue-chip IT stock. At the time, I convinced myself it was a “strategic reallocation.”

Two years later, I looked back at my old notebook. I hadn't written “strategic reallocation.” I had scrawled: “Market looks scary. News says recession incoming. Getting out to be safe.”

Reading that was a wake-up call. I realized I wasn't making a financial decision; I was making an emotional one. That entry saved me lakhs in future mistakes because I learned to identify my trigger: Fear of the unknown.

Read - The Art of Jugaad Finance: Indian Innovation in Money Management

How to Build Your Investment Journal (The Framework)

You don’t need expensive software. A simple Excel sheet, a Notion page, or even a classic physical diary works perfectly. The goal is to reduce friction so you actually use it.

Here is the exact structure I use. Before I click “Buy” or “Sell,” I force myself to fill out these five fields:

1. The “What” and “When”

- Date: 17th Jan 2026

- Asset: HDFC Bank

- Price: ₹1,750

- Quantity: 20 shares

2. The Thesis (Why am I doing this?)

This is the most critical section. Don't just write “It will go up.” Be specific.

- Example: “I believe the merger synergies will start showing results in Q4. The stock has corrected 15% and valuations look reasonable compared to historical PE.”

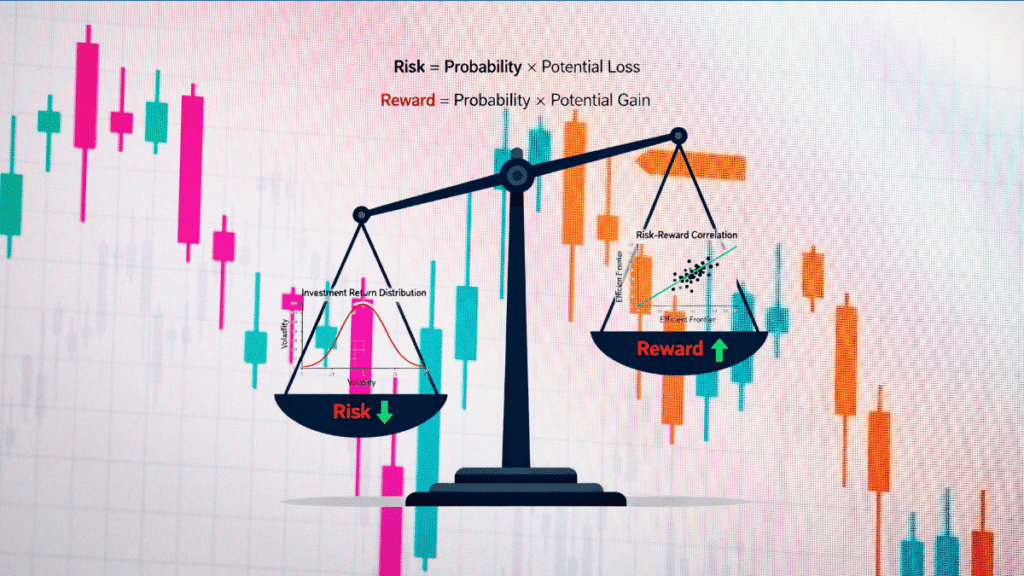

3. The Risk (What could go wrong?)

Invert the problem.

- Example: “If net interest margins compress further, the stock might stagnate for another year. Am I okay holding this for 3 years if it does nothing?”

4. The Exit Strategy

Decide when you will sell before you buy. This prevents greed from taking over later.

- Example: “I will review if the price hits ₹2,500 or if the quarterly earnings show a decline in margins for two consecutive quarters.”

5. The Emotional Check-in

Rate your emotion on a scale of 1-10.

- Are you excited? Anxious? FOMO (Fear Of Missing Out)?

- If your excitement is a 10/10, wait 24 hours before buying. Excitement is usually a sign of chasing a trend.

A Real Indian Case Study: The “Tip” Trap

Let’s look at a hypothetical scenario involving “Rohan,” a 28-year-old software engineer from Bangalore.

The Scenario: Rohan gets a WhatsApp forward about a small-cap infrastructure company, “InfraBoom Ltd,” claiming it will double in a month.

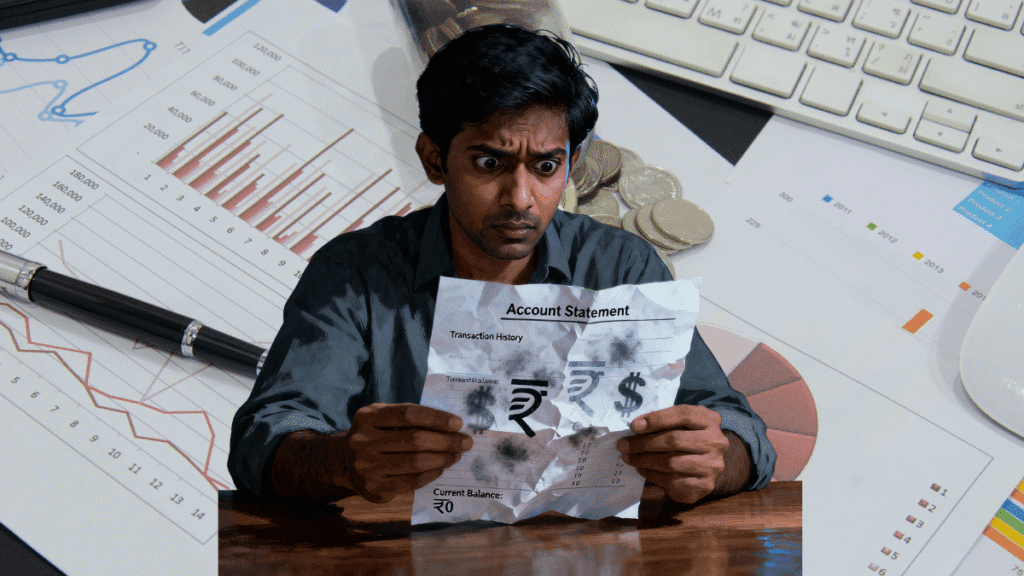

Without a Journal: Rohan buys ₹50,000 worth of shares. The stock falls 20%. He holds on, hoping it bounces back. He eventually sells at a 50% loss, blaming “market manipulation.”

With an Investment Journal: Rohan opens his journal.

- Thesis: “My friend Sent the tip.”

- Risk: “I don't know what this company actually does.”

- Emotional State: “FOMO. Everyone is talking about it.”

Writing this down acts as a speed bump. Rohan realizes his thesis is weak. He decides to invest only ₹5,000 (money he can afford to lose) or skips it entirely to buy a Nifty 50 Index Fund instead. The journal slowed him down enough to think.

The “Khata” of Your Mind

In India, every business maintains a Khata or Bahi Khata (ledger). It tracks every rupee coming in and going out.

Think of your investment journal as the Khata of your wisdom.

It transforms you from a gambler into a business owner. When you track your decisions, you stop treating the stock market like a casino and start treating it like a serious wealth-building vehicle.

Pro Tip: Review your journal every quarter. You will start to see patterns. Do you always buy tech stocks when they are overpriced? Do you panic sell when the Sensex drops 500 points? The data won't lie.

Summary: Start Small, Start Today

You don't need to be a financial expert to be a successful investor. You just need to be disciplined.

Actionable Next Step: Open a fresh Note on your phone or grab a notebook right now. Title it “My Investment Journal.” For your next transaction, write down Why you are doing it. That’s it. You have just started.

Disclaimer: I am a financial content creator, not a SEBI-registered investment advisor. The examples used (like HDFC Bank or Tata Motors) are for educational purposes only and are not buy/sell recommendations. Please consult a qualified financial advisor before making any investment decisions.