Finding the right investment options for 25000 salary can seem challenging, but with smart planning and disciplined approach, you can build substantial wealth over time. Whether you're a fresh graduate starting your career or a young professional looking to optimize your finances, this comprehensive guide will help you make informed decisions about where to invest your hard-earned money.

With a ₹25,000 monthly salary, strategic investment planning becomes crucial to secure your financial future. This article covers everything from budget allocation to specific investment products, tax-saving strategies, and long-term wealth creation methods specifically tailored for Indian investors earning ₹25,000 per month.

Understanding Your Financial Landscape with ₹25,000 Salary

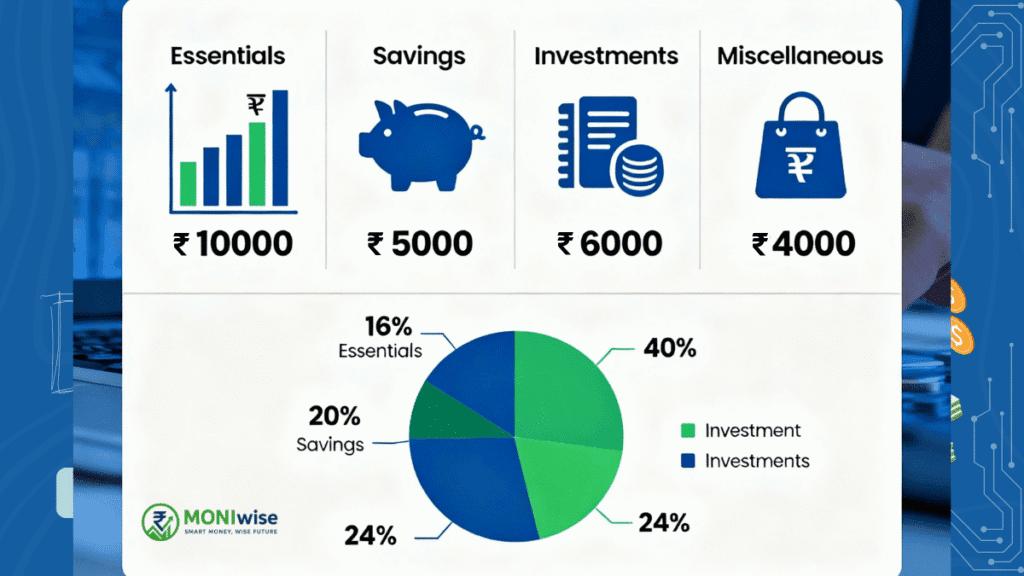

The 50-30-20 Budget Rule

Financial experts recommend the 50-30-20 rule for budget planning middle class India. Here's how to allocate your ₹25,000 monthly salary:

- Needs (50% – ₹12,500): Rent, food, utilities, transportation, EMIs

- Wants (30% – ₹7,500): Entertainment, dining out, shopping, hobbies

- Savings & Investments (20% – ₹5,000): Building your financial future

This allocation ensures you cover essential expenses while building wealth systematically. The key is sticking to this budget consistently, even during festival seasons or unexpected expenses.

Current Financial Reality for ₹25,000 Earners

According to recent studies, many Indians earning ₹25,000 live paycheck to paycheck without proper financial planning guide India. Common challenges include:

- Rising living costs in metro cities

- Lack of emergency funds covering basic expenses

- No systematic investment approach

- Limited knowledge about tax-saving options

- Inadequate insurance coverage

Step 1: Build Your Emergency Fund First

Why Emergency Fund Matters

Before exploring investment options for 25000 salary, establish an emergency fund. This serves as your financial safety net during unexpected events like job loss, medical emergencies, or family crises.

Emergency Fund Calculation

For a ₹25,000 salary earner:

- Monthly essential expenses: ₹16,250 (needs + 50% of wants)

- Emergency fund target: ₹97,500 (6 months of expenses)

- Monthly allocation: ₹1,000 towards emergency fund building

Where to Keep Emergency Funds

Best Options for Emergency Fund:

- Savings Account: Instant liquidity, 3-4% returns

- Liquid Mutual Funds: 1-day withdrawal, 6-7% returns

- Fixed Deposits: 3-month tenure, 6-7% returns

Step 2: Secure Adequate Insurance Coverage

Life Insurance Requirements

Insurance planning young professionals should start with term insurance. For ₹25,000 salary:

- Life cover needed: ₹30 lakhs (10-12x annual salary)

- Monthly premium: ₹500-₹750

- Tax benefits: Deduction under Section 80C up to ₹1.5 lakh annually

Health Insurance Essentials

Health insurance coverage recommendations:

- Individual cover: ₹5 lakh minimum

- Family floater: ₹10 lakh if married

- Monthly premium: ₹200-₹400

- Tax benefits: Section 80D deduction up to ₹25,000

Recommended Insurance Providers

| Provider | Term Insurance | Health Insurance | Key Features |

|---|---|---|---|

| HDFC Life | Click 2 Protect | Health Guard | Online purchase, competitive rates |

| ICICI Prudential | iProtect Smart | Health Shield | Comprehensive coverage, cashless network |

| Max Life | Smart Secure Plus | Health Companion | Flexible terms, add-on riders |

| SBI Life | eShield | Health Plus | Trusted brand, nationwide presence |

Step 3: Maximize Tax Saving Under Section 80C

Understanding Section 80C Benefits

Tax saving options 25000 salary earners can claim up to ₹1.5 lakh deduction annually under Section 80C. This reduces your taxable income and saves approximately ₹15,000-₹30,000 in taxes annually.

Best 80C Investment Options

| Investment Type | Lock-in Period | Expected Returns | Risk Level | Monthly Investment |

|---|---|---|---|---|

| ELSS Mutual Funds | 3 years | 10-15% | High | ₹1,000-₹2,000 |

| PPF | 15 years | 7-8% | Low | ₹500-₹1,500 |

| EPF | Until retirement | 8-9% | Low | Automatic deduction |

| Life Insurance Premium | Policy term | 6-8% | Low | ₹500-₹1,000 |

| Tax Saver FDs | 5 years | 6-7% | Very Low | ₹1,000-₹2,000 |

Step 4: Start Systematic Investment Plans (SIPs)

Why SIPs Work for ₹25,000 Salary

SIP investment 25k monthly allocation helps in:

- Rupee cost averaging: Reduces market volatility impact

- Disciplined investing: Automated monthly investments

- Power of compounding: Small amounts grow significantly over time

- Flexibility: Start with ₹500, increase gradually

Recommended SIP Allocation

Monthly SIP Investment Strategy:

- Large Cap Equity Fund: ₹800 (stability + growth)

- Mid Cap Fund: ₹500 (higher growth potential)

- ELSS Fund: ₹1,000 (tax saving + equity exposure)

- Debt Fund: ₹500 (stability + liquidity)

- Total Monthly SIP: ₹2,800

Top SIP Mutual Fund Recommendations

| Fund Name | Category | 3Y Returns | 5Y Returns | Min SIP | Expense Ratio |

|---|---|---|---|---|---|

| HDFC Top 100 | Large Cap | 19.2% | 16.8% | ₹500 | 0.85% |

| Mirae Asset Large Cap | Large Cap | 18.7% | 15.9% | ₹1,000 | 0.78% |

| Parag Parikh Flexi Cap | Flexi Cap | 19.8% | 16.2% | ₹1,000 | 0.75% |

| Axis Midcap Fund | Mid Cap | 24.3% | 18.7% | ₹500 | 1.15% |

| Mirae Asset ELSS | Tax Saver | 22.1% | 17.4% | ₹500 | 0.65% |

Interactive Investment Calculator

Step 5: Fixed Deposits vs Mutual Funds Analysis

When to Choose Fixed Deposits

Fixed deposit benefits for 25k salary:

- Guaranteed returns: 6-8% annually

- Capital protection: Principal amount safe

- Predictable income: Fixed interest payouts

When to Prefer Mutual Funds

Mutual fund investment strategies:

- Higher return potential: 10-15% long-term returns

- Inflation beating: Helps maintain purchasing power

- Tax efficiency: Long-term capital gains at 10%

Comparative Analysis Table

| Feature | Fixed Deposits | Mutual Funds |

|---|---|---|

| Returns | Fixed 6-8% | Variable 8-15% |

| Risk | Very Low | Low to High |

| Liquidity | Penalty on early withdrawal | High (1-3 days) |

| Taxation | Income tax slab rate | LTCG 10% above ₹1 lakh |

| Inflation Protection | Limited | Better protection |

| Minimum Investment | ₹1,000 | ₹500 |

Step 6: Goal-Based Investment Planning

Short-term Goals (1-3 years)

Investment allocation for short-term goals:

- Emergency fund completion: ₹1,000/month

- Vacation or gadget purchase: Debt funds or FDs

- Festival expenses: Liquid funds

- Recommended allocation: 60% debt, 40% equity

Medium-term Goals (3-7 years)

Wealth building 25000 salary for medium-term:

- House down payment: Hybrid mutual funds

- Marriage expenses: Balanced funds

- Vehicle purchase: Large cap equity funds

- Recommended allocation: 40% debt, 60% equity

Long-term Goals (7+ years)

Long-term investment strategies:

- Retirement planning: Equity-heavy portfolio

- Children's education: SIP in diversified equity funds

- Wealth creation: Small and mid cap funds

- Recommended allocation: 20% debt, 80% equity

Advanced Investment Strategies

Asset Allocation Matrix

Age-based investment allocation for ₹25,000 salary:

| Age Group | Equity | Debt | Gold | Real Estate |

|---|---|---|---|---|

| 22-30 | 70% | 20% | 5% | 5% |

| 30-40 | 60% | 30% | 5% | 5% |

| 40-50 | 50% | 40% | 5% | 5% |

Step-up SIP Strategy

Annual SIP increase methodology:

- Start with ₹2,000/month SIP

- Increase by 10-15% annually

- Align with salary increments

- Target: ₹5,000/month by Year 5

Comparison Table: Investment Options

| Investment Type | Minimum Amount | Lock-in Period | Expected Returns | Risk Level | Tax Benefits |

|---|---|---|---|---|---|

| ELSS Funds | ₹500 | 3 years | 10-15% | High | Section 80C |

| PPF | ₹500 | 15 years | 7-8% | Low | Section 80C + Tax-free |

| Fixed Deposits | ₹1,000 | Flexible | 6-7% | Very Low | Tax-saver FD: 80C |

| Equity SIP | ₹500 | None | 12-15% | High | LTCG 10% |

| Debt Funds | ₹500 | None | 6-9% | Low-Medium | Indexation benefits |

| Gold ETF | ₹500 | None | 8-12% | Medium | LTCG 20% |

| NPS | ₹1,000 | Until 60 years | 9-12% | Medium | Section 80CCD |

Common Mistakes to Avoid

Investment Mistakes by Young Professionals

- Not starting early: Delaying investments reduces compounding benefits

- Inadequate emergency fund: Leads to premature withdrawal of investments

- Chasing high returns: Taking excessive risk without understanding

- No goal-based planning: Random investments without specific objectives

- Ignoring inflation: Not considering purchasing power erosion

Budgeting Mistakes with ₹25,000 Salary

- Living beyond means: Spending more than 50% on needs

- No systematic saving: Saving whatever is left instead of paying yourself first

- Avoiding insurance: Thinking insurance is unnecessary at young age

- Credit card debt: Using credit cards for wants instead of needs

Infographic Description

Suggested Visual Elements:

- Pie chart: 50-30-20 budget allocation

- Timeline: Investment growth over 10, 20, 30 years

- Comparison bars: Different investment returns

- Step-by-step flowchart: Investment decision process

- Portfolio allocation: Age-wise asset allocation

Data Visualization:

- ₹5,000 monthly SIP growth over 20 years

- Emergency fund building timeline

- Tax savings comparison across different options

Tax Implications and Benefits

Income Tax Planning for ₹25,000 Salary

Annual tax calculation:

- Gross salary: ₹3,00,000

- Standard deduction: ₹50,000

- 80C investments: ₹1,50,000

- 80D health insurance: ₹25,000

- Taxable income: ₹75,000

- Tax liability: ₹0 (below ₹2.5 lakh limit)

Beyond Section 80C Tax Saving

Additional tax-saving opportunities: (Only allowed in old Tax Regime)

- Section 80D: Health insurance premiums up to ₹25,000

- Section 80E: Education loan interest (no limit)

- Section 80G: Donations to eligible institutions

- HRA exemption: If paying rent and no house owned

Regional Investment Considerations

Metro vs Non-Metro Investment Approach

Investment strategies by location:

| Location Type | Rent Budget | Investment Capacity | Recommended Focus |

|---|---|---|---|

| Metro Cities | ₹8,000-₹12,000 | ₹3,000-₹4,000 | Tax saving, emergency fund |

| Tier-2 Cities | ₹5,000-₹8,000 | ₹4,000-₹6,000 | Aggressive equity, real estate |

| Tier-3 Cities | ₹3,000-₹5,000 | ₹5,000-₹7,000 | Diversified portfolio |

Cultural Financial Planning

Indian family considerations:

- Joint family expenses: Adjust allocation for family contributions

- Festival budgeting: Separate fund for celebrations

- Parent healthcare: Additional insurance coverage

- Marriage planning: Long-term saving strategy

Frequently Asked Questions (FAQs)

Q1. What are the best investment options for someone earning ₹25,000 per month?

The best investment options include building an emergency fund first, then investing in ELSS mutual funds for tax saving, starting SIPs in large-cap funds, and securing adequate insurance coverage. Allocate ₹5,000 monthly using the 50-30-20 rule.

Q2. How much should I invest from a ₹25,000 salary?

Follow the 50-30-20 rule: invest 20% (₹5,000) monthly. Allocate ₹1,000 for emergency fund, ₹750 for insurance, ₹1,250 for tax-saving investments, ₹1,500 for equity SIPs, and ₹500 for debt investments.

Q3. Is ₹25,000 salary enough to start investing in mutual funds?

Yes, you can start SIPs in mutual funds with as little as ₹500 per month. With ₹25,000 salary, you can comfortably invest ₹2,000-₹3,000 monthly in diversified mutual fund portfolios for long-term wealth creation.

Q4. How can I save tax with a ₹25,000 salary?

Maximize Section 80C deductions by investing ₹12,500 monthly in ELSS funds, PPF, or life insurance premiums. Also claim Section 80D benefits for health insurance. Your total tax liability might be zero with proper planning.

Q5. Should I choose fixed deposits or mutual funds with ₹25,000 salary?

For long-term goals, choose mutual funds as they offer better inflation-adjusted returns (10-15%) compared to FDs (6-7%). Use FDs only for emergency funds or short-term goals where capital protection is crucial.

Q6. How much life insurance do I need with ₹25,000 salary?

You need life insurance coverage of ₹30-₹36 lakhs (10-12 times annual salary). Term insurance plans can provide this coverage for just ₹500-₹750 monthly premium at a young age.

Q7. When should I start investing with ₹25,000 salary?

Start investing immediately after securing your first job. The earlier you start, the more time your investments have to grow through compounding. Even ₹1,000 monthly invested at age 25 can create substantial wealth by retirement.

Conclusion & Call to Action

Successfully managing investment options for 25000 salary requires discipline, proper planning, and consistent execution. Start with building an emergency fund, securing adequate insurance, and then gradually building a diversified investment portfolio through SIPs and tax-saving instruments.

Remember that wealth building 25000 salary is entirely possible with the right strategy. The key is starting early, staying consistent, and gradually increasing your investment amounts as your income grows. Every rupee invested today can grow into significant wealth over the long term through the power of compounding.

Ready to Transform Your Financial Future?

- Calculate Now – Use our investment calculator to plan your portfolio

- Compare Plans – Analyze different investment options

- Get Expert Advice – Consult with certified financial planners

- Start Your SIP – Begin your systematic investment journey today

Subscribe to moniwise.in for more expert financial advice, investment strategies, and wealth-building tips tailored for Indian middle-class investors. Share your investment journey in the comments below and inspire others to start their financial planning!

DISCLAIMER:

The information provided in this article is for educational and informational purposes only and should not be construed as financial advice or a direct recommendation to invest. Investments in mutual funds and other financial instruments carry risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly recommend that you thoroughly research and consider your own financial situation, risk appetite, and investment objectives before making any investment decisions. It is advisable to consult a qualified financial advisor or professional for personalized guidance tailored to your individual circumstances. Neither the author nor the platform accepts any responsibility for any loss or damage resulting from the use of this information.