Are you curious about the electric vehicle sector and wondering if it's a good investment opportunity? With India's ambitious target of 30% electric vehicle adoption by 2030, the EV industry presents exciting possibilities for investors looking to participate in the country's green mobility transformation.

This comprehensive guide will walk you through everything you need to know about the electric vehicle sector – from understanding the market dynamics to identifying investment opportunities and risks involved in this rapidly growing industry.

What Is the Electric Vehicle Sector?

The electric vehicle sector encompasses companies involved in designing, manufacturing, and distributing electric vehicles, batteries, charging infrastructure, and supporting technologies. In India, this sector includes everything from two-wheeler manufacturers like Hero Electric to major automotive players like Tata Motors with their popular Nexon EV.

The sector covers various segments including electric two-wheelers (which dominate India's EV market), three-wheelers used for commercial purposes, passenger cars, and commercial vehicles like buses and trucks. Supporting this ecosystem are companies manufacturing batteries, charging stations, motor controllers, and other essential components.

Currently valued at USD 8.49 billion in 2024, India's electric vehicle market is projected to grow at an impressive CAGR of 40.7% from 2025 to 2030. This growth is driven by government policies, environmental concerns, and increasing cost-effectiveness of electric vehicles compared to traditional petrol and diesel vehicles.

Why Electric Vehicle Sector Matters for Investors

The electric vehicle sector represents one of the most significant investment themes of this decade for several compelling reasons. India imports nearly 80% of its crude oil requirements, making the transition to electric mobility both an environmental and economic necessity.

Government support is unprecedented – the FAME II scheme allocates ₹10,000 crore to promote EV adoption, while the new PM E-DRIVE scheme adds another ₹10,900 crore to boost India's EV ecosystem. These policies include substantial subsidies: ₹15,000 per kWh for two-wheelers, ₹10,000 per kWh for three and four-wheelers, and ₹20,000 per kWh for e-buses.

The market opportunity is massive. S&P Global forecasts that battery-powered passenger vehicle production in India will surge by 140.2% year-over-year to approximately 301,400 units in 2025. By 2030, the government anticipates annual EV sales of 17 million units.

Real-Life Example: Tata Motors Success Story

Consider Tata Motors' journey in the electric vehicle space. The company's Nexon EV became India's best-selling electric car, helping Tata Motors capture a significant market share in the passenger EV segment. Their stock has benefited from this EV focus, demonstrating how traditional automakers can successfully transition to electric mobility and reward investors.

Investment Strategies for the Electric Vehicle Sector

When investing in the electric vehicle sector, you can choose from multiple approaches depending on your risk tolerance and investment horizon.

Direct Stock Investment Approach:

- Pure-play EV manufacturers like Tata Motors (TATAMOTORS) with their strong EV portfolio

- Component suppliers such as Amara Raja Energy & Mobility (ARE&M) for battery solutions

- Charging infrastructure companies like Exicom Tele-Systems for EV charging solutions

- Traditional automakers pivoting to EVs like Mahindra & Mahindra and Bajaj Auto

Diversified Investment Strategy:

Consider investing across the entire EV value chain rather than focusing on a single company. This includes battery manufacturers, motor suppliers, charging station operators, and even companies supplying raw materials like copper and lithium.

Thematic Investment Options:

Some mutual funds and smallcases offer ready-made EV-focused portfolios. For example, the Electric Mobility Theme smallcase by Windmill Capital includes companies driving India's EV growth through manufacturing, infrastructure, and clean energy initiatives.

Pro Tips for EV Sector Investing

Research Government Policies: Stay updated on policy changes like subsidy modifications or new incentive schemes, as these significantly impact EV companies' profitability.

Focus on Localization: Companies increasing domestic manufacturing capabilities may benefit from lower costs and government incentives under the PLI scheme.

Consider the Complete Ecosystem: Don't just invest in car manufacturers – battery companies, charging infrastructure providers, and component suppliers often offer better growth prospects.

Common Mistakes to Avoid

Ignoring Import Dependencies: Many EV companies still rely heavily on imported components, especially batteries and motors, which can affect margins during supply chain disruptions.

Overlooking Profitability: Some EV companies trade at high valuations despite limited profitability – focus on companies with clear paths to sustainable earnings.

Timing the Market: The EV sector can be volatile due to policy changes and global supply chain issues – consider systematic investment plans rather than lump-sum investments.

Expert Insights and Market Data

India's electric vehicle penetration currently stands at around 7.6% and needs to reach 30% by 2030 to meet government targets. This requires the penetration rate to nearly double from 200 basis points annually to 380 basis points per year.

The battery segment represents the largest opportunity, with demand projected to surge from 4 GWh in 2023 to nearly 139 GWh by 2035. Currently, battery pack localization in India is only 10-20%, presenting significant opportunities for domestic manufacturers.

Major investments are flowing into the sector – Indian carmakers are investing around ₹85,420 crore (US$ 10 billion) in electric vehicles, lithium-ion batteries, and EV manufacturing. The auto component industry alone will see ₹25,000-30,000 crore investment in FY26 for capacity expansion and EV parts.

Two-wheelers and three-wheelers lead adoption with 90-95% localization of components, while passenger vehicles still import about 20% of their components. E-two wheelers are expected to reach a market of 5 million by 2025, with e-three wheelers accounting for 30% of sales.

Related Investment Topics You Can Explore

- Read also: Renewable Energy Stocks Investment Guide India

- Read also: Government Bonds vs Corporate Bonds Comparison

- Read also: Mutual Fund SIP Calculator and Planning Guide

Conclusion

The electric vehicle sector in India stands at an inflection point, offering significant investment opportunities for those willing to navigate its complexities. With robust government support, growing consumer acceptance, and improving technology, the sector is well-positioned for substantial growth through 2030.

However, investors must carefully evaluate factors like import dependencies, policy risks, and company-specific fundamentals before making investment decisions. Focus on companies with strong balance sheets, clear competitive advantages, and exposure to the growing domestic EV ecosystem.

Remember that while the long-term outlook appears promising, the electric vehicle sector can experience short-term volatility due to policy changes, supply chain disruptions, and global economic factors. Consider diversifying across different segments of the EV value chain and maintain a long-term investment horizon to maximize potential returns.

FAQs About Electric Vehicle Sector

Q1. What is the minimum amount to start investing in EV stocks in India?

A1. You can start investing in EV stocks with as little as ₹500, depending on your broker and the share price of individual stocks. Most leading EV stocks are available for investment through regular demat accounts.

Q2. Which are the best EV stocks for beginners in India?

A2. For beginners, consider large-cap stocks like Tata Motors, Mahindra & Mahindra, or Bajaj Auto, which have established EV divisions and relatively stable business models compared to pure-play EV startups.

Q3. Are EV stocks risky for long-term investment?

A3. EV stocks carry moderate to high risk due to technology changes, policy dependencies, and market volatility. However, the long-term growth potential is significant given India's commitment to electric mobility and supportive government policies.

Q4. How do government policies affect EV stock prices?

A4. Government policies like FAME subsidies, import duty changes, and new incentive schemes can significantly impact EV stock prices. Positive policy announcements typically drive stock prices up, while subsidy reductions can cause temporary declines.

How to Start Investing in Electric Vehicle Sector

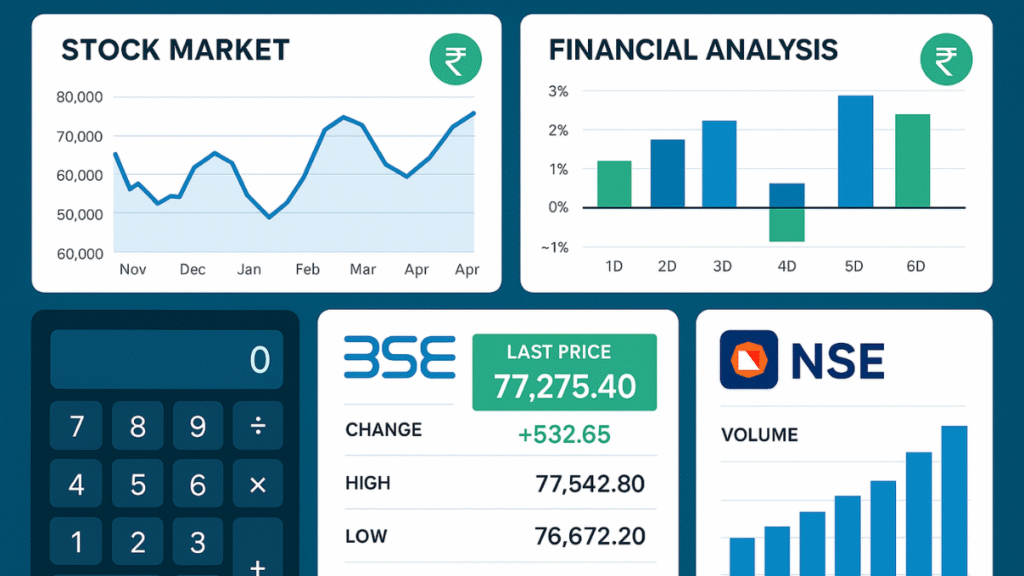

- Open a Demat Account – Check here a reliable broker offering access to NSE/BSE listed EV stocks

- Research EV Companies – Study financial statements, growth prospects, and competitive positioning of different EV players

- Start with Diversification – Invest across different segments like manufacturers, battery companies, and infrastructure providers

- Monitor Policy Changes – Stay updated on government policies and incentives affecting the EV sector

- Consider SIP Approach – Use systematic investment plans to reduce timing risks and benefit from rupee cost averaging