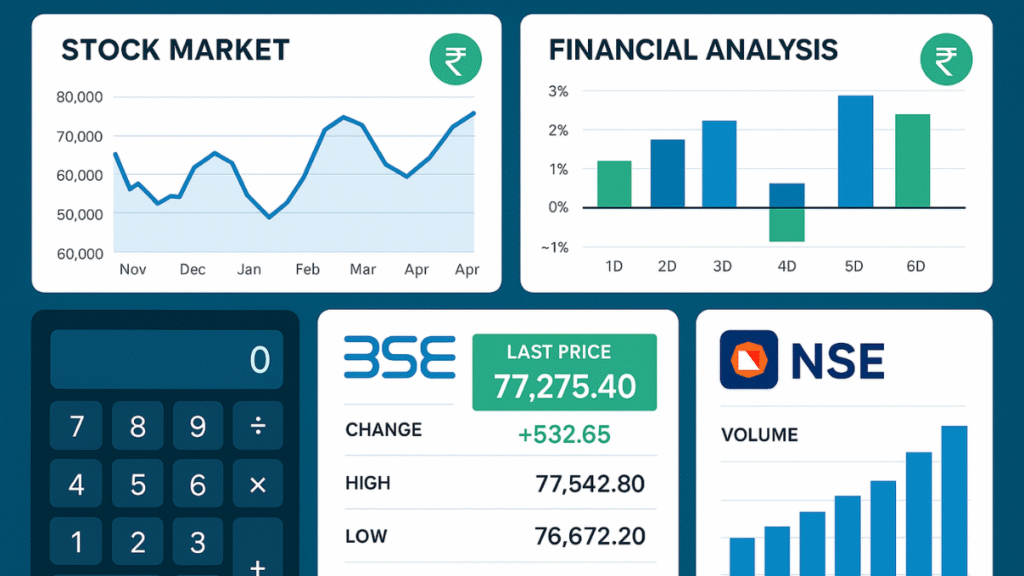

Fundamental analysis remains the cornerstone of successful long-term investing in Indian stock markets. As we navigate through 2025, with increasing market volatility and evolving economic conditions, understanding how to evaluate a company's intrinsic value has become more crucial than ever. This comprehensive guide will equip you with the essential skills to perform thorough fundamental analysis of Indian stocks listed on BSE and NSE.

Whether you're analyzing blue-chip companies like Reliance Industries and TCS or exploring mid-cap growth stories, fundamental analysis helps you make informed investment decisions based on a company's financial health, competitive position, and growth prospects. Unlike technical analysis that focuses on price movements, fundamental analysis digs deep into the underlying business fundamentals to determine if a stock is undervalued or overvalued.

Understanding Fundamental Analysis

Fundamental analysis is a method of evaluating securities by attempting to measure their intrinsic value through examination of related economic, financial, and other qualitative and quantitative factors. For Indian stocks, this involves analyzing company-specific data, industry trends, and macroeconomic factors that could impact stock performance.

The primary goal is to determine whether a stock is trading above or below its fair value. If the intrinsic value is higher than the current market price, the stock may be undervalued and represent a buying opportunity. Conversely, if the market price exceeds intrinsic value, the stock might be overvalued.

Two Main Approaches to Fundamental Analysis

Absolute Valuation Method

This approach focuses on the company's intrinsic value independent of market conditions. Key techniques include:

Relative Valuation Method

This compares the company's valuation metrics with peer companies in the same industry. Common ratios include:

Key Financial Statements Analysis

Balance Sheet Analysis

The balance sheet provides a snapshot of a company's financial position at a specific point in time. Key components for Indian stock analysis include:

Assets Analysis:

- Current Assets: Cash, inventory, accounts receivable, and short-term investments

- Fixed Assets: Property, plant, equipment, and long-term investments

- Intangible Assets: Patents, trademarks, and goodwill

Liabilities Assessment:

- Current Liabilities: Short-term debt, accounts payable, and accrued expenses

- Long-term Liabilities: Long-term debt, deferred tax liabilities, and pension obligations

Shareholders' Equity:

- Paid-up Capital: The actual amount paid by shareholders

- Reserves and Surplus: Retained earnings and other reserves

Income Statement Evaluation

The income statement shows a company's revenue, expenses, and profitability over a specific period. Critical metrics include:

Revenue Analysis:

- Top-line Growth: Year-over-year revenue growth trends

- Revenue Quality: Recurring vs. one-time revenue sources

- Segment Performance: Revenue breakdown by business divisions

Profitability Metrics:

- Gross Profit Margin: (Revenue – Cost of Goods Sold) / Revenue

- Operating Profit Margin: Operating Income / Revenue

- Net Profit Margin: Net Income / Revenue

Cash Flow Statement Assessment

The cash flow statement reveals how a company generates and uses cash. For Indian stocks, focus on:

Operating Cash Flow (OCF):

- Indicates the company's ability to generate cash from core operations

- Should ideally be positive and growing consistently

Investing Cash Flow:

- Capital expenditures for growth and maintenance

- Acquisitions and divestments

Financing Cash Flow:

- Debt issuance or repayment

- Dividend payments and share buybacks

Free Cash Flow (FCF) = Operating Cash Flow – Capital Expenditures

Free cash flow is crucial for determining a company's ability to pay dividends, reduce debt, or invest in growth opportunities.

Essential Financial Ratios for Indian Stocks

Valuation Ratios

Price-to-Earnings (P/E) Ratio

The P/E ratio compares a company's current share price to its earnings per share (EPS).

Formula: P/E Ratio = Current Market Price / Earnings Per Share

Interpretation for Indian Markets:

- Banking Sector: Average P/E of 12-15 is considered reasonable

- IT Services: P/E ratios of 20-30 are typical due to growth prospects

- FMCG: Higher P/E ratios (35-50) reflect stable, predictable earnings

Price-to-Book (P/B) Ratio

The P/B ratio compares market value to book value per share.

Formula: P/B Ratio = Market Price Per Share / Book Value Per Share

A P/B ratio below 1.0 may indicate an undervalued stock, while ratios above 3.0 suggest premium valuations.

Profitability Ratios

Return on Equity (ROE)

ROE measures how effectively a company uses shareholders' equity to generate profits.

Formula: ROE = Net Income / Shareholders' Equity × 100

Indian Market Benchmarks:

- Excellent: ROE > 20%

- Good: ROE 15-20%

- Average: ROE 10-15%

- Poor: ROE < 10%

Return on Capital Employed (ROCE)

ROCE evaluates how efficiently a company uses its capital to generate profits.

Formula: ROCE = EBIT / Capital Employed × 100

ROCE is particularly useful for comparing companies with different capital structures.

Leverage Ratios

Debt-to-Equity (D/E) Ratio

The D/E ratio measures a company's financial leverage.

Formula: D/E Ratio = Total Debt / Shareholders' Equity

Industry Variations:

- Capital-intensive industries (infrastructure, telecom): D/E ratios of 1.0-2.0 may be acceptable

- Asset-light businesses (IT, pharma): D/E ratios should typically be below 0.5

Liquidity Ratios

Current Ratio

The current ratio measures a company's ability to pay short-term obligations.

Formula: Current Ratio = Current Assets / Current Liabilities

Interpretation:

- Above 2.0: Strong liquidity position

- 1.5-2.0: Adequate liquidity

- Below 1.0: Potential liquidity concerns

Quick Ratio (Acid-Test Ratio)

The quick ratio provides a more stringent liquidity measure by excluding inventory.

Formula: Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Valuation Methods and Models

Discounted Cash Flow (DCF) Analysis

DCF analysis is considered the gold standard for intrinsic valuation. It estimates a company's value based on projected future cash flows discounted to present value.

DCF Formula:

DCF Value = Σ [FCFₙ / (1 + r)ⁿ] + Terminal Value / (1 + r)ⁿ

Where:

- FCFₙ = Free Cash Flow in year n

- r = Discount rate (WACC)

- n = Number of years

Terminal Value Calculation:

Terminal Value = FCF₅ × (1 + g) / (r – g)

Where g = perpetual growth rate (typically 2-4% for mature Indian companies).

Enterprise Value (EV) Analysis

Enterprise Value represents the total value of a company's operations.

Formula: EV = Market Capitalization + Total Debt – Cash and Cash Equivalents

EV/EBITDA Ratio:

This ratio is particularly useful for comparing companies with different capital structures.

Price-to-Sales (P/S) Ratio

The P/S ratio is helpful when analyzing companies with inconsistent earnings.

Formula: P/S Ratio = Market Capitalization / Annual Revenue

Dividend Discount Model (DDM)

For dividend-paying Indian stocks, DDM can provide valuation insights.

Formula: Stock Value = D₁ / (r – g)

Where:

- D₁ = Expected dividend next year

- r = Required rate of return

- g = Dividend growth rate

Industry and Sector Analysis

Sector-Specific Considerations

Banking and Financial Services

- Focus on Net Interest Margin (NIM), Return on Assets (ROA), and Non-Performing Assets (NPA)

- Regulatory changes by RBI significantly impact valuations

Information Technology

- Emphasize revenue growth, client concentration, and margin sustainability

- Currency fluctuations affect profitability for export-oriented companies

Fast-Moving Consumer Goods (FMCG)

- Analyze brand strength, distribution network, and raw material costs

- Premium valuations justified by consistent cash flows

Pharmaceuticals

- Consider R&D pipeline, regulatory approvals, and patent expirations

- Generic vs. branded drug portfolio impact

Accessing Financial Data for Indian Companies

Official Sources

SEBI Disclosures

Listed companies must comply with SEBI's Listing Obligations and Disclosure Requirements (LODR).

Key Mandatory Disclosures:

- Quarterly financial results within 45 days of quarter-end

- Annual reports with detailed business analysis

- Material events affecting company operations

Stock Exchange Portals

- BSE: Historical stock prices, corporate announcements, and financial data

- NSE: Real-time quotes, derivatives data, and company fundamentals

Popular Financial Platforms

Screener.in

Comprehensive database of Indian company financials with screening capabilities.

MoneyControl

Detailed financial statements, ratio analysis, and peer comparisons.

Ticker by Finology

Advanced financial analysis tools with ratio calculations.

Step-by-Step Fundamental Analysis Process

Step 1: Company Overview and Business Model

Understanding the Business:

- Core products and services

- Revenue streams and business segments

- Competitive advantages and moats

- Management quality and track record

Step 2: Financial Statement Analysis

Historical Performance Review:

- 5-10 year revenue and profit trends

- Consistency of financial performance

- Cash flow generation patterns

Step 3: Ratio Analysis

Calculate Key Ratios:

- Valuation ratios (P/E, P/B, EV/EBITDA)

- Profitability ratios (ROE, ROCE, margins)

- Leverage ratios (D/E, interest coverage)

- Liquidity ratios (current, quick ratio)

Step 4: Peer Comparison

Industry Benchmarking:

- Compare ratios with industry averages

- Identify relative strengths and weaknesses

- Assess competitive positioning

Step 5: Valuation Assessment

Intrinsic Value Calculation:

- Apply DCF analysis for long-term value

- Use relative valuation for market comparisons

- Consider multiple valuation approaches

Step 6: Risk Assessment

Key Risk Factors:

- Business risks: Competition, regulation, technology disruption

- Financial risks: High leverage, working capital issues

- Management risks: Corporate governance concerns

Common Mistakes to Avoid

Over-reliance on Single Metrics

Avoid making investment decisions based solely on P/E ratios or any single financial metric. A comprehensive analysis requires multiple perspectives.

Ignoring Industry Context

Financial ratios vary significantly across industries. A P/E ratio of 30 might be expensive for a bank but reasonable for a high-growth technology company.

Neglecting Qualitative Factors

Important Qualitative Aspects:

- Management integrity and vision

- Competitive positioning

- Regulatory environment

- ESG (Environmental, Social, Governance) factors

Short-term Focus

Fundamental analysis is most effective for long-term investment decisions. Avoid frequent trading based on quarterly results.

Tools and Resources

Free Resources

Government Sources:

- Ministry of Corporate Affairs: Annual reports and filings

- RBI Database: Banking sector statistics

- SEBI: Regulatory filings and investor education

Financial Websites:

- BSE/NSE: Official stock exchange data

- Screener.in: Free stock screening and analysis

- Investing.com: Global financial data and analysis

Premium Tools

Professional Platforms:

- Bloomberg Terminal: Comprehensive financial data

- Dion Global: Indian market database and analytics

- Capital IQ: Detailed company and industry analysis

Excel Templates and Calculators

DIY Analysis Tools:

Advanced Techniques

Sum-of-the-Parts (SOTP) Valuation

For conglomerates like Reliance Industries, value each business segment separately and sum the parts.

Economic Value Added (EVA)

EVA measures value creation beyond the cost of capital:

EVA = NOPAT – (Capital × WACC)

DuPont Analysis

Break down ROE into its components:

ROE = Net Profit Margin × Asset Turnover × Equity Multiplier

This helps identify the drivers of profitability.

Interactive Calculator: P/E Ratio Analysis

Sample Calculation for Indian Stock:

- Current Market Price: ₹500

- Earnings Per Share (EPS): ₹25

- P/E Ratio: 500 ÷ 25 = 20

Industry Comparison:

If the industry average P/E is 15, this stock appears overvalued. However, consider growth prospects and other factors before concluding.

FAQ Section

Q1: What is the ideal P/E ratio for Indian stocks?

There's no universal ideal P/E ratio. It varies by industry – banking stocks typically trade at P/E 10-15, while FMCG companies may trade at P/E 30-50. Compare with industry peers and historical averages.

Q2: How often should I perform fundamental analysis?

Review your holdings quarterly when companies release results, and conduct comprehensive analysis annually. However, monitor for material developments that might affect your investment thesis.

Q3: Can fundamental analysis predict short-term price movements?

Fundamental analysis is primarily designed for long-term investment decisions. It may not accurately predict short-term price fluctuations, which are often driven by market sentiment and technical factors.

Q4: What's the difference between ROE and ROCE?

ROE measures returns on shareholders' equity only, while ROCE considers all capital employed (equity + debt). ROCE provides a better picture of overall capital efficiency.

Q5: How important is dividend yield in fundamental analysis?

Dividend yield indicates income potential but shouldn't be the sole decision factor. Consider dividend sustainability, payout ratio, and company's growth reinvestment needs.

Q6: Should I rely on consensus analyst ratings?

Use analyst reports for insights and data, but form your own conclusions. Analysts may have conflicts of interest or different time horizons than your investment strategy.

Q7: How do I analyze companies with negative earnings?

For loss-making companies, focus on revenue growth, path to profitability, cash burn rate, and runway (how long current cash will last). Use Price-to-Sales ratio instead of P/E.

Q8: What role does corporate governance play in fundamental analysis?

Corporate governance is crucial for long-term value creation. Poor governance can destroy shareholder value regardless of financial metrics. Consider board composition, management integrity, and transparency.

Q9: How do I factor in ESG considerations?

ESG factors increasingly impact long-term returns. Evaluate environmental policies, social initiatives, and governance practices. Companies with strong ESG profiles often command premium valuations.

Q10: What's the best way to stay updated on regulatory changes affecting my stocks?

Follow SEBI announcements, subscribe to company investor relations updates, and monitor industry associations. Regulatory changes can significantly impact sector valuations.

Conclusion

Mastering fundamental analysis of Indian stocks requires patience, continuous learning, and practical application. While the process may seem complex initially, consistent practice will help you develop the skills to identify undervalued opportunities and avoid overpriced stocks in the Indian market.

Remember that fundamental analysis is most effective when combined with a long-term investment approach. Focus on companies with strong business models, capable management teams, and sustainable competitive advantages. The Indian stock market offers numerous opportunities for investors who can identify quality businesses trading below their intrinsic value.

Start with blue-chip companies to practice your analysis skills, then gradually expand to mid-cap and small-cap stocks as you gain confidence. Always maintain a diversified portfolio and never invest more than you can afford to lose.

Ready to start your fundamental analysis journey? Begin by analyzing a company you're familiar with using the framework outlined in this guide. Download our free financial ratio calculator and start building your investment knowledge today.

Disclaimer: This article is for educational purposes only and should not be considered as investment advice. Stock markets are subject to risks, and past performance does not guarantee future results. Please consult with a qualified financial advisor before making investment decisions. Always read the offer documents carefully before investing in any securities.