Green Energy Stocks: The Next Big Investment Theme

The global shift towards sustainable energy has positioned Green Energy Stocks India as one of the most compelling investment opportunities of this decade. As India accelerates its renewable energy transition with ambitious targets and robust policy support, investors are presented with unprecedented opportunities in this rapidly expanding sector.

India's Renewable Energy Revolution

India's renewable energy sector experienced remarkable growth in 2024, with the country adding a record-breaking 24.5 GW of solar capacity and 3.4 GW of wind capacity. This surge represents more than a twofold increase in solar installations and a 21% rise in wind installations compared to 2023. As of March 2025, India's total renewable energy capacity has reached 220.10 GW, up from 198.75 GW in the previous fiscal year.

The sector's momentum is driven by India's commitment to achieving 500 GW of non-fossil fuel-based energy capacity by 2030, as part of its carbon neutrality pledge by 2070. This ambitious target, combined with strong government support and favorable policies, has created a robust foundation for green energy investments.

Market Size and Growth Projections

The Indian renewable energy market presents substantial investment potential, with current market size reaching $23.9 billion in 2024. Industry projections indicate the market will expand to $52.1 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.1% during 2025-2033. This growth trajectory is supported by increasing foreign direct investment, which has reached $6.137 billion in renewable energy equity inflows through September 2023.

Top Green Energy Investment Opportunities

Solar Energy Leadership

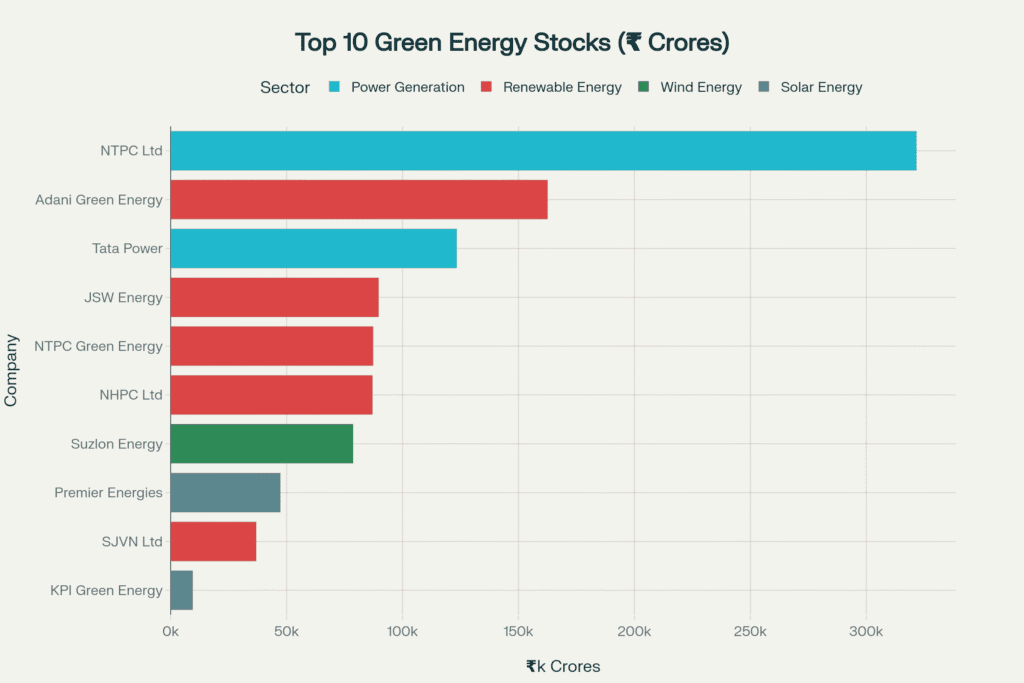

Solar energy dominates India's renewable capacity with 105.65 GW installed, including 81.01 GW from ground-mounted installations and 17.02 GW from rooftop solar. Leading solar energy stocks include Adani Green Energy Ltd (market cap: ₹1,62,526 crores), Premier Energies Ltd (₹47,295 crores), and KPI Green Energy Ltd (₹9,483 crores).

The government's PM Surya Ghar Yojana provides subsidies covering up to 40% of rooftop solar installation costs, while the rooftop solar sector recorded significant growth with 4.59 GW of new capacity in 2024, marking a 53% increase.

Wind Energy Potential

India's wind energy sector contributed 47.72 GW to the renewable energy mix, with states like Gujarat, Karnataka, and Tamil Nadu leading capacity additions. Key wind energy investments include Suzlon Energy Ltd (₹78,628 crores market cap) and Inox Wind companies.

Emerging Green Hydrogen Sector

Green hydrogen represents a transformative investment opportunity, with Reliance Industries planning to invest ₹75,000 crores in green energy initiatives, including electrolyser manufacturing and hydrogen production. Other major players include NTPC Ltd, Adani Green Energy, and Indian Oil Corporation, all developing significant green hydrogen capabilities.

Government Policy Support and Incentives

India's renewable energy growth is underpinned by comprehensive government support:

Financial Incentives: The PM Surya Ghar Yojana offers substantial subsidies for household solar installations, while Production Linked Incentives boost domestic manufacturing of solar components.

Infrastructure Development: The government plans to invest ₹9,12,000 crores in power transmission infrastructure by 2032 to support renewable energy integration. Additionally, 53 solar parks with total capacity of 39,323 MW have been approved across 13 states.

Green Hydrogen Mission: The National Green Hydrogen Mission targets production of 5 million metric tons by 2030, requiring 125 GW of renewable energy capacity.

Investment Strategies and Considerations

Direct Stock Investments

Investors can choose from diverse green energy stocks across different sub-sectors:

- Established Players: NTPC Ltd (₹3,21,638 crores), Tata Power (₹1,23,340 crores)

- Pure-Play Renewables: Adani Green Energy, NTPC Green Energy, NHPC Ltd

- Technology Specialists: Premier Energies (solar), Suzlon Energy (wind)

Mutual Funds and ETFs

For diversified exposure, investors can consider ESG thematic funds and renewable energy mutual funds. Top-performing options include:

- ICICI Prudential ESG Exclusionary Strategy Fund (42.05% 1-year return)

- SBI ESG Exclusionary Strategy Fund (31.54% 1-year return)

- Tata Resources & Energy Fund (35.13% 1-year return)

- DSP Natural Resources and New Energy Fund (46.34% 1-year return)

Green Energy ETFs

Energy ETFs provide cost-effective sector exposure, including the ICICI Prudential Nifty Oil & Gas ETF and Nippon India CPSE ETF, which include significant renewable energy holdings.

Key Growth Drivers and Catalysts

Technology Advancements: Rapid improvements in solar photovoltaics, wind turbines, and energy storage systems are reducing costs and improving efficiency.

Corporate Adoption: Major corporations are increasingly committing to renewable energy to meet sustainability goals and reduce carbon emissions.

Energy Security: India's focus on reducing fossil fuel dependence and enhancing energy security through domestic renewable sources.

Electric Vehicle Integration: Growing EV adoption creates demand for clean electricity and charging infrastructure.

Risk Factors and Challenges

High Valuation Concerns: Some green energy stocks trade at premium valuations, with P/E ratios ranging from 13.73 (NTPC) to 183.53 (NTPC Green Energy).

Policy Dependency: Regulatory changes in subsidies, tariffs, or renewable energy policies could impact sector performance.

Grid Integration Challenges: India's aging grid infrastructure requires significant upgrades to accommodate intermittent renewable energy sources.

Competition from Traditional Energy: Fossil fuels remain cost-competitive in certain applications, creating competitive pressure.

Investment Calculator Recommendation

For investors evaluating green energy investments, consider developing a Renewable Energy Portfolio Calculator that factors in:

- Target allocation percentages across solar, wind, and emerging technologies

- Risk tolerance based on stock volatility and sector concentration

- Expected returns using historical performance and growth projections

- Diversification benefits across different renewable energy sub-sectors

Comparison of Investment Options

| Investment Type | Risk Level | Potential Returns | Liquidity | Diversification |

|---|---|---|---|---|

| Individual Green Energy Stocks | High | 15-45% annually | High | Low |

| ESG Mutual Funds | Medium-High | 12-35% annually | Medium | High |

| Renewable Energy ETFs | Medium | 8-25% annually | High | Medium |

| Green Bonds | Low-Medium | 6-12% annually | Medium | Low |

Future Outlook and Investment Strategy

The renewable energy sector's long-term prospects remain exceptionally strong, driven by India's commitment to net-zero emissions by 2070 and the 500 GW renewable capacity target by 2030. Key trends shaping the investment landscape include:

Hybrid Projects: Combined solar-wind installations are gaining popularity, accounting for over half of auction volumes in 2024.

Energy Storage: Battery storage investments are growing rapidly, from 1% in 2017 to 9% in 2024, supporting grid stability.

Green Hydrogen Scale-up: Major corporations plan investments exceeding ₹67,42,400 crores in green hydrogen and clean energy projects.

Conclusion and Action Plan

Green energy stocks represent a transformative investment opportunity aligned with India's sustainable development goals and global climate commitments. The sector's strong fundamentals, government support, and technological advancements position it as a compelling long-term investment theme.

Investors should consider:

- Diversifying across solar, wind, and emerging green hydrogen opportunities

- Balancing growth potential with valuation considerations

- Monitoring policy developments and regulatory changes

- Maintaining a long-term investment horizon to capture the sector's full potential

The convergence of favorable policies, technological innovation, and increasing adoption creates an unprecedented opportunity for investors to participate in India's renewable energy transformation while generating attractive financial returns.

green_energy_stocks_analysis.csv

Generated File

Frequently Asked Questions

Q1: What makes green energy stocks a good investment opportunity in India?

India's green energy stocks offer compelling investment potential due to the country's ambitious renewable energy targets, strong government policy support, and rapid sector growth. With India targeting 500 GW of non-fossil fuel capacity by 2030 and having added record renewable capacity in 2024, the sector presents significant long-term growth opportunities.

Q2: Which are the top green energy stocks to consider in India?

Leading green energy stocks include NTPC Ltd (₹3.2 lakh crores market cap), Adani Green Energy (₹1.6 lakh crores), Tata Power, JSW Energy, and NHPC Ltd. These companies span across solar, wind, and hybrid renewable energy projects with strong market positions and growth prospects.

Q3: How has the Indian renewable energy market performed in recent years?

India's renewable energy sector achieved remarkable growth in 2024, adding 24.5 GW of solar capacity and 3.4 GW of wind capacity. The total renewable energy capacity reached 220.10 GW by March 2025, representing consistent double-digit growth rates and attracting over $6 billion in FDI.

Q4: What government policies support green energy investments in India?

Key government initiatives include the PM Surya Ghar Yojana offering 40% subsidies for rooftop solar, the National Green Hydrogen Mission targeting 5 MMT production by 2030, and ₹9.12 lakh crores planned investment in transmission infrastructure. These policies create a supportive environment for renewable energy growth.

Q5: What are the risks associated with investing in green energy stocks?

Main risks include high stock valuations with P/E ratios ranging from 13 to 180+, policy dependency on government support, grid integration challenges, and competition from traditional energy sources. Investors should consider diversification and maintain long-term investment horizons to mitigate these risks.

Q6: How can investors diversify their green energy portfolio in India?

Investors can diversify through direct stock investments across solar (Premier Energies, KPI Green Energy), wind (Suzlon, Inox Wind), and integrated renewable companies (Adani Green, NTPC Green). Additionally, ESG mutual funds and renewable energy ETFs provide sector-wide exposure with professional management.

Q7: What is the market size and growth projection for India's renewable energy sector?

The Indian renewable energy market is valued at $23.9 billion in 2024 and projected to reach $52.1 billion by 2033, exhibiting an 8.1% CAGR. This growth is driven by increasing energy demand, technological advancements, and the country's commitment to carbon neutrality by 2070.

Ready to invest in India's green energy future? Start your sustainable investment journey today by researching these top renewable energy stocks and consider consulting with a financial advisor to build a diversified clean energy portfolio aligned with your investment goals.