How to Make 1 Crore in 5 Years Using SIP: The “Joint Family” Advantage

Let’s be honest. Seeing “₹1 Crore” and “5 Years” in the same sentence usually sets off alarm bells. It sounds like a “get rich quick” scheme.

But today, we are going to look at this purely through mathematics and cultural strategy.

Is it possible? Yes.

Is it easy? Absolutely not.

To hit this target, you don't just need a high-performing fund; you need a massive investible surplus. And this is where our contrarian take comes in. While the Western world glorifies moving out at 18 and paying rent to “find yourself,” we believe the traditional Indian joint living arrangement is actually a hidden financial super-weapon.

Here is the blueprint on how to aim for that golden ₹1 Crore mark.

The Cold Hard Math: What Does it Take?

Before we talk about how to save the money, let’s look at how much you need to invest.

To reach ₹1 Crore in 60 months (5 years), relying solely on compound interest isn't enough because the timeframe is too short. Compound interest works best over 10-15 years. For a 5-year sprint, the heavy lifting must come from your principal contribution.

Here is the SIP calculation assuming different annual return scenarios:

| Target Amount | Time Frame | Assumed Return (Annual) | Monthly SIP Needed (Approx) |

|---|---|---|---|

| ₹1 Crore | 5 Years | 12% (Conservative Equity) | ₹1,22,500 |

| ₹1 Crore | 5 Years | 15% (Aggressive Equity) | ₹1,13,000 |

| ₹1 Crore | 5 Years | 18% (Very Aggressive) | ₹1,04,500 |

Note: Returns are market-linked and not guaranteed.

The Reality Check:

Most young professionals in India earn decent salaries, but very few have a spare ₹1.15 Lakhs lying around every month to put into a SIP.

So, how do you bridge the gap?

The “Independence Tax” vs. The Joint Family Dividend

This is where behavioral finance meets Indian culture.

In Western personal finance narratives, success is often defined by “independence”—having your own apartment, your own car, and your own bills. But financially, this is a leak. We call this the Independence Tax.

If you live in a metro city like Mumbai, Bangalore, or Gurgaon:

- Rent: ₹25,000 – ₹40,000

- Utilities & Maid: ₹8,000

- Groceries/Food: ₹15,000

That is roughly ₹50,000 to ₹60,000 leaving your pocket purely for the privilege of living alone.

The Contrarian Strategy

Instead of viewing living with parents as “uncool,” view it as a strategic wealth-building partnership. By staying in the family home for 5 extra years, or living with a spouse and sharing costs with family, you effectively unlock the Joint Family Dividend.

That ₹60,000 you saved on “independence”? That is half of your SIP requirement right there.

Read Here : How to Start SIP with ₹1000 – Complete Beginner’s Guide

Case Study: The “Rohan & Priya” Accelerator

Let’s look at a hypothetical example to see how this works in real life.

Profile: Rohan (27) and Priya (26), a newly married couple living in Pune.

Combined Income: ₹2.5 Lakhs post-tax.

Scenario A: The Western Model (Nuclear Living)

They rent a fancy 2BHK. They buy new furniture on EMI. They order food separately.

- Total Expenses: ₹1.4 Lakhs

- Investible Surplus: ₹1.1 Lakhs

- Allocation: They save a bit, travel a bit.

- SIP Amount: ₹50,000

- Result in 5 Years (12%): Approx ₹41 Lakhs. (Good, but not 1 Crore).

Scenario B: The Indian Wealth Model (Joint Living)

They decide to live with Rohan’s or Priya's parents for 5 years. They split household utilities with parents (reducing the burden on elders) but avoid paying market rent.

- Rent Saved: ₹35,000

- Shared Utilities/Food Saved: ₹15,000

- Total Expenses: ₹90,000 (Combined)

- Investible Surplus: ₹1.6 Lakhs

- SIP Amount: ₹1.2 Lakhs

- Result in 5 Years (12%): Approx ₹1 Crore.

By simply leveraging the shared economy of a joint household, they hit the target without earning more money.

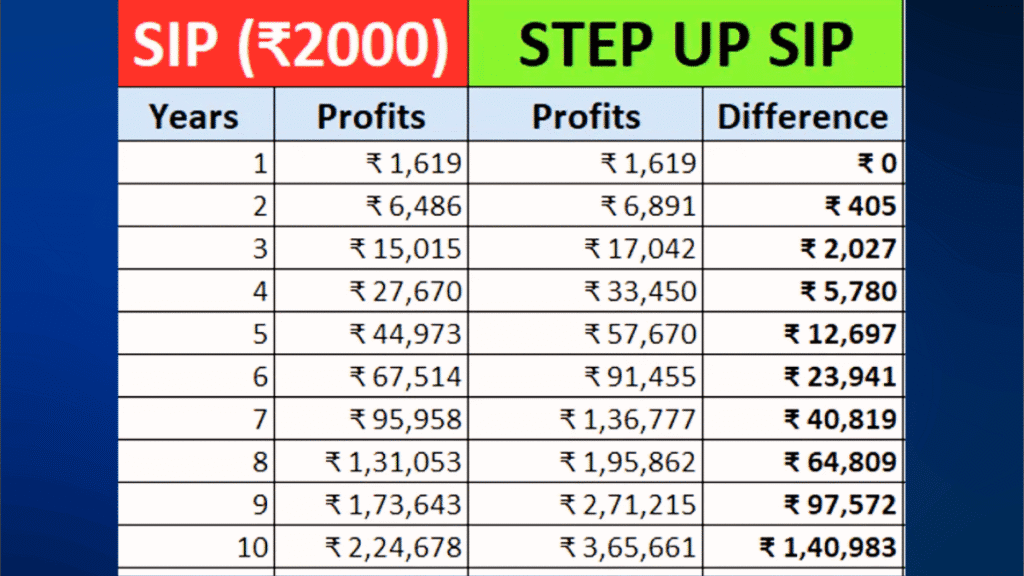

The “Step-Up” SIP: Your Secret Weapon

If you cannot start with ₹1.2 Lakhs immediately, don't panic. You can use the Step-Up SIP method.

This involves starting with a lower amount and increasing your contribution every year as your salary hikes come in.

- Start Monthly SIP: ₹85,000

- Annual Increase (Step-up): 20%

- Expected Return: 14%

- Final Corpus (5 Years): ₹98 Lakhs – ₹1.02 Crore

This is much more manageable for a couple or a high-earning individual. It relies on the discipline of committing your future salary hikes to your goal, not your lifestyle.

Where Should You Invest? (Asset Allocation)

To aim for 1 Crore in 5 years, you cannot play it too safe with Fixed Deposits (FDs), but you cannot gamble with penny stocks either. You need a balanced but aggressive portfolio.

A common allocation for a 5-year aggressive goal might look like this:

- Flexi Cap Funds (50%): These allow fund managers to switch between large, mid, and small companies based on market opportunities.

- Mid Cap Funds (30%): Higher growth potential than large caps, but with higher volatility.

- Large Cap Index Funds (20%): Stability to ensure you don't lose capital if the market corrects.

Tip: Consult a SEBI Registered Investment Advisor (RIA) to tailor this to your risk appetite.

Tap to get zero delivery brokerage & expert tools – limited-time referral offer!

Summary: The Price of the Crore

Making 1 Crore in 5 years is mathematically possible, but it requires a lifestyle sacrifice.

You have to trade the immediate gratification of a “fancy lifestyle” or “independent living” for the long-term security of a massive corpus. It challenges the norm, but the math doesn't lie.

Your Action Plan:

- Calculate: Check your current surplus.

- Consolidate: Can you move in with family or get a flatmate to cut housing costs by 50%?

- Automate: Set up a SIP for the day your salary hits.

- Step-Up: Commit 50% of your next bonus or hike to the fund.

Financial freedom isn't about earning the most; it's about keeping the most.

Disclaimer: I am a financial content writer, not a SEBI registered investment advisor. The calculations above are for educational purposes only. Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully and consult a professional advisor before investing.