Banking disputes can be frustrating, but India's financial system offers robust consumer protection through the RBI Banking Ombudsman Scheme. This comprehensive guide explains exactly how to register banking complaints online and get your grievances resolved efficiently through the Reserve Bank of India's complaint management system.

Understanding the RBI Integrated Ombudsman Scheme 2021

The Reserve Bank Integrated Ombudsman Scheme (RB-IOS) 2021, launched on November 12, 2021, represents a revolutionary approach to banking dispute resolution. This unified system combines three previous schemes into a single, streamlined platform following the “One Nation One Ombudsman” principle.

The scheme integrates the former Banking Ombudsman Scheme 2006, Ombudsman Scheme for Non-Banking Financial Companies 2018, and Ombudsman Scheme for Digital Transactions 2019. This consolidation eliminates jurisdictional barriers, allowing customers to file complaints from anywhere in India.

Key Features of the Integrated Ombudsman Scheme

Cost-Free Service: Filing complaints with the RBI Banking Ombudsman is completely free. There are no charges for registration, processing, or resolution of complaints.

24/7 Online Portal: The Complaint Management System (CMS) at https://cms.rbi.org.in operates round-the-clock, providing continuous access to complaint filing and tracking services.

Centralized Processing: All physical and email complaints are processed through the Centralized Receipt and Processing Centre (CRPC) in Chandigarh, ensuring uniform handling.

Multi-Language Support: The toll-free helpline 14448 supports Hindi, English, and eight regional languages, making the service accessible across India's diverse linguistic landscape.

Who Can File Complaints Under the Banking Ombudsman Scheme

Any individual or organization having a grievance against RBI-regulated entities can file a complaint. The scheme covers

Eligible Complainants:

- Individual account holders

- Joint account holders

- Business entities

- Non-Resident Indians (NRIs)

- Legal heirs and nominees

- Authorized representatives

Covered Financial Institutions:

- All commercial banks (public, private, foreign)

- Regional Rural Banks

- Small Finance Banks and Payment Banks

- Scheduled and Non-Scheduled Primary Cooperative Banks with deposits ₹50 crore and above

- NBFCs with assets ₹100 crore and above or deposit-taking NBFCs

- Payment System Participants

- Credit Information Companies

Grounds for Filing Banking Complaints

The RB-IOS 2021 defines “deficiency in service” as the primary ground for complaints. This broad definition covers various banking service failures:

Loan and Advance Related Complaints

- Delays in loan sanction or disbursement

- Non-adherence to prescribed loan processing timelines

- Unjustified rejection of loan applications

- Incorrect interest calculations

- Harassment during loan recovery

Digital Banking and Card Issues

- Unauthorized transactions in accounts

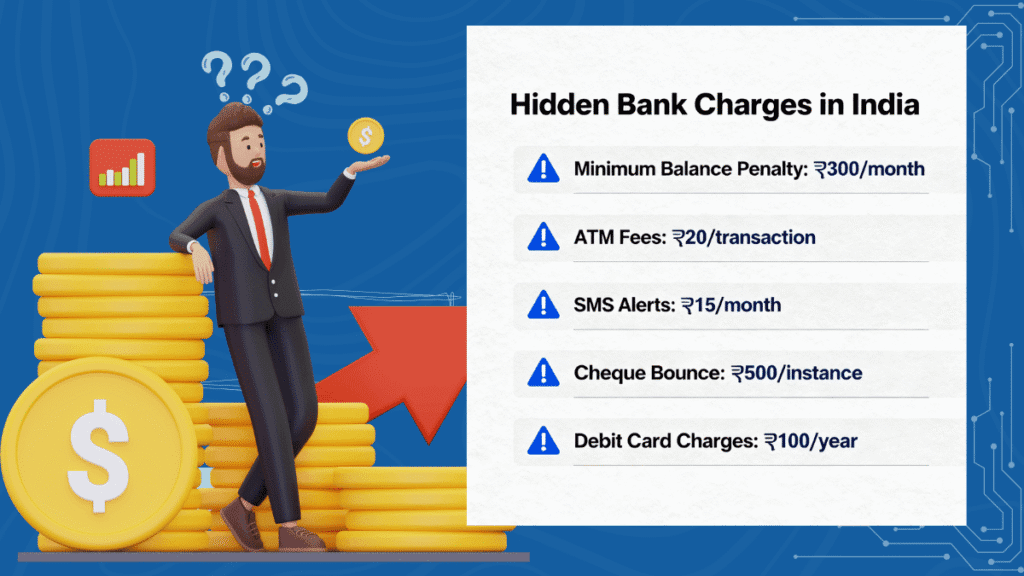

- ATM, debit card, or credit card malfunctions

- Mobile and internet banking failures

- UPI transaction disputes

- Digital wallet problems

Account Operations Problems

- Delays in account opening or closure

- Incorrect account statements

- Non-payment or delay in cheque clearance

- Premature account closure without notice

- Refusal to open deposit accounts without valid reason

Service Quality Issues

- Poor customer service standards

- Non-adherence to prescribed working hours

- Levying charges without adequate notice

- Failure to provide promised banking facilities

- Violation of fair practices code

What Complaints Cannot Be Filed

The RB-IOS 2021 specifies clear exclusions to prevent misuse:

Procedural Exclusions:

- Complaints not first raised with the concerned bank

- Issues filed before waiting 30 days for bank response

- Complaints older than one year after bank's response

- Matters already under litigation or arbitration

Nature-Based Exclusions:

- Commercial decisions like loan approvals or rejections

- Employee-employer disputes within banks

- General complaints against bank management

- Frivolous or vexatious complaints

Jurisdictional Exclusions:

- Issues involving entities not regulated by RBI

- Disputes between different banks

- Matters where banks comply with legal orders

Step-by-Step Guide to Register Complaints Online

Pre-Filing Requirements

Before approaching the Banking Ombudsman, you must first complaint to your bank. The bank has 30 days to respond. You can proceed to the Ombudsman if:

- No response is received within 30 days

- The complaint is rejected wholly or partially

- You're unsatisfied with the bank's response

Time Limit: Complaints must be filed within one year of receiving the bank's reply or one year and 30 days if no reply is received.

Online Complaint Registration Process

Step 1: Access the CMS Portal

Visit https://cms.rbi.org.in and click “File a Complaint”. The portal is available 24/7 and supports multiple languages.

Step 2: Initial Verification

Enter the captcha code (case-sensitive) and provide your name and mobile number for OTP verification.

Step 3: Eligibility Assessment

Answer five qualifying questions to confirm your complaint meets the scheme's criteria. These questions verify whether you've approached the bank first and waited the required period.

Step 4: Bank Details and Complaint Information

Provide comprehensive details including:

- Bank name and branch address

- Your account number or card details

- Date and details of your original complaint to the bank

- Transaction dates and reference numbers

- Clear description of the grievance (maximum 2,000 characters)

Step 5: Supporting Documents

Upload relevant documents such as:

- Copy of original complaint to the bank

- Bank's response (if received)

- Transaction receipts and statements

- Correspondence with bank officials

Step 6: Relief Sought

Specify the compensation amount and nature of relief requested. Remember, the maximum compensation is ₹20 lakhs for actual loss plus ₹1 lakh for mental agony.

Step 7: Review and Submit

Verify all information, accept the declaration, and submit your complaint. Download and save the complaint acknowledgment for future reference.

Alternative Filing Methods

Email Complaints: Send detailed complaints to

Physical Complaints: Mail your complaint in the prescribed format to:

Centralized Receipt and Processing Centre

Reserve Bank of India, 4th Floor, Sector 17

Chandigarh – 160017

Phone Assistance: Call the toll-free helpline 14448 (9:30 AM to 5:15 PM) for guidance, though complaints cannot be filed through this channel.

Required Documents for Filing Complaints

Essential Documentation

Identity and Contact Proof:

- Government-issued ID (Aadhaar, PAN, Passport)

- Current address proof

- Mobile number (mandatory for notifications)

Banking Relationship Evidence:

- Account statements or passbook copies

- Loan agreements or credit card terms

- Transaction receipts and confirmations

Complaint Trail Documentation:

- Original complaint submitted to the bank

- Bank's acknowledgment and response letters

- Follow-up correspondence

- Any reminder notices sent

Transaction-Specific Evidence:

- Payment receipts and vouchers

- Screenshots of online transactions

- ATM transaction slips

- SMS notifications and emails

Supporting Legal Documents:

- Power of attorney (if filed by representative)

- Legal heir documents (if applicable)

- Court orders (where relevant)

Complaint Processing and Resolution Timeline

Standard Processing Timeline

Acknowledgment: Immediate online confirmation with unique complaint reference number.

Initial Review: RBI screens complaints within 48 hours for completeness and eligibility.

Bank Response Period: The concerned bank receives the complaint and must respond within 30 days.

Ombudsman Review: The Banking Ombudsman examines the case and typically resolves complaints within 30-60 days.

Final Decision: Written communication of the decision is sent to both parties.

Resolution Methods

Mutual Settlement: 57.07% of maintainable complaints are resolved through conciliation and mediation.

Ombudsman Award: Binding decisions issued when deficiency in service is established.

Complaint Dismissal: 40.78% of cases are dismissed due to absence of service deficiency.

Appeal Process

If unsatisfied with the Ombudsman's decision, you can appeal to the Appellate Authority (Executive Director, Consumer Education and Protection Department, RBI) within 30 days. The Appellate Authority may extend this period by another 30 days for sufficient cause.

Compensation and Awards

Maximum Compensation Limits

The Banking Ombudsman can award:

- Up to ₹20 lakhs for actual financial loss due to deficiency in service

- Up to ₹1 lakh for mental agony and harassment

- Additional compensation for time lost and expenses incurred

Penalty for Non-Compliance

If banks fail to comply with Ombudsman awards within 30 days, they face penalties of ₹1 lakh per day, subject to a maximum of ₹1 crore.

Tracking Your Complaint Status

Online Tracking Process

Step 1: Visit https://cms.rbi.org.in and click “Track Your Complaint”.

Step 2: Enter your mobile number for OTP verification.

Step 3: Input your complaint reference number and captcha code.

Step 4: View real-time status updates and communications.

The system provides detailed updates including acknowledgment, bank response, Ombudsman review progress, and final decision.

Success Rate and Statistics

Recent Performance Data

According to RBI's latest annual report for 2023-24:

- 9.34 lakh complaints received under RB-IOS 2021

- 95.1% disposal rate achieved by Banking Ombudsmen

- 32.81% increase in complaints compared to previous year

Complaint Categories (2023-24)

Top Complaint Areas:

- Loans and Advances: 85,281 complaints (29.01%)

- Mobile/Electronic Banking: 57,242 complaints (19.48%)

- Deposit Account Operations: 46,358 complaints (15.77%)

- Credit Cards: 42,329 complaints (14.40%)

Geographic Distribution

States with highest complaint rates per lakh accounts: Chandigarh, NCT of Delhi, Rajasthan, Gujarat, and Uttarakhand. This indicates both higher financial activity and greater awareness of consumer rights in these regions.

Tips for Successful Complaint Filing

Documentation Best Practices

Maintain Comprehensive Records: Keep chronological files of all banking correspondence, including emails, letters, and SMS communications.

Clear Narrative: Write a factual, chronological account of events without emotional language.

Specific Relief: Clearly state the exact remedy sought, including monetary compensation with supporting calculations.

Regular Follow-up: Track complaint status regularly using the reference number and respond promptly to any requests for additional information.

Common Mistakes to Avoid

Incomplete Information: Ensure all mandatory fields are filled accurately to prevent rejection.

Missing Prerequisites: Always approach the bank first and wait the required 30 days before filing with the Ombudsman.

Delayed Filing: Submit complaints within the prescribed time limits to avoid dismissal.

Inadequate Evidence: Provide sufficient supporting documents to substantiate your claims.

Interactive Calculator: Potential Compensation Estimator

For customers seeking to estimate potential compensation, consider these factors:

- Direct Financial Loss: Actual monetary loss due to bank's action/inaction

- Opportunity Cost: Interest lost on delayed payments or incorrect debits

- Time and Expense: Costs incurred in pursuing resolution

- Mental Agony: Harassment or distress caused (up to ₹1 lakh)

Example Calculation:

If unauthorized debit of ₹50,000 caused 60-day delay in important payment:

- Direct loss: ₹50,000

- Opportunity cost: ₹50,000 × 8% × 60/365 = ₹658

- Time and expenses: ₹2,000

- Mental agony: ₹25,000

- Total potential compensation: ₹77,658

Comparison: Banking Ombudsman vs Other Dispute Resolution Options

| Feature | Banking Ombudsman | Consumer Court | Civil Court |

|---|---|---|---|

| Filing Fee | Free | Nominal fee | Court fees required |

| Time Frame | 30-60 days | 3-6 months | 1-3 years |

| Expertise | Banking specialist | General consumer law | General civil law |

| Compensation Limit | ₹21 lakhs maximum | No limit | No limit |

| Enforcement | RBI backing | Legal enforcement | Court enforcement |

| Appeal Options | Yes, to RBI | Yes, to higher court | Yes, appellate court |

Regional Considerations and Cultural Context

State-Specific Variations

While the scheme operates uniformly across India, local factors influence complaint patterns:

Metropolitan Areas: Higher digital banking complaints due to greater technology adoption.

Rural Regions: More complaints about basic banking services and agent banking issues.

Festival Seasons: Increased loan and remittance-related complaints during Diwali, Eid, and regional festivals.

Joint Family Considerations

Indian joint family structures create unique scenarios:

- Multiple Signatories: Complaints may involve several family members

- Succession Issues: NRI accounts and inheritance disputes

- Agricultural Loans: Seasonal income patterns affecting loan servicing

Infographic Description: Complaint Filing Process

A visual representation of the complaint process would include:

- Pre-Filing: Bank complaint → 30-day wait → Unsatisfactory response

- Online Portal: Visit CMS portal → OTP verification → Form filling

- Documentation: Upload supporting documents → Review details → Submit

- Processing: RBI review → Bank response → Ombudsman decision

- Resolution: Award/Dismissal → Appeal option → Final closure

Frequently Asked Questions (FAQs)

1. How long does the Banking Ombudsman take to resolve complaints?

The Banking Ombudsman typically resolves complaints within 30-60 days from filing. Simple cases may be resolved faster, while complex matters involving detailed investigation might take the full 60 days. The timeline includes bank response period and Ombudsman review.

2. Can I file a complaint directly with the Banking Ombudsman without approaching my bank first?

No, you must first file a written complaint with your bank and wait for 30 days. You can approach the Banking Ombudsman only if the bank doesn't respond, rejects your complaint, or if you're unsatisfied with their response.

3. What is the maximum compensation the Banking Ombudsman can award?

The Banking Ombudsman can award up to ₹20 lakhs for actual financial loss and an additional ₹1 lakh for mental agony and harassment. The total maximum compensation is therefore ₹21 lakhs per complaint.

4. Is there any fee for filing complaints with the Banking Ombudsman?

No, filing complaints with the Banking Ombudsman is completely free. There are no charges for registration, processing, or resolution of complaints under the RB-IOS 2021.

5. Can I track my complaint status online after filing?

Yes, you can track your complaint status 24/7 through the CMS portal at https://cms.rbi.org.in. Use your complaint reference number and registered mobile number to access real-time updates on your case progress.

6. What happens if my bank doesn't comply with the Ombudsman's award?

If banks fail to comply with Ombudsman awards within 30 days, RBI can impose penalties of ₹1 lakh per day, subject to a maximum of ₹1 crore. The RBI has strong enforcement mechanisms to ensure compliance.

7. Can NRIs file complaints under the Banking Ombudsman Scheme?

Yes, Non-Resident Indians (NRIs) can file complaints regarding their Indian bank accounts, remittances, and other banking services. The scheme specifically covers NRI-related banking grievances.

Conclusion

The RBI Banking Ombudsman Scheme represents India's most accessible and effective mechanism for resolving banking disputes. With a 95.1% success rate in complaint resolution and completely free service, it provides genuine consumer protection in the financial sector.

The digitized complaint process through https://cms.rbi.org.in makes it easier than ever to seek redressal for banking grievances. Whether you're dealing with unauthorized transactions, loan processing delays, or poor customer service, the Banking Ombudsman offers a reliable path to resolution.

Key takeaways: Always approach your bank first, maintain proper documentation, file within prescribed time limits, and use the online portal for fastest processing. With proper preparation and understanding of the process, you can effectively protect your banking rights and secure appropriate compensation for any deficiency in service.

Take advantage of this powerful consumer protection mechanism – your financial rights matter, and the RBI Banking Ombudsman is there to safeguard them.

Ready to file your banking complaint? Visit the official CMS portal at https://cms.rbi.org.in and take the first step toward resolving your banking grievance today.