An Initial Public Offering (IPO) represents a transformative milestone in a company's journey, marking the transition from private ownership to public trading on stock exchanges. For Indian investors and companies, understanding IPOs is crucial for making informed investment decisions and accessing capital markets effectively.

What is an IPO?

An IPO, or Initial Public Offering, is the process through which a private company offers its shares to the general public for the first time. When a company “goes public” through an IPO, it transforms from a privately-held entity into a publicly-traded company, allowing retail and institutional investors to purchase ownership stakes.

In the Indian context, an IPO enables companies to raise capital from public investors while providing liquidity to existing shareholders, including promoters and early investors. This process is strictly regulated by the Securities and Exchange Board of India (SEBI) to ensure transparency and protect investor interests.

Key Components of an IPO

Fresh Issue vs. Offer for Sale

An IPO can comprise either a fresh issue of new shares, an offer for sale (OFS) by existing shareholders, or a combination of both. In a fresh issue, the company creates new shares and receives the proceeds directly for business expansion or debt reduction. In an OFS, existing shareholders sell their stakes, providing them with an exit opportunity while the company doesn't receive the funds directly.

Types of IPOs in India

Based on Pricing Mechanism

1. Fixed Price IPO

In a fixed price IPO, the company sets a predetermined price for its shares before the offering opens. Investors can only bid at this fixed price, providing certainty but potentially missing optimal price discovery. The demand is known only after the subscription period ends, making it less flexible than book-building methods.

2. Book Building IPO

The book-building method involves setting a price band (typically with a 20% difference between floor and cap prices) within which investors can bid. The final price is determined based on demand during the bidding process, ensuring better price discovery and market-driven valuation. Most mainboard IPOs in India use this method due to its transparency and efficiency.

Based on Company Size

Mainboard IPO

Mainboard IPOs are for established companies with a post-issue paid-up capital of ₹10 crores or more. These companies must meet stringent eligibility criteria, including profitability requirements and extensive regulatory compliance. They are listed on major exchanges like BSE and NSE, providing access to a broader investor base.

SME IPO

Small and Medium Enterprise IPOs cater to companies with post-issue paid-up capital between ₹1 crore and ₹25 crores. SME IPOs have relaxed regulatory requirements and are listed on specialized platforms like NSE Emerge and BSE SME. These companies must be profitable at the operating level (EBITDA) for two out of three financial years.

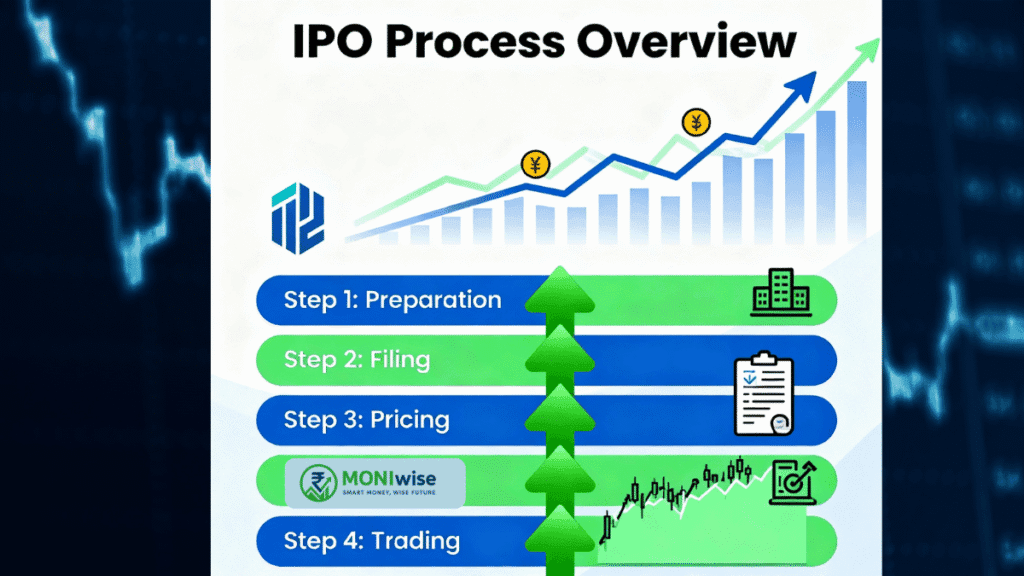

IPO Process: Step-by-Step Journey

Phase 1: Pre-IPO Preparation

1. Investment Banker Appointment

Companies first appoint merchant bankers or lead managers to orchestrate the entire IPO process. These SEBI-registered entities conduct due diligence and coordinate with all stakeholders throughout the journey.

2. Due Diligence and Documentation

The company undergoes comprehensive financial and legal due diligence. Key documents include audited financial statements, corporate governance frameworks, and business strategy documentation.

Phase 2: Regulatory Filing

3. DRHP Submission

The Draft Red Herring Prospectus (DRHP) is filed with SEBI, containing detailed company information but excluding final pricing and issue size. This preliminary document undergoes SEBI review, typically taking 2-4 months for mainboard IPOs.

4. RHP Filing

After incorporating SEBI's observations, the company files the Red Herring Prospectus (RHP), an updated version with current financials and pricing details. The RHP must be filed at least 3 days before the IPO opens.

Phase 3: Marketing and Launch

5. Roadshows and Marketing

Companies conduct roadshows to generate investor interest, meeting with institutional investors, analysts, and media representatives across different cities.

6. Price Band Determination

For book-building issues, the price band is announced at least two working days before the IPO opens. The band cannot exceed 20% difference between floor and cap prices.

7. IPO Launch

The IPO opens for subscription for a minimum of 3 working days. Investors place bids within the price band, and the final price is determined after the bidding period closes.

Phase 4: Allotment and Listing

8. Share Allotment

Shares are allotted within 10 days of the issue closing. The allotment process varies by investor category and subscription levels.

9. Listing

Shares begin trading on stock exchanges within 3 days of issue closure, transitioning from primary to secondary market trading.

Investor Categories and Allocation

Retail Individual Investors (RII)

Individual investors applying for up to ₹2 lakhs are classified as retail investors. They receive at least 35% reservation in book-building issues and 50% in fixed-price issues. Retail investors benefit from guaranteed minimum allocation of one lot in oversubscribed issues through a lottery system.

Non-Institutional Investors (NII/HNI)

High Net Worth Individuals investing more than ₹2 lakhs fall under the NII category, receiving 15% reservation. This category is further divided into:

- Small NII (sHNI): Investments between ₹2-10 lakhs (1/3rd allocation)

- Large NII (bHNI): Investments above ₹10 lakhs (2/3rd allocation)

Qualified Institutional Buyers (QIB)

Institutional investors like mutual funds, banks, and FPIs receive 50% reservation in regular IPOs or 75% for loss-making companies. QIBs benefit from proportionate allotment rather than lottery systems.

Anchor Investors

Large institutional investors can participate before the IPO opens, investing minimum ₹10 crores for mainboard issues. They provide confidence to other investors but face lock-in periods of 30-90 days.

How to Apply for an IPO

UPI-Based Application Process

Step 1: UPI Setup

Create a UPI ID through any UPI-enabled app like Google Pay, PhonePe, or BHIM. Link your bank account and set up a UPI PIN for secure transactions.

Step 2: Choose Intermediary

Apply through authorized intermediaries including stock brokers, depository participants, or registrar agents. Most retail investors prefer online applications through broker platforms .

Step 3: Submit Application

Fill the IPO application form with investment details, UPI ID, and bid information. For book-building issues, you can bid at any price within the band or choose the cut-off price.

Step 4: UPI Mandate Authorization

Approve the UPI mandate request on your mobile app to block the required funds. The blocked amount remains in your account until allotment.

Step 5: Allotment Process

Wait for allotment results, typically announced 3-5 days after IPO closure. Check your status using PAN number, application number, or DP ID/Client ID.

Required Documents

- Valid PAN Card

- Demat Account

- Bank account linked to UPI ID

- Active UPI application on smartphone

IPO Benefits and Risks

Benefits for Companies

Capital Access and Growth

IPOs provide substantial capital for business expansion, debt reduction, and strategic investments. Companies gain access to a broader pool of investors and improved financial flexibility.

Enhanced Credibility and Visibility

Public listing increases brand recognition and market credibility. It attracts better management talent and provides prestige to employees through stock-based compensation.

Liquidity for Existing Shareholders

Promoters and early investors gain liquidity through offer-for-sale components. This provides exit opportunities while maintaining strategic control.

Benefits for Investors

Early Investment Opportunities

Investors can participate in high-growth companies at potentially attractive valuations. IPOs offer access to companies not previously available in public markets.

Listing Gains Potential

Successful IPOs may provide immediate profits if shares list at a premium to the issue price. These gains reflect strong market demand and positive investor sentiment.

Portfolio Diversification

IPOs enable investors to diversify across sectors and company sizes, potentially reducing overall portfolio risk.

Risks and Challenges

Market Volatility and Overvaluation

IPO shares often experience high volatility in initial trading days. Companies may be overvalued due to market hype, leading to subsequent price corrections.

No Guarantee of Allotment

High demand may result in oversubscription, with retail investors receiving shares through lottery systems. Popular IPOs may have allotment ratios below 10%.

Business and Regulatory Risks

Companies face ongoing compliance costs and regulatory scrutiny. Market conditions can change rapidly between filing and listing, affecting performance.

Limited Historical Data

Unlike established public companies, IPO companies have limited trading history, making valuation assessment challenging.

IPO Taxation in India

Short-Term Capital Gains (STCG)

Profits from IPO shares sold within 12 months are taxed as STCG at 20% (plus surcharge and cess). This applies to most listing gains since shares are typically sold on listing day or shortly after.

Example: If you purchase IPO shares at ₹100 and sell at ₹150 within 12 months, the ₹50 profit per share is taxed at 20%, resulting in ₹10 tax per share.

Long-Term Capital Gains (LTCG)

Gains from shares held for more than 12 months qualify for LTCG treatment. LTCG up to ₹1.25 lakh per financial year is tax-exempt, with amounts above this threshold taxed at 12.5% without indexation benefits.

Tax Planning Strategies

Investors can optimize tax liability by holding shares for more than 12 months to benefit from lower LTCG rates and the ₹1.25 lakh exemption. However, this strategy requires confidence in long-term company performance.

Recent IPO Performance and Market Trends

2024-2025 Market Overview

The Indian IPO market has shown mixed performance in recent years. While some companies like Nykaa delivered substantial listing gains of 77%, others like Paytm faced significant declines with 27% drop on listing day.

Sector-wise Performance

Technology and consumer-focused companies have generally performed better, while traditional sectors faced more volatility. Investors increasingly focus on business fundamentals rather than market hype.

Key Success Factors

Companies with strong business models, clear growth strategies, and appropriate valuations tend to perform better post-listing. Market timing and overall economic conditions also significantly impact IPO success.

Strategic Considerations for Investors

Due Diligence Process

Financial Analysis: Review the company's RHP thoroughly, focusing on revenue growth, profitability trends, debt levels, and cash flow generation.

Business Model Assessment: Understand the company's competitive position, market opportunity, and growth drivers.

Management Quality: Evaluate the leadership team's experience, track record, and strategic vision.

Risk Management

Portfolio Allocation: Limit IPO investments to a reasonable percentage of your overall portfolio to manage risk.

Diversification: Apply for multiple IPOs rather than concentrating on single issues to improve allotment chances and reduce risk.

Exit Strategy: Decide whether to hold for long-term gains or book listing profits based on individual financial goals.

Key Documents and Their Importance

Draft Red Herring Prospectus (DRHP)

The DRHP serves as the preliminary offering document containing comprehensive business details, financial information, and risk factors. It lacks final pricing and issue size details but provides essential information for initial assessment.

Red Herring Prospectus (RHP)

The RHP is the updated version incorporating SEBI feedback and including price band information. This document is crucial for final investment decisions as it contains complete offering details.

Final Prospectus

Filed after price determination, the final prospectus contains all details including final price and allocation information.

Frequently Asked Questions

1. What is the minimum investment amount for IPOs?

For mainboard IPOs, the minimum investment is typically around ₹15,000 per lot, while retail investors can invest up to ₹2 lakhs to remain in the retail category.

2. How long does the IPO process take?

Mainboard IPOs typically take 6-12 months from planning to listing, while SME IPOs are faster at 3-4 months.

3. Can NRIs invest in Indian IPOs?

Yes, NRIs can invest in IPOs under the retail category (up to ₹2 lakhs) or NII category (above ₹2 lakhs), subject to RBI and FEMA regulations.

4. What happens if an IPO is oversubscribed?

Retail investors receive allotment through computerized lottery ensuring at least one lot per successful applicant. NIIs and QIBs receive proportionate allotment based on subscription levels.

5. Are IPO application fees charged?

No, there are no fees for applying to IPOs. Investors only pay brokerage and statutory charges if shares are allotted and subsequently sold.

6. Can IPO applications be withdrawn?

Retail investors can withdraw applications during the bidding period in book-building issues. Other categories typically cannot withdraw but can modify bids upward.

7. How are listing gains taxed?

Listing gains are taxed as short-term capital gains at 20% since shares are typically sold within 12 months of allotment.

Conclusion

IPOs represent a significant opportunity for both companies seeking growth capital and investors looking for early-stage investment opportunities in promising businesses. The Indian IPO market, regulated by SEBI, provides a structured framework ensuring transparency and investor protection while facilitating capital formation.

Success in IPO investing requires thorough research, understanding of market dynamics, and careful risk management. While listing gains can be attractive, investors should focus on long-term business fundamentals and maintain diversified portfolios to optimize returns while managing risk effectively.

The evolving regulatory landscape, technological improvements in application processes through UPI, and increasing retail participation make IPOs an integral part of India's capital market ecosystem. Whether you're a company considering going public or an investor evaluating opportunities, understanding the comprehensive IPO framework is essential for making informed decisions in India's dynamic financial markets.

Before investing in any IPO, conduct thorough research, read the RHP carefully, and consider consulting with a qualified financial advisor to align investments with your risk tolerance and financial goals.