Starting your investment journey with mutual funds doesn't require a large capital anymore. Thanks to recent regulatory changes and technological advancement, beginners can now start investing in mutual funds with as little as ₹100 per month. This comprehensive guide will help you understand everything about mutual fund investing for beginners with small amounts, from basic concepts to practical investment strategies.

What Are Mutual Funds?

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities like stocks, bonds, and other financial instruments. Professional fund managers handle these investments on behalf of investors, making mutual funds an ideal choice for beginners who lack expertise in stock market analysis.

When you invest in mutual funds, you purchase units of the fund at the current Net Asset Value (NAV). The value of your investment fluctuates based on the performance of the underlying securities in the fund's portfolio.

Why Mutual Funds Are Perfect for Beginners with Small Amounts

Low Minimum Investment Requirements

The Securities and Exchange Board of India (SEBI) has mandated that mutual funds offer a minimum investment of ₹100 for lump-sum investments and ₹500 for Systematic Investment Plans (SIPs). However, many fund houses now offer SIPs starting from just ₹100 per month, making mutual fund investing accessible to everyone.

Professional Management

Mutual funds are managed by experienced fund managers who have expertise in analyzing markets, selecting securities, and managing portfolios. This professional management eliminates the need for beginners to have extensive market knowledge.

Diversification Benefits

With a small amount like ₹100, you can gain exposure to a diversified portfolio of stocks or bonds that would otherwise require thousands of rupees if invested individually. This diversification helps reduce investment risk.

Regulated by SEBI

All mutual funds in India are regulated by SEBI under the SEBI (Mutual Funds) Regulations, 1996, ensuring transparency, investor protection, and fair practices.

Types of Mutual Funds for Small Investors

1. Equity Linked Savings Scheme (ELSS)

ELSS funds are equity-oriented mutual funds that offer tax benefits under Section 80C of the Income Tax Act. You can claim deductions up to ₹1.5 lakh annually and save up to ₹46,800 in taxes. These funds have a mandatory 3-year lock-in period, which is the shortest among all tax-saving instruments.

Key Features:

- Minimum SIP: ₹100-₹500 depending on the fund house

- Tax benefits under Section 80C

- 3-year lock-in period

- Potential for higher returns due to equity exposure

2. Index Funds

Index funds are passively managed funds that track a specific market index like Nifty 50 or BSE Sensex. They have lower expense ratios compared to actively managed funds, making them cost-effective for small investors.

3. Large Cap Funds

Large cap funds invest in stocks of well-established companies with large market capitalizations. These funds are generally less volatile and suitable for conservative beginners.

4. Multi-Asset Funds

Multi-asset funds invest across different asset classes like equity, debt, and gold, providing built-in diversification. They're ideal for beginners who want exposure to multiple asset classes with a single investment.

Understanding SIP vs Lump Sum Investment

Systematic Investment Plan (SIP)

SIP allows you to invest a fixed amount regularly (monthly, quarterly, or annually) in mutual funds. This method is particularly beneficial for beginners with limited capital.

Advantages of SIP:

- Rupee Cost Averaging: You buy more units when prices are low and fewer units when prices are high, averaging out the cost over time

- Power of Compounding: Regular investments combined with reinvestment of returns can lead to significant wealth creation over time

- Disciplined Investing: SIPs inculcate a habit of regular saving and investing

- No Market Timing Required: You don't need to worry about timing the market

Lump Sum Investment

A lump sum investment involves investing a large amount at once. While this can be beneficial when markets are low, it requires market timing skills that beginners typically lack.

For beginners with small amounts, SIP is generally the better option as it provides flexibility, reduces risk, and doesn't require large upfront capital.

Step-by-Step Guide to Start Investing

Step 1: Complete Your KYC Process

Before investing in mutual funds, you must complete the Know Your Customer (KYC) process. This is mandatory under the Prevention of Money Laundering Act, 2002.

Documents Required:

- PAN Card (mandatory)

- Aadhaar Card for identity and address proof

- Recent passport-size photographs

- Bank account details

- Address proof (utility bills, passport, voter ID, driving license)

KYC can be completed:

- Online: Through AMC websites or KRA (KYC Registration Agency) portals

- Offline: By visiting AMC offices or authorized branches

Step 2: Choose the Right Platform

Several platforms allow you to invest in mutual funds with small amounts. Popular options include:

- Groww: User-friendly interface, suitable for beginners, minimum SIP ₹100

- Zerodha Coin: Zero commission on direct plans, integrated with trading platform

- Paytm Money: Simple interface, personalized recommendations

- ETMoney: Comprehensive financial planning tools

- AngelOne: Wide range of mutual fund schemes

Step 3: Select Suitable Mutual Funds

For beginners with small amounts, consider:

Tax-Saving Options:

- SBI Long Term Equity Fund: 3-year annualized return of 23.51%

- Motilal Oswal ELSS Tax Saver Fund: 3-year annualized return of 22.18%

- HDFC ELSS Tax Saver Fund: 3-year annualized return of 21.54%

Diversified Options:

- HDFC Balanced Advantage Fund: Dynamic allocation between equity and debt

- ICICI Prudential Multi-Asset Fund: Exposure to multiple asset classes

Step 4: Start Your SIP

Once you've selected your funds:

- Choose your SIP amount (minimum ₹100)

- Select investment frequency (monthly recommended for beginners)

- Set up auto-debit from your bank account

- Monitor your investments regularly but avoid frequent changes

Understanding Mutual Fund Taxation

Understanding taxation is crucial for making informed investment decisions.

Equity Mutual Funds (Post Budget 2024)

- Short-term Capital Gains (STCG): 20% + cess for holdings less than 12 months

- Long-term Capital Gains (LTCG): 12.5% for gains above ₹1.25 lakh annually for holdings more than 12 months

Debt Mutual Funds

- Capital gains are taxed at your income tax slab rate regardless of holding period for funds purchased after April 1, 2023

ELSS Funds

- Gains are taxed as LTCG at 12.5% above ₹1.25 lakh after the 3-year lock-in period

Key Risks to Understand

While mutual funds offer excellent opportunities for wealth creation, they come with certain risks:

Market Risk

The value of your investment can fluctuate based on market conditions. Equity funds are more volatile compared to debt funds.

Credit Risk

Relevant for debt funds, this occurs when bond issuers default on their payments.

Liquidity Risk

Some funds may face difficulty in selling securities quickly during market stress.

Interest Rate Risk

Changes in interest rates affect debt fund performance inversely.

Risk Mitigation Strategies:

- Diversify across fund categories

- Invest for the long term (5+ years)

- Review and rebalance portfolio annually

- Don't panic during market volatility

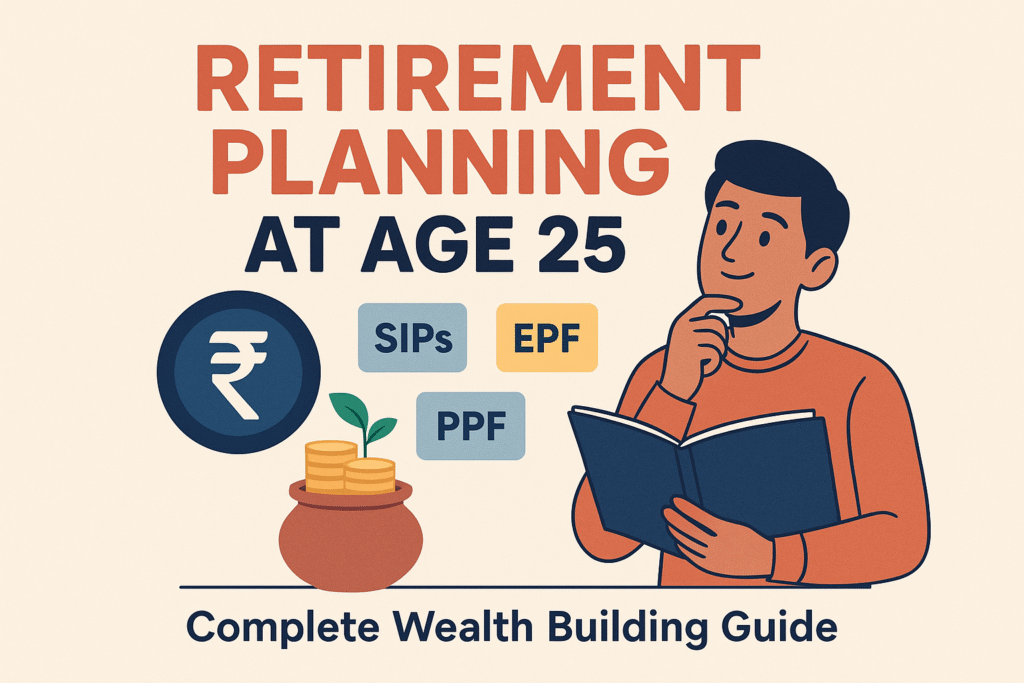

Investment Strategies for Small Investors

Goal-Based Investing

Define clear financial goals before investing:

- Short-term (1-3 years): Liquid funds, ultra-short duration funds

- Medium-term (3-5 years): Balanced advantage funds, conservative hybrid funds

- Long-term (5+ years): Equity funds, ELSS funds

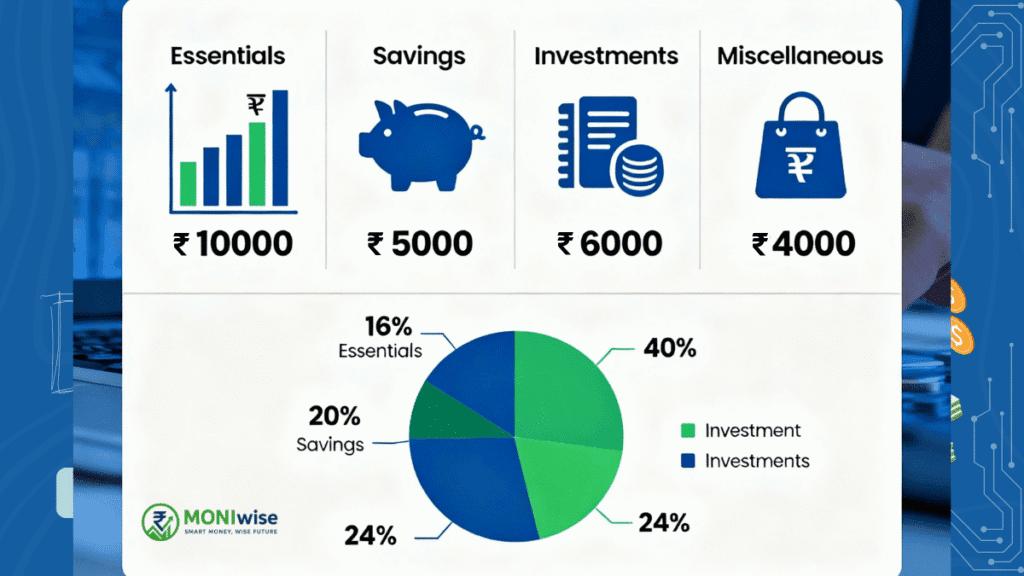

Asset Allocation

As a beginner, consider this simple allocation:

- Age 20-30: 70-80% equity, 20-30% debt

- Age 30-40: 60-70% equity, 30-40% debt

- Age 40+: Reduce equity allocation gradually

Progressive SIP Strategy

Start with a small amount and gradually increase your SIP every year:

- Year 1: ₹500 per month

- Year 2: ₹750 per month

- Year 3: ₹1,000 per month

This strategy helps you adapt to increasing income while building a substantial corpus over time.

Important Fees and Charges

Expense Ratio

This is the annual fee charged by mutual funds for managing your money. Equity funds typically charge 0.5-2.5% annually.

Exit Load

Most equity funds charge 1% exit load if you redeem within 12 months of investment. This discourages short-term trading.

No Entry Load

SEBI has banned entry loads, so you don't pay any fee when investing.

Technology and Apps for Small Investors

Modern technology has made mutual fund investing accessible through Mobile apps. Most platforms offer:

- Zero paperwork: Complete digital onboarding

- Low minimums: Start with ₹100

- Real-time tracking: Monitor investments 24/7

- Educational resources: Learn while you invest

- Goal-based planning: Tools to achieve financial objectives

Current Market Performance and Trends

The Indian mutual fund industry has shown remarkable growth in 2024:

- Total AUM: Crossed ₹68 lakh crore in November 2024

- SIP Growth: Monthly SIP inflows reached ₹25,320 crore in November 2024, up 48% year-over-year

- New SIP Accounts: 10.23 crore SIP accounts as of November 2024

- Equity Fund Performance: Average returns of 17.67% in the first half of 2024

These statistics indicate growing investor confidence and the effectiveness of SIP as an investment strategy.

Common Mistakes to Avoid

1. Investing Without Research

Don't invest in funds just because they have high recent returns. Consider long-term performance, risk factors, and fund manager track record.

2. Frequent Switching

Avoid changing funds frequently based on short-term performance. Give your investments time to grow.

3. Ignoring Expense Ratios

High expense ratios can significantly impact your returns over time. Choose funds with reasonable expense ratios.

4. Not Diversifying

Don't put all your money in one fund or one category. Diversify across different fund types and asset classes.

5. Emotional Investing

Don't make investment decisions based on market sentiment. Stick to your investment plan and goals.

Advanced Strategies for Growing Investors

Systematic Transfer Plan (STP)

Once your investment grows, you can use STP to systematically move money from debt funds to equity funds, providing better risk management.

Systematic Withdrawal Plan (SWP)

This allows you to withdraw a fixed amount regularly from your mutual fund investments, useful for creating regular income.

Fund of Funds

These are mutual funds that invest in other mutual fund schemes, providing instant diversification across multiple fund houses.

Regulatory Framework and Investor Protection

SEBI ensures investor protection through various measures:

- Mandatory disclosures: Fund houses must provide detailed information about investment objectives, risks, and portfolio holdings

- Standardized categories: Clear classification helps investors understand fund types

- Regular audits: Ensures compliance with investment objectives and risk parameters

- Grievance redressal: Robust mechanism for addressing investor complaints

Building Long-term Wealth with Small Amounts

Power of Compounding Example

If you invest ₹1,000 monthly in an equity fund earning 12% annual returns:

- After 10 years: ₹2.3 lakh (investment: ₹1.2 lakh)

- After 20 years: ₹9.9 lakh (investment: ₹2.4 lakh)

- After 30 years: ₹35.2 lakh (investment: ₹3.6 lakh)

This example illustrates how small, regular investments can create substantial wealth over time through the power of compounding.

Interactive Calculator Recommendation

SIP Calculator Features to Include:

- Monthly SIP amount input

- Investment duration slider

- Expected return rate adjustment

- Visual representation of corpus growth

- Comparison with traditional savings accounts

- Tax impact calculator

- Goal-based planning tool

Comparison Table: Investment Options for Small Investors

| Investment Option | Minimum Amount | Lock-in Period | Tax Benefits | Expected Returns | Risk Level |

|---|---|---|---|---|---|

| ELSS Funds | ₹100 | 3 years | Section 80C (old Tax Regime) | 12-15%* | High |

| Index Funds | ₹100 | None | No | 10-12%* | Medium |

| Large Cap Funds | ₹100 | None | No | 8-12%* | Medium |

| Debt Funds | ₹100 | None | No | 6-9%* | Low |

| Bank FD | ₹1,000 | Varies | Limited | 5-7% | Low |

| PPF | ₹500 | 15 years | Section 80C (old Tax Regime) | 7-8% | Low |

*Returns are indicative and based on historical performance

Frequently Asked Questions (FAQs)

1. Can I start investing in mutual funds with just ₹100?

Yes, many mutual fund houses now allow SIP investments starting from ₹100 per month. Some funds like Mirae Asset have reduced their minimum SIP amount to ₹99. This makes mutual fund investing accessible to everyone, including students and young professionals.

2. Which mutual funds are best for beginners with small amounts?

For beginners, ELSS funds offer tax benefits with a 3-year lock-in period, making them ideal for long-term wealth creation. Index funds and large cap funds are also suitable due to their lower risk profile compared to mid and small cap funds.

3. Is SIP better than lump sum investment for small investors?

SIP is generally better for small investors as it allows you to start with small amounts, provides rupee cost averaging benefits, and doesn't require market timing. You can invest regularly without worrying about market fluctuations.

4. How safe are mutual funds compared to fixed deposits?

While mutual funds carry market risks, they are regulated by SEBI and offer potential for higher returns compared to fixed deposits. For small investors, diversified mutual funds managed by professionals are relatively safer than individual stock investments.

5. What documents do I need to start investing in mutual funds?

You need to complete KYC with your PAN card (mandatory), Aadhaar card for identity and address proof, recent photographs, and bank account details. The process can be completed online through fund house websites or investment platforms.

6. How are mutual fund returns taxed for small investors?

For equity funds held more than 12 months, long-term capital gains above ₹1.25 lakh are taxed at 12.5%. Short-term gains (less than 12 months) are taxed at 20%. ELSS funds qualify for tax deduction under Section 80C up to ₹1.5 lakh annually.

7. Can I increase or decrease my SIP amount later?

Yes, most mutual funds allow you to increase, decrease, pause, or stop your SIP anytime. Many platforms also offer step-up SIPs where you can automatically increase your SIP amount annually.

Conclusion

Starting your investment journey with mutual funds using small amounts is not only possible but also highly recommended for building long-term wealth. With minimum investments starting from ₹100, professional management, diversification benefits, and regulatory protection, mutual funds offer an excellent entry point for beginners.

The key to success lies in starting early, investing regularly through SIPs, choosing appropriate funds based on your risk profile and investment goals, and staying invested for the long term. Remember that mutual fund investments are subject to market risks, but with proper planning and disciplined investing, you can harness the power of compounding to achieve your financial objectives.

Take action today – start your mutual fund investment journey with whatever small amount you can afford. Every financial expert agrees that the best time to start investing was yesterday; the second-best time is now.

Ready to begin your investment journey? Use our SIP Calculator to plan your investments and consult with a certified financial advisor to create a personalized investment strategy that aligns with your financial goals.

Disclaimer:

The information provided in this article is for educational and informational purposes only and should not be construed as financial advice or a direct recommendation to invest. Investments in mutual funds and other financial instruments carry risks, including the potential loss of principal. Past performance is not indicative of future results. We strongly recommend that you thoroughly research and consider your own financial situation, risk appetite, and investment objectives before making any investment decisions. It is advisable to consult a qualified financial advisor or professional for personalized guidance tailored to your individual circumstances. Neither the author nor the platform accepts any responsibility for any loss or damage resulting from the use of this information.