Starting retirement planning at age 25 might seem premature when you're focused on building your career, paying off student loans, or enjoying newfound financial independence. However, beginning your retirement journey at 25 is arguably the smartest financial decision you can make. This comprehensive guide explores how young professionals can leverage time, compound interest, and strategic investment choices to build substantial wealth for their golden years.

Why Age 25 is the Perfect Time to Start Retirement Planning

The power of starting early cannot be overstated when it comes to retirement planning. At 25, you have approximately 35-40 years until traditional retirement age, giving your investments maximum time to benefit from compound growth. Research shows that someone starting investments at age 25 needs to save significantly less each month compared to those who delay.

Consider this compelling example: If you start investing ₹15,000 per month at age 25 with a 12% annual return, you can accumulate ₹10 crore by age 60. However, if you wait until age 40, you'll need to invest ₹1,00,000 per month—nearly seven times more—to achieve the same corpus. This dramatic difference illustrates why the phrase “time is money” holds particular significance in retirement planning.

The Mathematics of Early Investment

The magic lies in compound interest, often called the eighth wonder of the world. When you invest early, you earn returns not just on your principal amount but also on the accumulated interest from previous years. This compounding effect becomes exponential over longer periods, making early investment incredibly powerful.

For instance, if you invest ₹10,000 monthly starting at age 25 for 30 years with an expected 12% return, you could potentially accumulate ₹3.08 crore by age 55. The same investment starting at age 35 would result in significantly lower corpus due to reduced compounding time.

Setting Your Retirement Goals at 25

Calculating Your Future Financial Needs

Most financial experts recommend that you'll need approximately 70-80% of your pre-retirement income to maintain your lifestyle during retirement. However, this percentage can vary based on your specific circumstances, lifestyle expectations, and inflation projections.

To calculate your retirement corpus accurately, consider these factors:

Current Monthly Expenses: Document your present monthly expenses as a baseline. Let's assume your current expenses are ₹30,000 per month.

Inflation Impact: With India's average inflation rate of 6-7% annually, your expenses will increase substantially over time. ₹30,000 today would require approximately ₹2.5 lakh per month after 35 years to maintain the same purchasing power.

Life Expectancy: With improving healthcare and lifestyle, plan for a retirement period of 25-30 years post-retirement.

Healthcare Costs: Medical expenses typically increase with age and often outpace general inflation rates. Factor in additional healthcare costs for your retirement years.

Using Retirement Calculators

Several online retirement calculators can help you determine your required corpus. These tools consider variables such as current age, retirement age, life expectancy, monthly expenses, inflation rates, and expected returns to project your financial needs accurately.

For example, a 25-year-old with current monthly expenses of ₹30,000, planning to retire at 60, would need approximately ₹2.39 crore as retirement corpus assuming 5% inflation and 15% investment returns.

Investment Options for 25-Year-Olds

1. Systematic Investment Plans (SIPs) in Mutual Funds

SIPs represent one of the most effective wealth-creation tools for young investors. They offer several advantages:

- Rupee Cost Averaging: Regular investments help average out market volatility

- Discipline: Automated investments ensure consistency

- Flexibility: Start with as little as ₹500 per month

- Professional Management: Expert fund managers handle investment decisions

Equity Mutual Funds: Given your long investment horizon, equity funds should form the core of your portfolio. Historical data suggests equity investments have the potential to generate 12-15% annual returns over long periods.

Example: Investing ₹3,000 monthly through SIP for 25 years at 12% returns can potentially create a corpus exceeding ₹56 lakhs.

2. Employee Provident Fund (EPF)

If you're a salaried employee, EPF is automatically deducted from your salary. Currently offering around 8.25% annual returns, EPF provides:

- Employer Contribution: Your employer matches your 12% contribution

- Tax Benefits: Contributions are tax-deductible under Section 80C

- Safety: Government-backed scheme with minimal risk

- Tax-Free Withdrawal: Maturity amount is tax-free if you complete 5 years of service

3. Public Provident Fund (PPF)

PPF remains one of India's most popular long-term investment options:

- Current Returns: Approximately 7.1% per annum

- Tax Benefits: Triple tax exemption (EEE status)

- Safety: Government-backed with sovereign guarantee

- Liquidity: Partial withdrawals allowed after 6 years

Maximum Investment: ₹1.5 lakh annually

Lock-in Period: 15 years (extendable in 5-year blocks)

4. National Pension System (NPS)

NPS offers market-linked returns with professional fund management:

- Tax Benefits: Additional ₹50,000 deduction under Section 80CCD(1B)

- Low Costs: Among the lowest expense ratios in the industry

- Flexibility: Choose your asset allocation between equity, corporate bonds, and government securities

- Portability: Account remains active across job changes

Returns Potential: NPS has historically generated 10-14% returns depending on asset allocation.

5. Equity Investments

Direct equity investments can provide higher returns but require market knowledge and risk tolerance:

- Blue-chip Stocks: Invest in established companies with consistent performance

- Sectoral Diversification: Spread investments across different sectors

- Dividend Stocks: Companies providing regular dividend income

6. Real Estate Investment

While requiring larger capital, real estate can provide:

- Rental Income: Regular cash flow during retirement

- Capital Appreciation: Long-term property value growth

- Inflation Hedge: Real estate typically keeps pace with inflation

7. Equity Linked Savings Scheme (ELSS)

ELSS mutual funds offer tax benefits with growth potential:

- Tax Deduction: Up to ₹1.5 lakh under Section 80C

- Lock-in Period: Only 3 years, shortest among 80C investments

- Equity Exposure: Potential for higher returns through stock market investments

Creating Your Asset Allocation Strategy

Age-Based Allocation

A common rule suggests investing your age percentage in debt instruments and the remainder in equity. At 25, this would mean:

- Equity: 75% of your portfolio

- Debt: 25% of your portfolio

However, given your long investment horizon, you might consider a more aggressive allocation:

- Equity/Equity Funds: 80-90%

- Debt/Fixed Income: 10-20%

Diversification Across Asset Classes

Domestic Equity: 60-70% through mutual funds and direct stocks

International Equity: 10-15% for global diversification

Fixed Income: 15-20% through PPF, EPF, bonds

Alternative Investments: 5-10% in REITs, gold, or commodities

Tax Planning Strategies for Retirement

Section 80C Investments

Maximize your ₹1.5 lakh annual limit through:

- EPF Contributions: Automatic if you're salaried

- PPF: Up to ₹1.5 lakh annually

- ELSS Mutual Funds: Tax-saving with equity growth potential

- Life Insurance Premiums: Term insurance for protection

- NSC/Tax-saving FDs: Conservative debt options

Section 80CCD Benefits

NPS Contributions: Additional ₹50,000 deduction under Section 80CCD(1B)

Employer NPS: Up to 10% of salary under Section 80CCD(2)

Long-term Capital Gains Planning

- Equity Mutual Funds: Gains up to ₹1.25 lakh annually are tax-free

- Systematic Withdrawal: Plan tax-efficient withdrawals during retirement

Common Retirement Planning Mistakes to Avoid

1. Starting Too Late

This is the most costly mistake in retirement planning. Every year you delay reduces the compounding benefit and increases the required monthly investment significantly.

2. Not Setting Clear Goals

Without specific targets, it's impossible to determine if you're saving enough. Calculate your required corpus and work backwards to determine monthly investment needs.

3. Ignoring Inflation

Many young investors underestimate inflation's impact on their purchasing power. Always factor in 6-7% annual inflation when calculating future expenses.

4. Over-Conservative Approach

At 25, you can afford higher risk for potentially higher returns. Being too conservative with debt instruments may not generate sufficient corpus for retirement.

5. Not Reviewing and Adjusting

Your retirement plan should evolve with changing income, life circumstances, and market conditions. Review annually and adjust accordingly.

6. Early Withdrawals

Avoid premature withdrawals from retirement accounts. This reduces your corpus and often attracts penalties and tax implications.

7. Neglecting Healthcare Planning

Healthcare costs rise with age and often exceed general inflation rates. Invest in comprehensive health insurance and factor higher medical expenses in retirement planning.

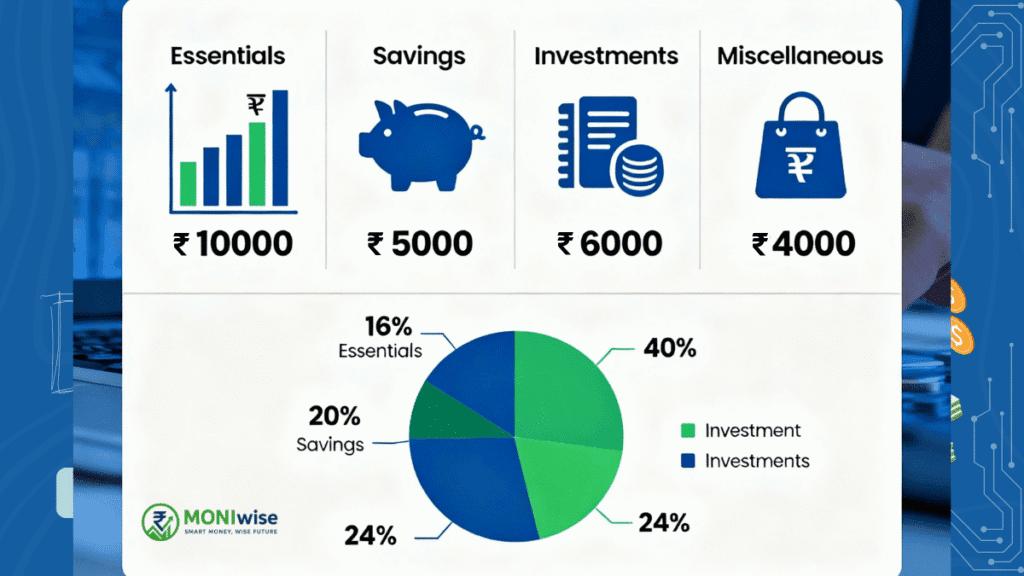

Building Your Monthly Investment Plan

Income-Based SIP Strategy

Fresher (₹25,000-40,000 monthly income):

- Start with ₹3,000-5,000 monthly SIP

- Focus on equity mutual funds

- Gradually increase with salary increments

Mid-level Professional (₹50,000-80,000 monthly income):

- Invest ₹8,000-12,000 monthly

- Diversify across large-cap, mid-cap, and international funds

- Add PPF and NPS contributions

Senior Professional (₹80,000+ monthly income):

- Invest ₹15,000-20,000 monthly

- Include direct equity investments

- Maximize all tax-saving instruments

Progressive Investment Strategy

Year 1-2: Focus on equity mutual funds and EPF

Year 3-5: Add PPF and NPS contributions

Year 5-10: Introduce direct equity and international exposure

Year 10+: Consider real estate and alternative investments

Interactive Retirement Calculator Description

A comprehensive retirement calculator should include:

Input Fields:

- Current age (25)

- Retirement age (60)

- Current monthly expenses

- Expected inflation rate (6-7%)

- Investment return expectations

- Current savings amount

Output Results:

- Required retirement corpus

- Monthly SIP amount needed

- Projected wealth accumulation year-wise

- Inflation-adjusted future expenses

Advanced Features:

- Multiple investment scenario comparison

- Tax-efficient withdrawal strategies

- Healthcare cost projections

Step-by-Step Action Plan for 25-Year-Olds

Immediate Actions (Month 1-3)

- Open Investment Accounts:

- Start SIP in equity mutual funds

- Open PPF account

- Ensure EPF account is active

- Set Up Automation:

- Automate SIP payments

- Set up annual PPF contributions

- Get Protected:

- Buy adequate term life insurance

- Purchase comprehensive health insurance

Short-term Goals (Year 1-2)

- Build Emergency Fund: Accumulate 6-12 months of expenses in liquid funds

- Increase Investment Gradually: Scale up SIP amounts with salary increments

- Learn and Research: Understand different investment options and market basics

Medium-term Actions (Year 3-7)

- Diversify Portfolio: Add international funds and direct equity exposure

- Optimize Taxes: Maximize all available tax-saving instruments

- Review and Rebalance: Annual portfolio review and rebalancing

Long-term Strategy (Year 8+)

- Advanced Investments: Consider real estate, REITs, and alternative investments

- Estate Planning: Create will and succession planning

- Pre-retirement Planning: Start shifting to conservative investments as retirement approaches

Comparison Table: Investment Options for 25-Year-Olds

| Investment Option | Expected Returns | Risk Level | Lock-in Period | Tax Benefits | Liquidity |

|---|---|---|---|---|---|

| Equity Mutual Funds (SIP) | 12-15% | High | None | ELSS: 80C | High |

| PPF | 7.1% | Very Low | 15 years | 80C + Tax-free | Limited |

| EPF | 8.25% | Very Low | Until retirement | 80C + Tax-free | Limited |

| NPS | 10-14% | Medium | Until retirement | 80CCD | Very Limited |

| Direct Equity | 12-18% | Very High | None | LTCG benefits | High |

| Bank FDs | 6-7% | Very Low | Fixed tenure | 80C (5-year) | Low |

| NSC | 6.8% | Very Low | 5 years | 80C | Very Low |

| Real Estate | 8-12% | Medium | High transaction costs | None | Very Low |

Some Important Articles

- Calculate Now: After retirement calculator description

- Compare Plans: Following investment options section

- Get Quote: After insurance planning discussion

- Start SIP: At the end of mutual fund section

Frequently Asked Questions

1. How much should a 25-year-old save for retirement monthly?

Financial experts recommend saving 15-20% of your income for retirement. For a 25-year-old earning ₹50,000 monthly, this translates to ₹7,500-10,000 per month. However, you can start with smaller amounts like ₹3,000-5,000 and gradually increase with salary increments.

2. Is ₹10 crore retirement corpus realistic at age 25?

Yes, it's absolutely achievable. Starting a monthly SIP of ₹15,000 at age 25 with 12% expected returns can potentially create ₹10 crore by age 60. The key is starting early and maintaining disciplined investing over the long term.

3. Should I prioritize EPF, PPF, or mutual funds at age 25?

Given your long investment horizon, prioritize equity mutual funds for wealth creation while maintaining EPF and PPF for stability. A balanced approach would be 60-70% in equity funds, 20-25% in EPF/PPF, and 10-15% in other instruments.

4. How does inflation affect my retirement planning?

Inflation significantly erodes purchasing power over time. With 6-7% annual inflation, what costs ₹30,000 today will cost approximately ₹2.5 lakh after 35 years. Always factor inflation into your retirement corpus calculations using retirement calculators.

5. Can I retire early if I start investing at 25?

Yes, starting at 25 gives you the flexibility to achieve financial independence and retire early (FIRE movement). With aggressive saving rates of 50-70% of income and smart investing, early retirement by 40-45 is possible.

6. What's the biggest mistake 25-year-olds make in retirement planning?

The biggest mistake is not starting at all, followed by being too conservative with investments. At 25, you can afford higher risk for potentially higher returns through equity investments.

7. How often should I review my retirement plan?

Review your retirement plan annually or whenever there are significant life changes like job switch, salary increment, marriage, or childbirth. Adjust your investment amounts and asset allocation accordingly to stay on track with your goals.

Conclusion

Starting retirement planning at age 25 is not just wise—it's essential for building substantial wealth over time. The combination of a long investment horizon, compound interest, and disciplined investing can help you create a corpus that ensures financial independence and a comfortable retirement.

The key is to start immediately, even with small amounts, and gradually increase your investments as your income grows. Focus on equity investments through SIPs for wealth creation while maintaining a foundation of stable instruments like EPF and PPF. Most importantly, avoid common mistakes like starting late, ignoring inflation, or making premature withdrawals.

Remember, every month you delay starting your retirement planning makes achieving your goals significantly more expensive. Take action today, automate your investments, and let time and compound interest work their magic. Your future self will thank you for the financial discipline you develop at 25.

Ready to start your retirement journey? Begin with a small SIP today, open your PPF account, and take the first step toward a financially secure future. The power of starting at 25 cannot be replicated at any other age—make the most of this incredible advantage time has given you.

Disclaimer:

The information provided in this article is for educational purposes only and should not be considered as personalized financial advice. Investment returns mentioned are estimates based on historical data and market conditions may vary. Please consult with a qualified financial advisor before making investment decisions. Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing.