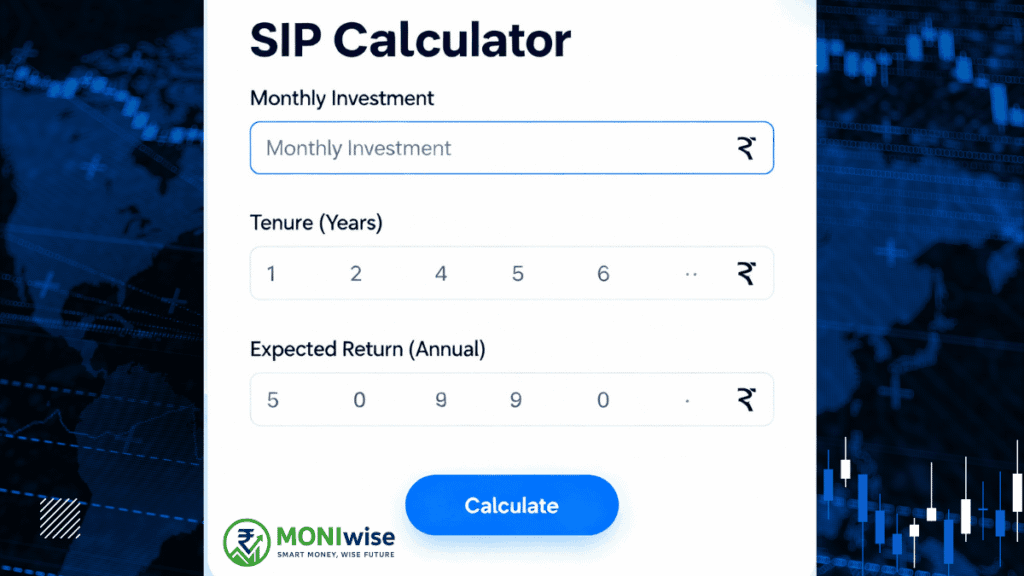

SIP Calculator India 2025

Calculate your Systematic Investment Plan returns with compound growth

Popular SIP Mutual Fund Schemes in India 2025

| Fund Name | Category | 3Y Returns | 5Y Returns | Min SIP |

|---|---|---|---|---|

| ICICI Prudential Infrastructure Fund | Sectoral | 33.05% | 31.3% | ₹500 |

| Motilal Oswal Midcap Fund | Mid Cap | 32.4% | 34.2% | ₹500 |

| SBI PSU Fund | PSU | 31.8% | 33.7% | ₹500 |

| HDFC Flexi Cap Fund | Flexi Cap | 24.5% | 30.2% | ₹100 |

| Parag Parikh Flexi Cap Fund | Flexi Cap | 22.7% | 23.9% | ₹1,000 |

| HDFC Large and Mid Cap Fund | Large & Mid Cap | 24.6% | 27.2% | ₹100 |

| Nippon India Small Cap Fund | Small Cap | 25.05% | 31.5% | ₹500 |

| ICICI Prudential Bluechip Fund | Large Cap | 19.8% | 23.0% | ₹1,000 |

Key Features of the SIP Calculator

Multiple Calculation Types

- Standard SIP: Fixed monthly investment calculation

- Step-up SIP: Annual increment feature (10% increase yearly)

- Target-based SIP: Calculate required monthly amount for specific goals

Interactive Design Elements

- Mobile-responsive layout optimized for all devices

- Interactive sliders for easy parameter adjustment

- Real-time calculations without page refresh

- Clean, professional interface suitable for finance websites

Indian Market Focus

- Formula specifically designed for Indian SIP calculations

- Popular mutual fund schemes table with current performance data

- INR currency formatting throughout

- Minimum SIP amounts starting from ₹100-₹1,000

SIP Calculator Formula Explained

Core Mathematical Formula

The calculator uses the standard SIP formula recognized across Indian financial institutions:

FV = P × ({[1 + i]^n – 1} / i) × (1 + i)

Where:

- FV = Future Value (Maturity Amount)

- P = Monthly SIP Investment Amount

- i = Monthly Rate of Return

- n = Total Number of Monthly Installments

Critical Formula Component: Monthly Return Conversion

Monthly Return = {(1 + Annual Return)^1/12} – 1

For example, with 12% annual return:

- Correct monthly return = 0.9489% (not simply 12÷12 = 1%)

- This precision ensures accurate compound interest calculations

Popular SIP Schemes Featured in Calculator

Top Performing Funds (2025 Data)

| Fund Name | Category | 3Y Returns | 5Y Returns | Min SIP |

| ICICI Prudential Infrastructure Fund | Sectoral | 33.05% | 31.3% | ₹500 |

| Motilal Oswal Midcap Fund | Mid Cap | 32.4% | 34.2% | ₹500 |

| SBI PSU Fund | PSU | 31.8% | 33.7% | ₹500 |

| HDFC Flexi Cap Fund | Flexi Cap | 24.5% | 30.2% | ₹100 |

| Parag Parikh Flexi Cap Fund | Flexi Cap | 22.7% | 23.9% | ₹1,000 |

Fund Categories Explained

Infrastructure Funds: Focus on infrastructure development companies, benefiting from government spending and economic growth

Mid Cap Funds: Invest in medium-sized companies with high growth potential, suitable for aggressive investors

PSU Funds: Target Public Sector Undertakings, gaining from government policies and reforms

Flexi Cap Funds: Provide diversified exposure across market capitalizations for balanced risk

How to Use the SIP Calculator

Step 1: Set Investment Parameters

- Monthly Amount: Choose between ₹500 to ₹1,00,000

- Investment Period: Select 1 to 40 years

- Expected Returns: Set realistic expectations (8-15% for equity funds)

Step 2: Choose Calculation Type

- Standard SIP: For consistent monthly investments

- Step-up SIP: For annual 10% increase in SIP amount

- Target-based: When you have a specific financial goal

Step 3: Analyze Results

The calculator displays:

- Total investment amount over the period

- Expected returns through compounding

- Final maturity value

- Wealth gained through SIP investing

Real Investment Examples

Example 1: Young Professional (Age 25)

- Monthly SIP: ₹5,000

- Investment Period: 10 years

- Expected Return: 12%

- Results: ₹6,00,000 invested becomes ₹11,20,179 (₹5,20,179 gains)

Example 2: Mid Career (Age 35)

- Monthly SIP: ₹10,000

- Investment Period: 15 years

- Expected Return: 15%

- Results: ₹18,00,000 invested becomes ₹61,63,656 (₹43,63,656 gains)

Example 3: Goal-Based Planning

- Target Amount: ₹50,00,000 (retirement corpus)

- Investment Period: 20 years

- Expected Return: 12%

- Required Monthly SIP: ₹5,436

Advanced Calculator Features

Step-up SIP Benefits

The step-up feature accounts for salary increments and inflation, significantly boosting long-term wealth:

- Starting SIP: ₹5,000

- 10% annual increase over 10 years

- Final monthly amount: ₹11,790

- Enhanced wealth accumulation compared to fixed SIP