What is Tata Capital IPO?

Tata Capital Limited, India's third-largest diversified Non-Banking Financial Company (NBFC), has launched its much-awaited Initial Public Offering (IPO) on October 6, 2025. This ₹15,511.87 crore IPO represents one of the largest public offerings in India's financial services sector and marks a significant milestone for the Tata Group's financial services arm.

The company operates as a comprehensive financial services provider, offering over 25 lending products across retail, SME, and corporate segments. With a loan book of ₹2,21,950 crore as of FY25, Tata Capital serves approximately 7 million customers through its extensive network of 1,496 branches across 27 states and union territories.

IPO Structure and Key Details

Pricing and Timeline

Tata Capital has set its IPO price band between ₹310-326 per share, significantly below its unlisted market trading levels of ₹735, offering investors an attractive entry point. The three-day subscription window runs from October 6-8, 2025, with shares expected to list on both NSE and BSE on October 13, 2025.

| Parameter | Details |

|---|---|

| Price Band | ₹310-₹326 |

| Issue Size | ₹15,511.87 crore |

| Fresh Issue | ₹6,846 crore (21 crore shares) |

| Offer for Sale (OFS) | ₹8,665.87 crore (26.58 crore shares) |

| Lot Size | 46 shares |

| Minimum Investment | ₹14,996 (at upper band) |

| IPO Open Date | October 6, 2025 |

| IPO Close Date | October 8, 2025 |

| Listing Date | October 13, 2025 |

| Allotment Date | October 9, 2025 |

| Market Cap (Upper Band) | ₹1.38 lakh crore |

| Book Value per Share (FY25) | ₹91.36 |

| P/E Ratio | 37.8x |

| P/B Ratio | 4.1x |

Issue Composition

The IPO comprises two key components:

- Fresh Issue: ₹6,846 crore (21 crore shares) – funds will strengthen company's capital base

- Offer for Sale (OFS): ₹8,665.87 crore (26.58 crore shares) by existing shareholders including Tata Sons and IFC

With a minimum lot size of 46 shares, retail investors need ₹14,996 to participate at the upper price band. The company's post-listing market capitalization is expected to reach approximately ₹1.38 lakh crore.

Business Model and Revenue Streams

Diversified Financial Services

Tata Capital operates as a systemically important NBFC with diversified revenue streams:

Primary Revenue Sources:

- Interest Income (90.84%): Core lending operations across retail and corporate segments

- Fee and Commission Income (6.29%): Advisory services, mutual fund distribution, insurance commissions

- Other Income (2.87%): Rental income, dividend income, and gains from financial asset sales

Product Portfolio

The company offers comprehensive financial solutions including:

- Personal loans and home loans

- Vehicle financing and equipment leasing

- Business loans and working capital finance

- Credit cards (through partnership with SBI Cards)

- Wealth management and investment advisory services

- Private equity and investment banking

Financial Performance Analysis

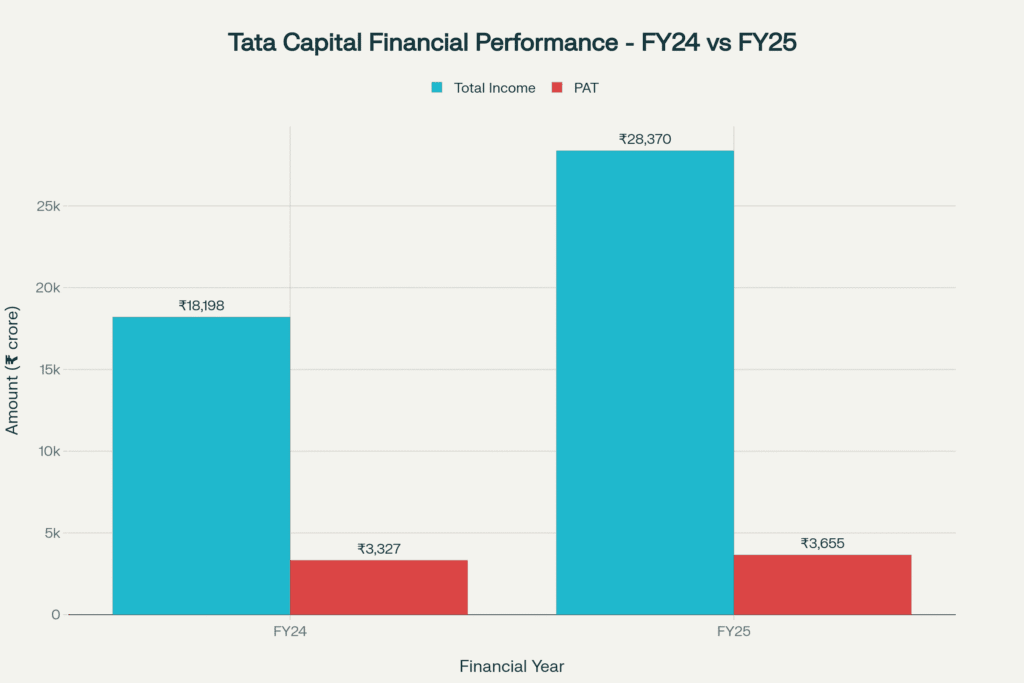

Strong Revenue Growth

Tata Capital demonstrated robust financial performance in FY25, with total income surging by 55.9% to ₹28,370 crore from ₹18,198 crore in FY24. This impressive growth was driven by aggressive loan book expansion and higher disbursements across key segments.

Tata Capital shows strong revenue growth of 55.9% in FY25, though profit growth was modest at 9.9% due to higher operational costs

Profitability Metrics

Despite strong revenue growth, profit after tax increased modestly by 9.9% to ₹3,655 crore in FY25. This disparity reflects:

- Increased operational expenses from ₹13,794 crore to ₹23,448 crore

- Higher provisioning for loan losses

- Rising cost of borrowing from 6.6% in FY23 to 7.8% in FY25

Key Financial Highlights:

- Earnings Per Share: ₹9.32 in FY25 vs ₹8.57 in FY24

- Book Value: Improved from ₹66.38 to ₹91.36 per share

- Loan Book CAGR: Impressive 37.3% growth over FY23-25

| Metric | Value |

|---|---|

| Total Income (FY25) | ₹28,370 crore |

| Total Income (FY24) | ₹18,198 crore |

| Revenue Growth (FY25) | 55.9% |

| Profit After Tax (FY25) | ₹3,655 crore |

| Profit After Tax (FY24) | ₹3,327 crore |

| PAT Growth (FY25) | 9.9% |

| Earnings Per Share (FY25) | ₹9.32 |

| Total Gross Loans (FY25) | ₹2,21,950 crore |

| Loan Book CAGR (FY23-25) | 37.3% |

| Net Interest Margin (FY25) | 5.1% |

| Gross NPA (FY25) | 2.33% |

| Net NPA (FY25) | 0.98% |

| Provision Coverage Ratio (FY25) | 58.5% |

| Cost of Borrowing (FY25) | 7.8% |

| Tier-1 Capital Ratio | 12.8% |

Competitive Position and Market Comparison

Peer Analysis

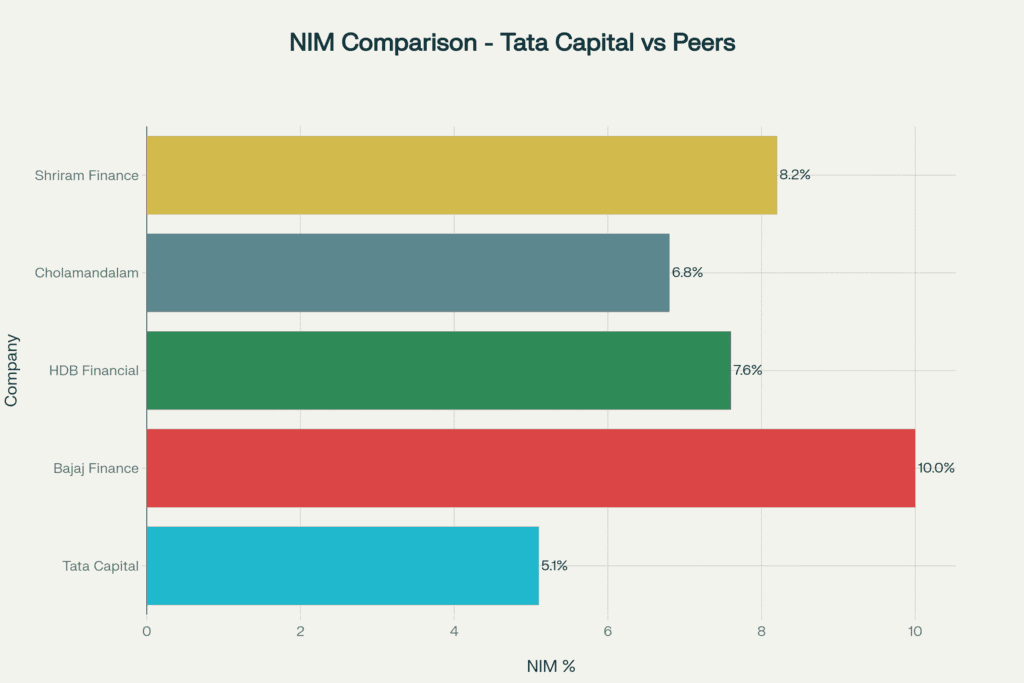

Tata Capital competes with established NBFCs including Bajaj Finance, HDB Financial Services, Cholamandalam Investment, and Shriram Finance.

Valuation Comparison:

- P/E Ratio: 37.8x (comparable to Bajaj Finance at 35.4x)

- P/B Ratio: 4.1x (reasonable compared to peers)

- Market Position: Third-largest diversified NBFC in India

Net Interest Margin comparison shows Tata Capital trails peers, reflecting its focus on lower-risk lending with stable margins

Asset Quality Assessment

Tata Capital maintains relatively better asset quality compared to most peers:

- Gross NPA: 2.33% (higher than Bajaj Finance's 1.18% but better than Cholamandalam and Shriram)

- Net NPA: 0.98% (comparable to industry standards)

- Provision Coverage Ratio: 58.5% (adequate but declined from 77.1% in FY23)

Growth Drivers and Opportunities

Market Expansion Potential

The Indian NBFC sector is projected to grow at 15-18% CAGR over the next three years, driven by:

- Rising credit penetration in semi-urban and rural markets

- Digital transformation and fintech integration

- Government infrastructure spending boosting commercial vehicle financing

- Growing demand for retail and SME credit

Digital Transformation

Tata Capital is investing heavily in AI-powered credit scoring, automated underwriting, and digital loan processing to improve operational efficiency. The company's cost-to-income ratio improved from 42% in FY25 to 37% in Q1 FY26, approaching peer levels.

Strategic Advantages

- Tata Brand Trust: Strong brand equity providing competitive advantage in customer acquisition

- Diversified Funding: AAA credit rating enabling access to low-cost funds from multiple sources

- Omni-channel Distribution: Extensive branch network combined with digital platforms

Key Risks and Challenges

Asset Quality Concerns

Several risk factors require investor attention:

Rising NPAs: Gross Stage 3 loans increased from 1.5% in FY24 to 1.9% in FY25, with loan write-offs jumping 257% to ₹1,803 crore. The merger with Tata Motors Finance (TMFL) added asset quality pressure, as TMFL had 7.1% gross NPAs.

Unsecured Exposure: Over 20% of the loan portfolio comprises unsecured loans, creating potential vulnerability during economic downturns.

Operational Challenges

Interest Rate Risk: 55% of borrowings are fixed while 64% of loans are floating, creating margin pressure if rates decline.

Legal Issues: The company faces 283 pending criminal cases with contingent liability of ₹765 crore, primarily related to loan disputes and vehicle repossession.

Competition Pressure: Increasing competition from banks offering lower-cost credit could impact market share and margins.

Regulatory Environment

As an Upper Layer NBFC, Tata Capital faces stringent regulatory requirements similar to banks. The RBI mandate requiring all Upper Layer NBFCs to list by end-2025 was a key driver for this IPO timing. Enhanced regulatory oversight provides system stability but increases compliance costs and reduces operational flexibility.

Expert Recommendations and Market Outlook

Analyst Ratings

Most brokerage firms have issued “Subscribe” ratings for long-term investors:

Positive Factors:

- Strong brand credibility and market position

- Diversified business model reducing concentration risk

- Reasonable valuation compared to premium peers

- Expected improvement in operational efficiency

Concerns:

- Lower Net Interest Margins (5.1%) compared to peer average of 7.6%

- Asset quality deterioration from TMFL merger

- Rising competitive pressure from banks

Grey Market Premium

The IPO shows modest grey market premium of approximately 3-4%, suggesting cautious market sentiment but limited downside risk given strong anchor investor participation of ₹4,641 crore.

Investment Recommendation

For Long-term Investors

Tata Capital IPO presents a tactical growth opportunity for investors seeking exposure to India's expanding financial services sector. The combination of Tata Group credibility, diversified business model, and improving operational metrics make it suitable for 3-5 year investment horizon.

Key Investment Rationale:

- Access to India's growing credit market through a trusted brand

- Expected improvement in profitability as operational efficiencies improve

- Strong capital base post-IPO supporting future growth

- Reasonable valuation leaving room for re-rating

Risk Considerations

Investors should carefully evaluate:

- Asset quality trends, particularly impact of TMFL merger

- Competitive pressure from banks and fintech players

- Interest rate cycle impact on margins

- Regulatory changes affecting NBFC operations

Frequently Asked Questions

Q: What is the minimum investment required for Tata Capital IPO?

A: The minimum investment is ₹14,996 for 46 shares at the upper price band of ₹326 per share.

Q: When will Tata Capital shares be listed?

A: The shares are expected to list on NSE and BSE on October 13, 2025, following the IPO closure on October 8, 2025.

Q: How does Tata Capital compare to Bajaj Finance?

A: While Bajaj Finance has higher margins (10% vs 5.1%) and better asset quality, Tata Capital offers reasonable valuation and strong brand backing with growth potential.

Q: What are the main uses of IPO proceeds?

A: Fresh issue proceeds of ₹6,846 crore will strengthen Tier-1 capital, supporting future lending growth and regulatory compliance.

Q: Is Tata Capital IPO suitable for retail investors?

A: Yes, for investors with 3-5 year investment horizon seeking exposure to India's financial services growth story, though careful risk assessment is recommended.

Q: What is the current grey market premium?

A: The GMP is approximately 3-4% above issue price, indicating modest listing gains expectation.

Q: How is Tata Capital's asset quality?

A: Asset quality shows some stress with gross NPAs at 2.33% in FY25, partly due to TMFL merger impact, but remains better than several peers.

Conclusion

Tata Capital IPO represents India's largest NBFC public offering, providing investors access to a well-established financial services platform with strong brand equity and diversified operations. While the company faces near-term challenges from asset quality pressures and competitive dynamics, its strategic positioning in India's growing credit market offers long-term value creation potential.

The IPO is reasonably priced at 4.1x P/B ratio, below premium peers, leaving room for valuation re-rating as operational improvements materialize. For investors seeking exposure to India's financial services sector through a trusted brand with improving fundamentals, Tata Capital IPO merits consideration with appropriate risk assessment.

Ready to participate in India's largest NBFC IPO? Evaluate your investment goals and risk appetite before making investment decisions. Consider consulting with a financial advisor for personalized investment guidance.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. IPO investments carry market risks, and investors should carefully read the offer document before making investment decisions. Past performance does not guarantee future results. Please consult with qualified financial advisors before investing.