A Week in My Wallet: Money Diary of a 30-Year-Old Investor

If someone opened your bank statement like a Netflix mini-series, what story would it tell?

This is a one-week “money diary” of a 30-year-old investor living in an Indian metro city. The numbers are realistic, the mistakes are honest, and the lessons are practical.

Nothing here is a stock tip or shortcut to become rich. It is simply real-world financial planning in action, so you can compare, reflect, and build your own money system.

My Financial Background (Setting the Scene)

Age: 30

City: Mumbai

Job: Mid-level salaried professional in a private company

Monthly in-hand salary: ₹95,000

Other income:

- Average monthly dividends: ₹2,000

- Freelance/side income: about ₹5,000 (not fixed)

Fixed monthly expenses (approx.):

- Rent: ₹25,000

- Groceries & utilities: ₹12,000

- Transport: ₹4,000

- SIPs & investments: ₹25,000

- Insurance premiums (life + health): ₹4,500

Average monthly savings rate: 30–35%

This week’s diary is from the second week of the month, when most major bills are already paid and regular investing is on auto-pilot.

Day 1 – Monday: Automated Investing Day

Morning:

Salary was credited a few days back, so this is the week when most of my SIPs and recurring investments go out.

Today, three SIPs got debited automatically:

- ₹8,000 into a Nifty 50 index fund

- ₹5,000 into a flexi-cap mutual fund

- ₹3,000 into a short-term debt fund (for stability and emergencies)

Total invested today: ₹16,000

Thought process:

- Index fund for core wealth building

- Flexi-cap for active management and growth

- Debt fund for risk management and some stability

Evening:

- Swiggy dinner: ₹320

- Ola share to office and back (because it rained): ₹280

Total spent today: ₹600 (discretionary)

🧠 Behavioral finance insight:

Automation protects from mood swings. When SIPs run on fixed dates, the temptation to “wait for market to fall more” reduces. This avoids emotional market timing, which often leads to missing out on long-term compounding.

How to Make 1 Crore in 5 Years Using SIP: The Family Advantage

Day 2 – Tuesday: Coffee vs Compounding

Morning:

Stopped at a café before office.

- Cappuccino + sandwich: ₹220

On the surface, it looks like a small, harmless expense. But the investor brain did a quick calculation:

If ₹220 was invested monthly at an assumed return of 12% for 20 years:

- Monthly ₹220 for 20 years at 12% could grow to roughly around ₹2 lakh+ (approximate, not guaranteed).

Still, did not feel guilty. Why?

- This is within a planned “guilt-free” budget” of ₹3,000 per month for eating out and small joys.

Evening:

- Recharged FASTag: ₹1,000 for upcoming highway trip next week.

Total spent today: ₹1,220

🧠 Behavioral finance insight:

The goal is not to cut every coffee. The goal is to avoid unplanned, mindless spending that eats into your savings rate. Allocating a fixed “fun money” budget helps maintain balance between today’s lifestyle and tomorrow’s financial goals.

Day 3 – Wednesday: Midweek Market Check (and FOMO Control)

Morning:

Stock market was slightly volatile today. One of my favourite stocks, a well-known banking stock, fell around 3%.

What many investors do: panic or overreact.

What I did instead:

- Opened my financial planning sheet

- Checked my asset allocation:

- Equity funds + stocks: 62%

- Debt + fixed income: 25%

- Cash & emergency fund: 13%

This is within my risk comfort zone. No need to react.

Afternoon break:

- Ordered tea and snacks with colleagues: ₹80

Evening:

- No extra spending. Cooked simple dinner at home.

Total spent today: ₹80

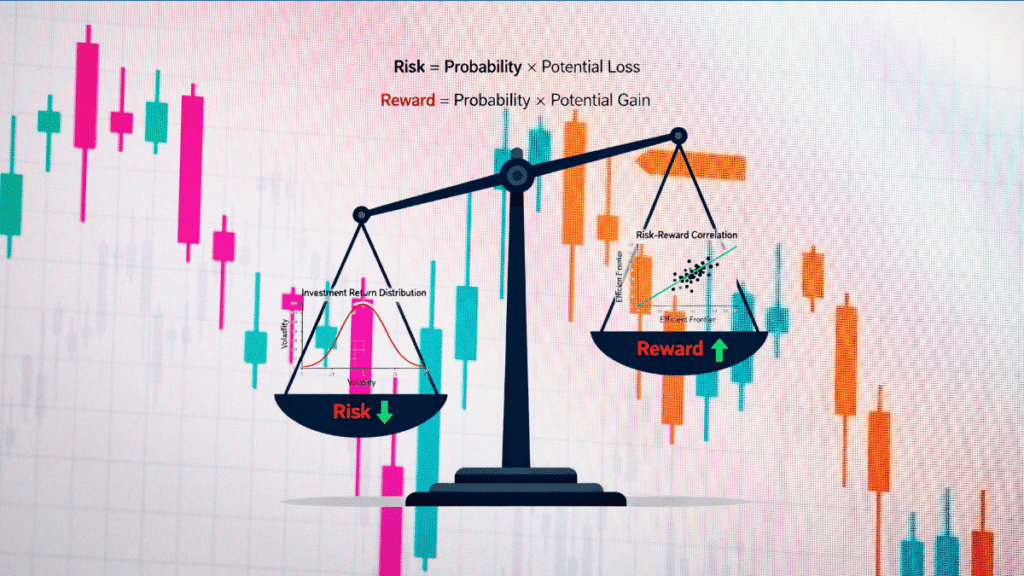

🧠 Behavioral finance insight:

Falling prices trigger emotions like fear and FOMO. But a clear asset allocation framework acts like Google Maps for your investing journey. If allocation is on track, market noise can be ignored for long-term goals.

Day 4 – Thursday: Insurance and Risk Management Check

Today’s main financial task: Risk review.

Morning:

Reviewed insurance policies during lunch break.

Current coverage:

- Term life insurance: ₹1 crore cover, annual premium around ₹14,000 (approx. ₹1,200/month)

- Health insurance: Family floater ₹10 lakh cover, premium around ₹26,000 per year (approx. ₹2,200/month)

Monthly budget impact: about ₹3,400–₹4,000 for both (already accounted in fixed expenses).

Why this matters at 30:

- With dependents or future responsibilities, protecting your family is more important than chasing highest returns.

- A term plan is pure protection, not an investment. This keeps financial planning clean and transparent.

Evening:

- Bought vegetables and groceries: ₹850

- Paid electricity bill: ₹1,350

Total spent today: ₹2,200

🧠 Behavioral finance insight:

Many investors focus only on returns and ignore risk management. In reality, a good term and health insurance plan can save your entire financial plan from being destroyed by one unfortunate event. Think of it as a safety helmet before riding the bike of investing.

Day 5 – Friday: Treat Day vs Lifestyle Inflation

Salary week, Friday evening, and friends’ group chat: perfect combination for overspending.

Evening outing:

- Movie ticket (multiplex): ₹280

- Popcorn + soft drink combo: ₹350

- Cab to and from mall: ₹260

Total spent: ₹890

Did this hurt my financial planning? Not really, because:

- Monthly “entertainment” budget: ₹3,500

- Actual spend so far this month (including today): around ₹1,900

There is still room without crossing the limit.

However, one pattern to watch:

- Earlier, a movie plus food used to cost ₹400–₹500

- Now, post-30, comfort spending has slowly increased

This is called lifestyle inflation – when income rises, spending quietly follows, often without conscious decisions.

🧠 Behavioral finance insight:

Lifestyle upgrades are not wrong. The risk is when upgrades happen unconsciously and start eating into savings or investments. Simple rule:

- Try to increase your savings rate before upgrading lifestyle. For example, if income grows 10%, aim to first increase investments by 5–7% before upgrading expenses.

Day 6 – Saturday: Deep-Dive into Goals and Numbers

Weekend is when major financial planning work happens.

Morning: Updated goal tracker spreadsheet. Current goals:

- Build a 6-month emergency fund (almost done: saved 5 months of expenses)

- Save for house down payment over next 5–7 years

- Invest regularly for retirement at 60

- Small yearly budget for travel: ₹60,000 per year (₹5,000 per month set aside in a separate savings account)

Some numbers:

- Monthly investment towards long-term goals: ₹25,000

- Emergency fund in liquid funds + savings: around ₹3.5 lakh

- Total equity + mutual fund portfolio: around ₹12–13 lakh (market-linked, so this changes daily)

Afternoon:

- Lunch outside with family: ₹750

- Monthly broadband + OTT bill auto-debit: ₹1,100

Total spent today: ₹1,850

🧠 Behavioral finance insight:

Seeing all numbers in one place gives clarity. Without this, it is easy to feel “I’m investing something” but not know whether the amount is adequate for goals like retirement, home, or children’s education.

Financial planning is like planning a train journey. You need:

- Starting point (current net worth)

- Destination (financial goals)

- Time of travel (years to goal)

- Type of coach (risk level and assets)

Day 7 – Sunday: Reflection, Regrets, and Realizations

Sunday is review plus reset.

Total spending this week (rounded):

- Monday: ₹600

- Tuesday: ₹1,220

- Wednesday: ₹80

- Thursday: ₹2,200

- Friday: ₹890

- Saturday: ₹1,850

- Sunday: ₹500 (approx. for snacks, local travel, etc.)

Total weekly spend: around ₹7,340

Against a monthly take-home of ₹95,000, this weekly spend is quite reasonable and within plan.

Where money went this week:

- Needs (essentials, bills, groceries): ~55–60%

- Wants (eating out, movie, café): ~15–20%

- Investments & long-term goals: ~25–30%

Regrets this week:

- Maybe could have skipped the costly popcorn at the multiplex.

- Impulse browsing of “new phone offers” on e-commerce. Almost added to cart, but stopped.

Wins this week:

- All SIPs went on time.

- Did not redeem any investment during market dip.

- Rechecked insurance and risk cover.

🧠 Behavioral finance insight:

A weekly money diary helps in building awareness. Many people underestimate their discretionary expenses. Writing it down for even 2–3 weeks can expose patterns—late-night ordering, unnecessary subscriptions, or emotional shopping.

Behavioral Finance Lessons from This Money Diary

Here are some key behavioral finance takeaways hidden inside this week:

- Automation beats motivation

Relying on “I will invest when I feel like it” rarely works. Automated SIPs aligned with salary dates prevent procrastination and emotional decisions. - Budgets are not cages; they are guardrails

A fixed “guilt-free” spending budget lets you enjoy life without mental stress. It keeps lifestyle inflation within boundaries. - Risk management is part of investing, not separate

Term insurance, health insurance, and an emergency fund are silent heroes. Without them, even a good portfolio can fall apart after one bad event. - Asset allocation reduces noise

Instead of checking stock prices every day, focus on whether your equity-debt-cash mix suits your age, goals, and risk appetite. - Awareness reduces regret

Maintaining a money diary for a few weeks helps you understand spending triggers—boredom, stress, peer pressure, or fear of missing out.

What Will Be the Nifty 50 Market in 2026? New Year Outlook

Simple Framework: How to Create Your Own Money Diary (Indian Context)

Here is a simple how-to framework to start your own money diary for one week.

- Step 1 – Define your categories

- Income (salary, business, freelance, rent, etc.)

- Essential expenses (rent, EMI, bills, groceries, transport)

- Discretionary expenses (eating out, shopping, subscriptions)

- Investments (SIP, stocks, PPF, NPS, EPF top-ups)

- Protection (insurance premiums)

- Step 2 – Track every rupee for 7 days

- Use notes app, spreadsheet, or any budgeting app.

- Write every spend: amount, what for, and how you felt (stress, joy, boredom).

- Step 3 – Review patterns on Sunday

- Calculate total weekly spend.

- Check what percent went into: needs, wants, and investments.

- Note any impulse buys or emotional spending.

- Step 4 – Set simple rules for next week

Examples:- “Eating out max 2 times a week.”

- “Every salary day, invest at least 20–30% before spending.”

- “Uninstall shopping apps for 15 days if impulse buying is high.”

- Step 5 – Create or refine your financial plan

- Build a basic emergency fund (3–6 months of expenses).

- Start SIPs in simple index funds or large-cap funds if your risk profile allows.

- Get adequate term and health insurance based on your needs.

- Align investments with goals (house, retirement, education, travel).

Cultural & Indian Money Mindset Angle

In many Indian households, money decisions are still heavily influenced by:

- Family expectations

- Social comparison (“log kya kahenge”)

- Emotional attachments to assets like gold, land, or real estate

For a 30-year-old Indian investor:

- Parents might push for an early home loan instead of renting.

- Relatives might suggest traditional LIC endowment policies instead of pure term plus mutual funds.

- Friends might push toward high-risk trading or crypto for “quick profits”.

Balancing this means:

- Respecting elders’ experiences, but still doing your own research.

- Choosing instruments that are transparent, regulated, and suitable to your goals, not just popular.

- Understanding that wealth building is a long game, not a weekend cricket match.

Key Takeaways from This Week in My Wallet

- A realistic savings rate of 30–35% in your 20s and 30s, if sustained and invested wisely, can create strong financial freedom over time.

- Small treats like coffee and movies are fine when they fit within a pre-decided budget and do not disturb your financial planning.

- Risk management through insurance and emergency funds is as important as stock market investing.

- A weekly money diary builds self-awareness, reduces wasteful spending, and strengthens your decision-making as an investor.

What You Can Do Next

- Start your own 7-day money diary from next Monday.

- Track every rupee and see where your wallet is silently leaking.

- Set up at least one automated SIP aligned to your salary date (if it fits your risk profile and goals).

- Review your insurance cover and emergency fund this month.

Financial independence is not built in one big move. It is built through hundreds of small, conscious decisions like these, week after week.

SEBI-Compliant Disclaimer

This article and money diary are for education and awareness only. The numbers, examples, and scenarios are illustrative and may not suit your personal situation. This is not investment advice, stock recommendation, or a promise of any return.

Investing in mutual funds, stocks, or any market-linked product involves risk, including possible loss of capital. Always assess your own risk profile, read all offer documents carefully, and consider consulting a SEBI-registered investment advisor before making any investment decisions.