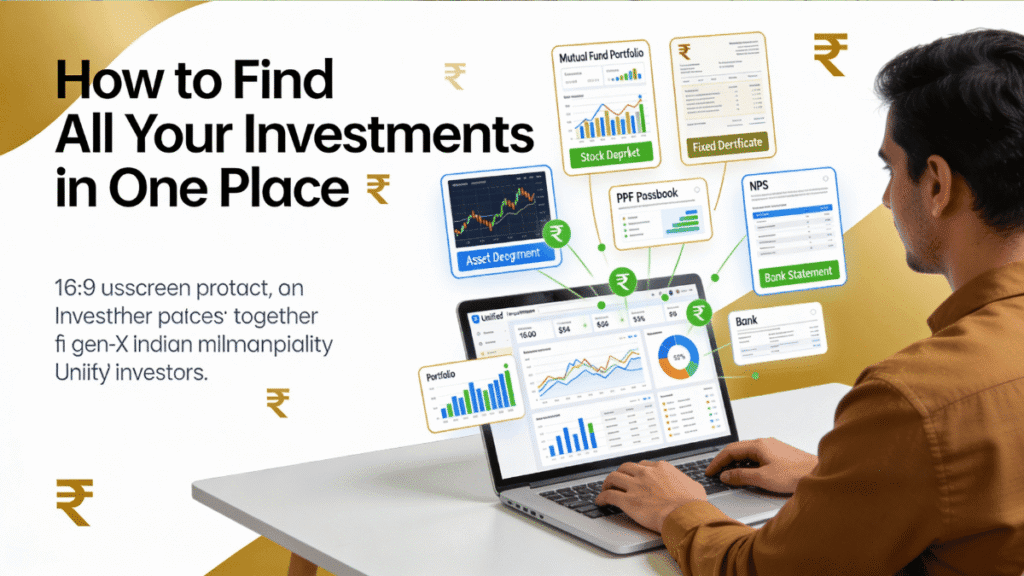

Consolidate All Investments in One Place – Complete Portfolio Guide for Indians

Introduction: The Hidden Wealth You’re Not Tracking Most Indian investors have a problem they never voice out loud: scattered investments. You bought mutual funds through your bank’s distributor three years ago. Your cousin recommended a stock trading app, so you opened another account. Your employer offers an employee stock plan. You have an old FD somewhere, […]

Consolidate All Investments in One Place – Complete Portfolio Guide for Indians Read More »