Introduction: The Hidden Wealth You're Not Tracking

Most Indian investors have a problem they never voice out loud: scattered investments.

You bought mutual funds through your bank's distributor three years ago. Your cousin recommended a stock trading app, so you opened another account. Your employer offers an employee stock plan. You have an old FD somewhere, a NPS account from years past, and maybe some PPF units gathering digital dust.

Suddenly, you don't own investments—you own chaos.

But here's the contrarian truth nobody talks about: The real wealth advantage doesn't come from chasing higher returns. It comes from knowing exactly what you own.

This knowledge gap doesn't just hurt your financial decisions. It's also one of the biggest advantages of shared family living that modern Western independence culture has quietly eliminated. When families lived together—and many still do in India—managing pooled assets was simple. One person knew everything. Today's scattered nuclear families scatter their wealth too.

Investment Consolidation Flowchart: From Scattered Assets to Unified Portfolio Dashboard

Let me show you how to reclaim that clarity, whether you're managing solo or consolidating family wealth.

Why Portfolio Consolidation Actually Matters

The True Cost of Fragmented Investments

Before exploring the “how,” let's look at the “why” through real rupee calculations.

Consider Rajesh's story: He has ₹25 lakhs invested across seven different platforms:

- Mutual funds in three different apps (₹8,00,000)

- Stocks in two brokers (₹6,50,000)

- Fixed deposits at two banks (₹5,00,000)

- NPS account (₹3,00,000)

- PPF (₹2,50,000)

Rajesh spends his Monday mornings logging into each account separately, taking 90 minutes to piece together a rough portfolio view. Multiply that by 52 weeks. He's spending 78 hours yearly just hunting for his own money.

But the real cost is hidden: Last year, his NPS account earned ₹2.1 lakhs, his best performer. But another mutual fund he forgot about lost 15% value and dropped from ₹4,00,000 to ₹3,40,000. He didn't rebalance. He didn't act. Because he didn't know.

If he'd been aware, professional rebalancing could have prevented ₹60,000 in losses alone.

That's not time management. That's money management failing.

The Behavioral Finance Angle: What You Can't See, You Can't Optimize

Our brains are wired to feel ownership of what we can see. Behavioral finance researchers call this the “salience bias”—we make better decisions about assets we actively track.

When you consolidate your investments, something shifts: Your portfolio becomes real. Suddenly, you see that you're 70% in equity when your risk profile suggests 50%. You notice dividend income you didn't know you were earning. You spot duplicates—mutual fund schemes that overlap in holdings.

This clarity alone drives better financial outcomes.

The Joint Family Wealth-Building Secret India Never Lost

Here's where the contrarian argument strengthens: Joint family living unlocks portfolio consolidation benefits that nuclear families have to work hard to recreate.

In a traditional joint family structure, one member often manages consolidated wealth. Expenses are shared—rent, groceries, utilities. Resources are pooled. When ₹40,000 monthly expenses are split among four earning members, each person saves ₹30,000 instead of personally managing ₹50,000+ expenses.

This isn't laziness. This is economics.

According to financial security surveys, 89% of respondents living in joint families reported feeling financially secure, compared to only 64% in nuclear families. The reason? Shared load and consolidated visibility.

If your household pools resources into shared investments, that consolidated view becomes automatic. You're not juggling eight accounts—you're managing two (individual + joint).

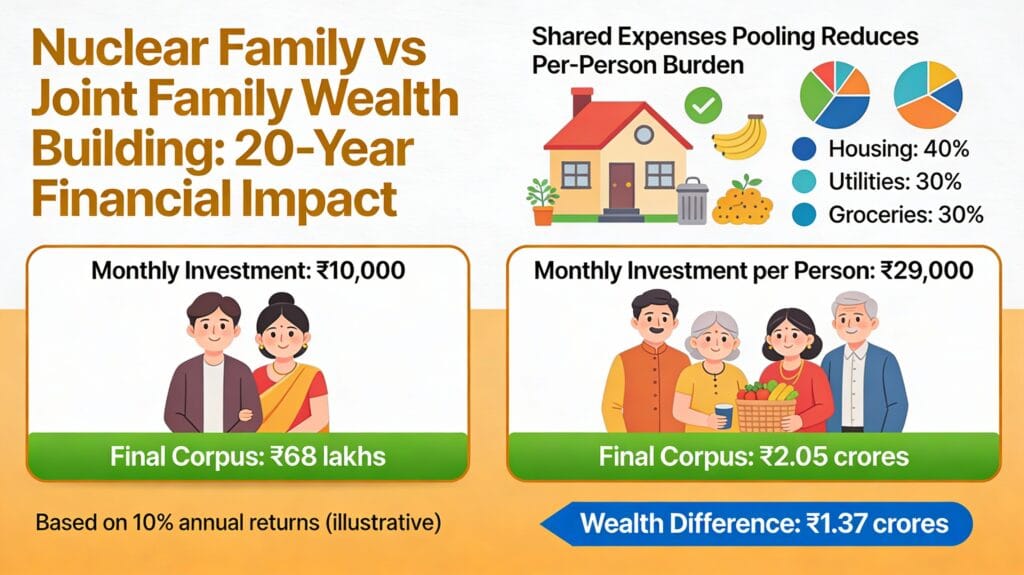

Joint Family vs Nuclear Family Wealth Accumulation Over 20 Years

The catch: Even in joint arrangements, tracking gets messy without a system.

Consolidation Tools & Methods for Indian Investors

Method 1: NSDL Consolidated Account Statement (CAS) — Your Official Government Record

This is your official, SEBI-backed investment consolidation.

What it covers: All your demat accounts across NSDL and CDSL, plus all mutual fund units.

How it works:

- NSDL automatically consolidates accounts based on your PAN

- If you have multiple demat accounts, the oldest one becomes the primary account

- The CAS is generated biannually and mailed to your registered address (or accessed online)

What appears in CAS:

- Equities and preferred shares

- Mutual fund units (both demat and non-demat)

- Government securities

- Corporate bonds

- PPF units (if held in demat form)

What's missing: Fixed deposits at individual banks, NPS (captured separately), some older investments

Access your CAS:

- Log into NSDL CAS portal (nsdlcas.nsdl.com) with your PAN and UIN

- Register your email and phone

- Download your consolidated statement

- View transaction history across all demat accounts

Compliance note: CAS is SEBI-approved and recognized for tax filing purposes.

Method 2: MF Central — For Your Mutual Funds

MF Central (mfcentral.com) is AMFI's official platform for MF consolidation.

What it does: Shows all mutual fund holdings across all AMCs (Asset Management Companies) in one view.

How it works:

- Visit mfcentral.com

- Enter your PAN

- The system pulls all folio numbers and holdings from all mutual fund houses

- You get a consolidated view without manually contacting each AMC

Information displayed:

- Folio numbers across all funds

- Scheme names and units held

- Current market value

- Purchase dates and cost base (for tax calculation)

- Dividend history

For portfolio management: This is simpler than NSDL CAS if you're primarily a mutual fund investor.

Method 3: Investment Aggregator Apps (Portfolio Trackers)

These apps use advanced technology to pull data from multiple brokers and platforms.

Popular trackers in India:

Kuvera:

- Import from stocks, MFs, FDs, EPF, NPS, PPF

- Zero commission on MF investments

- Advanced portfolio analytics

- Goal-based tracking

- Tax loss harvesting automation

- Flat learning curve for beginners

MProfit:

- Multi-asset tracking (stocks, MFs, bonds, commodities)

- Auto-import from 700+ brokers

- Capital gains and XIRR calculations (important for tax filing)

- Dividend and income tracking

- Professional-grade reporting

Dhan:

- Uses Account Aggregator (AA) framework—cutting-edge technology

- Tracks stocks across all brokers simultaneously

- Real-time portfolio analytics during market hours

- Consolidated view of external holdings

Start Trading with Zero Brokerage!

Join 950,000+ traders on India's fastest trading platform

Join Dhan Now →How Account Aggregator (AA) Framework Works:

The AA framework is a regulatory mechanism that lets financial data flow securely between institutions. It's like your permission slip to share data without creating new passwords everywhere.

Advantages: You log in once. Your consent is granted for data sharing. Updates happen automatically.

Key limitation: You need at least one holding in the aggregator's own platform to access external holdings.

Method 4: Manual Consolidation (The Spreadsheet Method)

For investors who prefer full control or have unusual holdings.

Simple spreadsheet structure:

| Broker/Source | Asset Type | Units/Amount | Buy Price | Current Price | Market Value | Notes |

|---|---|---|---|---|---|---|

| Zerodha | Infy Stock | 50 | ₹2,500 | ₹3,200 | ₹1,60,000 | Long-term |

| ICICI MF | Equity Fund | 5,200 | ₹150 | ₹178 | ₹92,560 | Via distributor |

| Bank FD | FD | ₹5,00,000 | — | ₹5,00,000 | ₹5,00,000 | Matures 2026 |

| PPF | PPF | ₹50,000 | — | ₹55,000 (est) | ₹55,000 | Govt scheme |

Advantages:

- Complete customization

- No login juggling

- Useful for complex portfolios

- Educational—forces you to know your holdings

Disadvantages:

- Requires manual updates

- Time-consuming

- Error-prone with price changes

Joint Family Wealth Consolidation: The Contrarian Advantage

Why Joint Living Creates Wealth Faster

Let's math this out for a realistic Indian family scenario.

Nuclear Family Model:

- Priya (age 32, earns ₹80,000/month)

- Budget: Rent ₹35,000 + Utilities ₹5,000 + Groceries ₹12,000 + Transport ₹4,000 + Phone/Internet ₹2,000 + Other ₹12,000 = ₹70,000

- Investable surplus: ₹10,000/month = ₹1,20,000/year

Joint Family Model (Same Income):

- Priya + Sister (earns ₹60,000) + Mother (earns ₹30,000)

- Combined income: ₹1,70,000/month

- Combined expenses: Rent ₹35,000 + Utilities ₹6,000 + Groceries ₹18,000 + Transport ₹6,000 + Phone/Internet ₹3,000 + Other ₹15,000 = ₹83,000

- Investable surplus per person: ₹29,000/month = ₹3,48,000/year

The math is clear: Each person invests nearly 3x more in a shared household.

Over 20 years at 10% annual returns:

- Nuclear family: ₹1.2L × 20 × (1.10^20) ≈ ₹68 lakhs

- Joint family: ₹3.48L × 20 × (1.10^20) ≈ ₹2.05 crores

The difference: ₹1.37 crores in additional wealth. This isn't luxury. This is mathematics.

Joint Family vs Nuclear Family Wealth Accumulation Over 20 Years

Structuring Joint Investments for Tax Efficiency

Option 1: Fully Joint Account (Simple, Transparent)

All family members contribute to a joint account used for household investments.

Tax considerations:

- Interest income is split equally among all account holders (unless a different contribution ratio is documented)

- Each person can claim up to ₹10,000 deduction on savings account interest under Section 80TTA

- Better documentation prevents later tax disputes

Best for: Couples, partners with shared goals, or extended families with documented contribution ratios

Option 2: Hindu Undivided Family (HUF) Structure (Tax-Optimized)

An HUF is a separate legal entity that acts as an additional taxpayer in your family.

How it works:

- One family member becomes the Karta (manager)

- Other members become coparceners (joint owners)

- The HUF has its own tax identity and exemption limits

Tax advantages:

- The HUF gets its own standard exemption (₹2.5 lakh, same as an individual)

- If you earn ₹15,75,000 combined as individuals + ₹5,75,000 as HUF, you pay tax on only ₹5,75,000 + individual exemptions

- Effective tax savings: ₹1,40,000+ for high-income families

Practical example:

A family of three earners (₹80,000 + ₹70,000 + ₹50,000/month) pools investments in an HUF:

- Individual incomes taxed at individual rates

- HUF income gets separate exemption (₹2.5L)

- Properties transferred to HUF generate tax-free income

- No additional compliance burden beyond one extra ITR

Formation process:

- Create a written HUF declaration (no government registration needed)

- Register with your bank and brokerage

- Open accounts in HUF name (format: “[Name] HUF”)

- File ITR Form using HUF identity

Step-by-Step Consolidation Roadmap

Week 1: The Inventory Phase

Create your investment master list:

- Gather all account statements (last 3-6 months)

- List every platform where you have money

- Record folio/account numbers

- Note current values

Checklist:

Investment Consolidation Master Checklist for Indian Investors

- ☐ Bank savings accounts

- ☐ Bank FDs

- ☐ Mutual funds (list each folio)

- ☐ Stock broking accounts

- ☐ IPO investments

- ☐ NPS account

- ☐ PPF

- ☐ Sukanya Samriddhi

- ☐ Recurring deposits

- ☐ Bonds or corporate securities

- ☐ Gold (digital or physical, if tracked)

- ☐ Crypto (if applicable)

Pro tip: Set a reminder for this annual inventory. Changes happen—job transfers, new platforms, duplicate schemes.

Week 2: Access Your Official Statements

Step 1: Get NSDL CAS

- Go to nsdlcas.nsdl.com

- Register with PAN and basic details

- Download biannual statement

- This covers demat accounts + mutual funds

Step 2: Access MF Central

- Visit mfcentral.com

- Enter PAN

- Export folio list

- Cross-check with your records

Step 3: NPS and Government Schemes

- NPS Lite account: Check at nsdl.co.in (your Permanent Retirement Account Number is in your welcome letter)

- PPF: Visit ppfonline.gov.in or contact your bank

- Sukanya Samriddhi: Ask your bank or post office

SEBI Compliance Note: These statements are official records. Maintain them for minimum 7 years for tax and legal purposes.

Week 3: Choose Your Consolidation Tool

Decision matrix:

| If you invest mostly in: | Best tool | Why |

|---|---|---|

| Mutual funds | MF Central + Kuvera | Easy, instant view across all AMCs |

| Stocks across brokers | Dhan (with AA) or MProfit | Real-time cross-broker tracking |

| Mixed portfolio (MF + stocks + FD + NPS) | Kuvera or MProfit | Best for comprehensive view |

| Complex/joint family holdings | Spreadsheet + MProfit | Maximum control and clarity |

| Basic tracking only | NSDL CAS + MF Central | Free, official, no privacy concerns |

My recommendation for most Indian investors: Start with official statements (NSDL CAS + MF Central). They're free, secure, and SEBI-approved. Add an aggregator app only if you need real-time updates.

Week 4: Set Up Your Chosen System

If using Kuvera:

- Download app

- Create account

- Link demat account (optional)

- Link mutual fund folios

- Add manual holdings (FDs, NPS, PPF)

- Set portfolio goals and alerts

If using MProfit:

- Sign up on website

- Link broker accounts

- Import historical data

- Connect MF holdings via PAN

- Enable automatic updates

If using spreadsheet:

- Create simple template (use the example table earlier)

- Update monthly

- Set calendar reminders for quarterly reviews

- Keep backup (cloud storage preferred)

Making Your Consolidated Portfolio Actually Useful

What to Do Once Everything Is in One Place

Consolidation isn't an end goal. It's the beginning of intelligent portfolio management.

Step 1: Asset Allocation Audit

Now that you see everything together, ask:

- How much is in equity vs. debt vs. gold vs. liquid?

- What's my current allocation vs. my target allocation?

- Are positions overlapping?

Example: You own three equity mutual funds from the same AMC with similar holdings. That's overlap. Consolidation into one fund reduces complexity without changing risk.

Step 2: Fee Analysis

Aggregator apps often show this automatically:

- Direct vs. regular mutual fund plans

- Brokerage charges

- Platform fees

Real calculation: If you're paying 1.5% annual fees instead of 0.5% (direct plans), on ₹20 lakhs, you're losing ₹2,000/year. Over 20 years, that's ₹40,000+ in lost compounding.

Step 3: Tax Optimization

Your consolidated view reveals:

- Which holdings have unrealized losses (tax loss harvesting opportunity)

- Which are eligible for long-term capital gains (hold 1+ year for stocks, 3+ for MFs)

- Whether you're missing 80C/80D deductions

Step 4: Rebalancing

With clear visibility, rebalancing becomes simple:

- Check quarterly if allocations have drifted

- Sell overweight positions

- Buy underweight assets

- Automate via STP (Systematic Transfer Plans)

Joint Family Portfolio Management: Roles and Governance

Recommendation for joint family investments:

The Manager (Primary Decision-Maker):

- Usually the most financially literate member

- Updates consolidated portfolio

- Makes rebalancing decisions

- Files combined tax returns

The Verifier (Secondary Account Holder):

- Reviews portfolio quarterly

- Ensures decisions align with family goals

- Provides second opinion on major changes

Why this matters: One person's illness shouldn't mean portfolio paralysis. The secondary person must know the system.

Annual Family Finance Meeting (Recommended):

- Review consolidated portfolio

- Discuss goal progress

- Adjust allocations if life circumstances change

- Ensure both (or all) members are informed

- Document decisions for future reference

Tools Summary & Quick Reference

Free Official Tools

| Tool | What it covers | Time to setup | Best for |

|---|---|---|---|

| NSDL CAS | Demat + MFs | 10 mins | Official record keeper |

| MF Central | All mutual funds | 5 mins | MF-only portfolios |

| NPS portal | NPS accounts | 5 mins | Government pension tracking |

| Bank portals | Bank investments | 5 mins | FDs and savings accounts |

Aggregator Apps (Paid/Free)

| App | Best feature | Learning curve | Cost |

|---|---|---|---|

| Kuvera | Goal-based planning + tax harvesting | Easy | Free for tracking |

| MProfit | Comprehensive reporting + capital gains | Medium | Free basic, premium for advanced |

| Dhan | Real-time cross-broker via AA | Easy | Free basic, premium features |

| Motilal Oswal MO Investor | Integration with trading | Medium | Free with trading account |

Important Disclaimers & SEBI Compliance

This article is educational only and not financial advice. Before making any investment decisions:

- Consult with a SEBI-registered financial advisor for personalized recommendations

- Verify all tax implications with a qualified CA, as joint account and HUF taxation has nuances

- Understand that past performance of any investment is not a guarantee of future results

- Be aware of your risk capacity before consolidating; visibility sometimes reveals you're over-exposed to risk

- Joint account and HUF holdings have specific tax rules; misreporting can lead to penalties

- Keep all documentation for minimum 7 years for tax compliance purposes

Important: The consolidated return figures in this article (10% annual returns example) are illustrative only and don't represent any guarantee. Actual returns vary based on market conditions, investment choices, and economic factors.

Conclusion: From Scattered Wealth to Consolidated Vision

You don't need to be rich to be financially secure. You need to know what you own.

In a world that celebrates independence, there's a hidden wisdom in the traditional joint family model: collective eyes catch what individual eyes miss.

This isn't about choosing nuclear vs. joint families. It's about recognizing that whether you're flying solo or managing shared wealth, the principle remains the same: Consolidation creates clarity. Clarity drives decisions. Decisions build wealth.

The technical tools are now simple. The barriers are gone. NSDL CAS is free. Portfolio tracker apps cost nothing. Setting up takes hours, not weeks.

The only remaining barrier is starting.

Next action: This week, download your NSDL CAS or visit MF Central. Spend 30 minutes creating your master list. See your full picture for the first time.

Then, decide what changes that clarity demands.

Frequently Asked Questions

Q: How often is the NSDL CAS sent?

A: The NSDL CAS is sent biannually (twice yearly). However, if there are no transactions in your accounts during a half-year period, you'll receive a holding statement instead. This is SEBI-compliant and counts as official documentation.

Q: What if I have investments in fixed deposits at my bank?

A: Bank FDs don't appear in NSDL CAS or MF Central. You must track them separately through your bank portal or manually add them to your aggregator app. This is why maintaining a master spreadsheet alongside apps is helpful.

Q: Can I consolidate investments with my spouse's holdings?

A: Yes, through joint accounts or by forming an HUF. Interest earned is split equally (by default) unless documented otherwise. Consult a CA regarding the tax implications specific to your situation, as joint account interest income is taxable in both names.

Q: Is NSDL CAS proof of investment ownership for legal purposes?

A: Yes. NSDL CAS is an official SEBI-approved statement and is accepted by courts, income tax authorities, and financial institutions as proof of ownership and holdings.

Q: What happens to my consolidated portfolio if I have accounts in both NSDL and CDSL?

A: The older demat account (whether in NSDL or CDSL) becomes the default account for your CAS. It will consolidate your holdings from both NSDL and CDSL demat accounts plus all mutual fund folios, as long as the PAN matches.

Q: Can I track cryptocurrency in these consolidation tools?

A: Most official tools (NSDL CAS, MF Central) don't cover crypto. Some aggregator apps like Kuvera have beta features for crypto tracking, but it's not comprehensive. Manual tracking via spreadsheet is currently the most reliable method for crypto portfolios.

Q: What's the difference between HUF and a joint account for investments?

A: A joint account is simpler—two (or more) people hold one account. An HUF is a separate legal entity that creates an additional tax identity. HUF is complex but offers better tax optimization for high-income families. A CA should advise you based on your specific situation.

Q: Can I use portfolio trackers if I have investments scattered across 10+ brokers?

A: Yes. Premium aggregator apps like MProfit can handle multiple brokers. The Account Aggregator framework (Dhan, upcoming features in other apps) is specifically designed for cross-broker consolidation. However, manual folio entry may still be required for less common brokers.

Q: Is consolidating all my investments in one app risky from a cybersecurity perspective?

A: Aggregator apps typically use industry-standard encryption and don't store sensitive data like passwords. However, you're right to be cautious. Many investors prefer keeping NSDL CAS and MF Central (official government/AMFI platforms) as their primary records, using aggregator apps only for monitoring. It's a personal risk tolerance decision.

Q: How often should I review my consolidated portfolio?

A: Quarterly reviews (every 3 months) are ideal. Annual reviews are minimum. If markets drop >15%, an emergency review is wise to check if your allocation has drifted and rebalancing is needed.