The Illusion of Control in Stock Trading: A Behavioral Trap Every Investor Should Understand

Have you ever felt confident about a stock pick, only to watch it crash unexpectedly? Or checked your portfolio multiple times a day, believing your constant monitoring will somehow improve returns? You're not alone. Millions of Indian retail investors fall prey to the illusion of control in stock trading—a psychological bias that makes us believe we have more influence over market outcomes than we actually do.

Recent SEBI data reveals a sobering reality: 91% of individual traders in India's equity derivatives (F&O) segment incurred losses in FY25, with collective losses exceeding ₹1.06 lakh crore. This isn't just about poor stock selection—it's largely about behavioral biases, particularly the illusion of control, that cloud judgment and lead to costly mistakes.

Understanding this psychological trap is the first step toward making smarter, evidence-based investment decisions. In this beginner-friendly guide, we'll explore what the illusion of control means, why it's dangerous for your portfolio, and how you can overcome it to become a more rational investor.

What Is the Illusion of Control in Stock Trading?

The illusion of control is a cognitive bias where individuals overestimate their ability to control or influence outcomes in uncertain situations. In financial markets, this translates into traders and investors believing they can predict market movements, time entries and exits perfectly, or outsmart other market participants through sheer skill or analysis.

This bias makes you feel like you're in the driver's seat when, in reality, stock markets are influenced by countless unpredictable factors—global economic events, policy changes, corporate announcements, and even mass investor psychology. While research, analysis, and strategy do matter, they cannot guarantee specific outcomes in an inherently uncertain environment.

The illusion of control is closely related to overconfidence bias, where investors overestimate their knowledge and abilities. Together, these biases create a dangerous cocktail that encourages excessive trading, poor risk management, and ultimately, financial losses.

Why the Illusion of Control Matters for Indian Investors

Understanding the illusion of control is crucial because it directly impacts your investment performance and wealth creation journey. Here's why this bias is particularly relevant in the Indian context:

Financial Losses Are Real and Significant: Between FY22 and FY25, Indian retail investors collectively lost nearly ₹3 lakh crore in equity derivatives. The average loss per trader in FY25 stood at ₹1.1 lakh. These aren't just statistics—they represent real money lost by individuals who believed they could control market outcomes through frequent trading and complex strategies.

It Encourages Risky Behavior: The illusion of control leads investors to underestimate risks and take positions larger than advisable. When you believe you can predict or influence market direction, you're more likely to ignore warning signs, dismiss contradictory evidence, and hold losing positions too long.

It Drives Overtrading: Feeling in control creates a false sense of certainty that encourages excessive buying and selling. A study found that investors who are overconfident tend to trade more frequently, resulting in higher transaction costs and lower net returns. One real-life example from India involved an IT professional who executed over 1,200 trades in five years, only to underperform a simple Nifty 50 index fund investment by more than 25%.

It Affects Both Novice and Experienced Traders: According to behavioral finance research, even professional investors and financial advisors are susceptible to the illusion of control. The bias intensifies after a series of successful trades, making you credit your skills rather than acknowledging the role of market conditions or luck.

Real-Life Example: The Overconfident Day Trader

Consider Rajesh, a 34-year-old investor from Bengaluru who believed that daily market monitoring and frequent trading would give him superior returns. He analyzed charts, read company reports, and followed market news religiously. His constant activity made him feel in control of his investments.

However, after five years of active trading, Rajesh discovered he had significantly underperformed a colleague who simply invested systematically in an index fund through SIPs. The illusion of control had cost him not just money, but valuable time and mental energy. His excessive activity created transaction costs, tax implications, and emotional stress—all while delivering inferior returns.

How the Illusion of Control Manifests in Stock Market Trading

The illusion of control shows up in various ways in investor behavior. Recognizing these patterns in yourself is essential:

Stock Picking Overconfidence: After spending hours researching companies and analyzing financial statements, investors believe they have special insight that gives them control over investment outcomes. While fundamental analysis is valuable, it doesn't guarantee you can predict how a stock will perform.

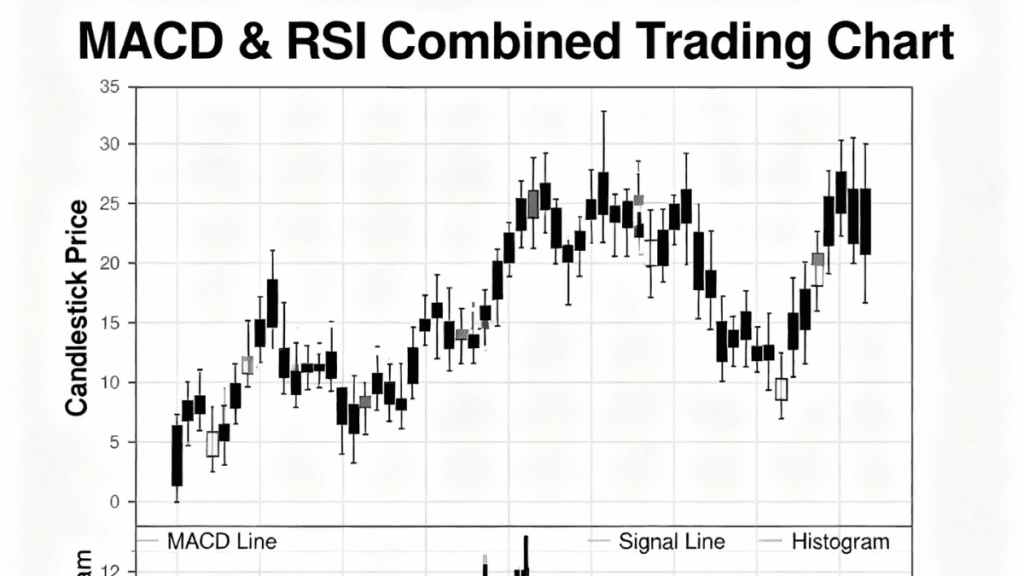

Market Timing Attempts: Many traders believe they can identify exact entry and exit points by studying charts and patterns. They think their analysis gives them the ability to know when markets will rise or fall, often ignoring the reality that short-term market movements are largely unpredictable.

Excessive Portfolio Monitoring: Checking your portfolio multiple times daily creates an illusion that your attention somehow influences performance. Modern zero-brokerage platforms and gamified trading apps with real-time notifications reinforce this feeling that action equals progress.

Ignoring Diversification: Overconfident investors often create concentrated portfolios, believing they've identified the few “winning” stocks that will outperform. This under-diversification exposes them to higher risk when market conditions change unexpectedly.

Dismissing Contradictory Evidence: When markets move against your position, the illusion of control makes you believe the market is “wrong” and will eventually validate your view. This leads to holding losing positions too long instead of cutting losses.

Strategies to Overcome the Illusion of Control

Breaking free from the illusion of control requires conscious effort and specific strategies. Here are practical steps you can take:

Accept Market Uncertainty

The first step is acknowledging that financial markets are inherently uncertain, and no amount of analysis can eliminate this uncertainty. Markets are influenced by countless factors beyond any individual's control—from RBI policy decisions to global events like oil price fluctuations or geopolitical tensions.

Successful investing isn't about controlling outcomes; it's about managing probabilities and risks while maintaining disciplined strategies.

Create and Follow a Written Trading Plan

A comprehensive trading plan acts as your defense against impulsive decisions driven by the illusion of control. Your plan should include:

- Clear investment goals and time horizon

- Specific entry and exit criteria based on objective measures

- Position sizing rules (never risk more than 1-2% of capital per trade)

- Stop-loss orders to limit potential losses

- Risk-reward ratios (aim for at least 1:3)

Once you have a plan, commit to following it regardless of momentary feelings or market noise. Professional traders live by the maxim: “Plan your trade and trade your plan”.

Implement Strict Risk Management

Risk management is your safety net against the consequences of overconfidence. Essential risk management strategies include:

Diversification: Spread investments across different sectors, asset classes, and investment styles. If one position underperforms, your entire portfolio won't collapse.

Position Sizing: Calculate appropriate position sizes based on your total capital and risk tolerance. Never put all your eggs in one basket, no matter how confident you feel about a particular trade.

Stop-Loss Orders: Always set stop-loss orders to automatically exit positions when they reach predetermined loss levels. This removes emotion from the decision and prevents small losses from becoming catastrophic ones.

Regular Portfolio Rebalancing: Periodically review and adjust your portfolio based on your original asset allocation plan, not based on gut feelings or recent performance.

Maintain a Trading Journal

Keeping detailed records of all your trades—including your reasoning, emotions, entry and exit points, and outcomes—provides objective feedback that counteracts the illusion of control. When you review your journal regularly, you can identify patterns in your decision-making and recognize when biases are influencing your choices.

A trading journal helps you distinguish between skill and luck in your investment outcomes. It creates accountability and provides valuable learning opportunities from both winning and losing trades.

Embrace Long-Term, Passive Investing

Research consistently shows that passive investing strategies like systematic investment plans (SIPs) in index funds often outperform active trading attempts. A landmark study found that the most active traders underperformed the market by 6.5% annually, while those who traded the least earned higher net returns.

By reducing activity and embracing a buy-and-hold approach with regular systematic investments, you remove the daily temptation to feel in control through constant trading. This approach acknowledges that you cannot control market movements but can control your behavior and investment discipline.

Seek External Perspectives

Consult with qualified financial advisors, mentors, or investment communities to gain objective viewpoints on your trading behavior. External perspectives help identify blind spots that the illusion of control creates. However, according to SEBI's 2025 Investor Survey, be cautious about relying solely on social media influencers—62% of retail investors make investment choices influenced by finfluencers, but this doesn't always lead to better outcomes.

Pro Tips: Common Mistakes to Avoid

Mistake 1: Trading Without Education: Many beginners jump into derivatives or complex instruments without understanding how they work. The complexity of options and futures creates additional opportunities for the illusion of control to mislead you.

Mistake 2: Revenge Trading: After experiencing losses, many traders immediately try to recover through additional trades. This emotional response, driven by the illusion that you can “make back” what you lost, typically worsens losses.

Mistake 3: Following Tips Blindly: Relying on stock tips from unverified sources creates a false sense of security. Even if the source seems knowledgeable, you're essentially transferring your illusion of control to someone else without doing your own analysis.

Mistake 4: Ignoring Transaction Costs: Frequent trading incurs brokerage, taxes, and other charges that eat into returns. The illusion of control makes you focus on potential gains while underestimating these real costs.

Mistake 5: No Defined Exit Strategy: Entering trades without predetermined exit criteria leaves you vulnerable to emotional decision-making. Know your profit targets and loss limits before you invest.

Expert Insights: What the Data Tells Us

Behavioral finance research and regulatory data provide clear evidence about the dangers of the illusion of control:

According to SEBI's comprehensive analysis covering FY22-FY24, 93% of individual traders in equity F&O incurred losses, with cumulative losses totaling approximately ₹1.81 lakh crore. The average loss per trader was around ₹2 lakh over this period.

The loss rate was even higher among younger traders (under 30 years old), with 93% losing money in FY24, compared to 79% for traders over 60. This suggests that experience and age may provide some protection against overconfidence, though the overall statistics remain concerning across all demographics.

Financial history shows numerous examples of how overconfidence and the illusion of control led to market disasters. The 2008 financial crisis was partially driven by traders and institutions who overestimated their ability to control risk in complex mortgage-backed securities. The collapse of Barings Bank in 1995 occurred because trader Nick Leeson's overconfidence led him to make unauthorized, highly risky bets that resulted in losses of £827 million.

In the Indian context, market manipulation cases like pump-and-dump schemes, circular trading, and spoofing take advantage of retail investors' illusion of control. When investors believe they've identified a “hot stock” based on artificially created trading activity, they become victims of schemes designed to exploit their overconfidence.

Research by behavioral economists Barber and Odean found that overconfident investors trade excessively and earn lower returns than those who trade less frequently. Their studies confirmed that more activity does not equal better outcomes—in fact, it often produces the opposite result.

SEBI's 2025 Investor Survey revealed that while 63% of Indian households are aware of securities market products, only 9.5% actually participate. Furthermore, among participating investors, only 36% demonstrated moderate or high levels of knowledge about securities markets, while 64% had limited understanding. This knowledge gap, combined with the illusion of control, creates a dangerous combination for retail investors.

Related Topics You Can Explore

- Read also: Why Traders Fail: 7 Key Reasons & How to Avoid Them in India

- Read also: SEBI Regulations Every Indian Investor Should Know

- Read also: Building a Winning Trading Plan for Beginners

Conclusion

The illusion of control in stock trading is a powerful psychological bias that makes investors believe they have more influence over market outcomes than they actually possess. This false sense of control leads to excessive trading, poor risk management, concentrated portfolios, and ultimately, significant financial losses.

SEBI data confirms the harsh reality: 91% of Indian retail traders in equity derivatives lost money in FY25, with average losses exceeding ₹1 lakh per person. These aren't just numbers—they represent real wealth destroyed largely due to behavioral biases like the illusion of control.

The good news is that awareness is the first step toward change. By recognizing this bias in yourself, accepting market uncertainty, creating a disciplined trading plan, implementing strict risk management, and embracing long-term investing strategies, you can protect yourself from its most damaging effects.

Remember, successful investing isn't about controlling the markets—it's about controlling yourself. Focus on what you can truly control: your investment discipline, risk management, continuous learning, and emotional responses to market volatility. With these foundations in place, you'll be better positioned to navigate India's dynamic stock markets and build lasting wealth.

Ready to become a more rational investor? Start by creating your written trading plan today and commit to following it for the next three months. Track your decisions, review your results, and adjust based on objective evidence rather than gut feelings. Your future financial self will thank you.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Stock market investments involve risk, and past performance does not guarantee future results. Please consult a SEBI-registered investment advisor before making investment decisions. Always invest according to your risk tolerance and financial goals.

FAQs About the Illusion of Control in Stock Trading

Q1. What is the illusion of control bias in stock trading?

A1. The illusion of control is a cognitive bias where investors overestimate their ability to influence or predict stock market outcomes. It makes you believe your analysis, timing, or trading activity gives you more control over results than you actually have.

Q2. How does the illusion of control lead to trading losses?

A2. This bias encourages excessive trading, inadequate diversification, ignoring risk management, and holding losing positions too long. These behaviors increase transaction costs and expose you to higher risks, resulting in lower overall returns and often significant losses.

Q3. How can I recognize if I'm affected by the illusion of control?

A3. Warning signs include: checking your portfolio multiple times daily, making frequent trades believing you can time the market, holding concentrated positions in a few stocks, dismissing information that contradicts your views, and feeling emotionally attached to specific investment decisions.

Q4. What percentage of Indian retail traders lose money in F&O?

A4. According to SEBI data, 91% of individual traders in India's equity derivatives (F&O) segment incurred net losses in FY25, with collective losses exceeding ₹1.06 lakh crore. Over three years (FY22-FY24), 93% of retail F&O traders lost money.

How to Overcome the Illusion of Control in Your Trading

- Acknowledge Market Uncertainty – Accept that markets are influenced by countless unpredictable factors beyond your control, from global events to policy changes.

- Create a Written Trading Plan – Document your investment goals, risk tolerance, entry/exit criteria, position sizing rules, and risk management strategies before making any trades.

- Set Stop-Loss Orders – Always use predetermined stop-loss levels to automatically exit positions when losses reach acceptable limits, removing emotional decision-making.

- Diversify Your Portfolio – Spread investments across different sectors, asset classes, and strategies to reduce the impact of any single position.

- Maintain a Trading Journal – Record all trades with reasoning, emotions, and outcomes to provide objective feedback and identify behavioral patterns.

- Limit Portfolio Monitoring – Reduce the frequency of checking your investments to avoid the temptation of making impulsive changes based on short-term fluctuations.

- Embrace Passive Investing – Consider systematic investment plans (SIPs) in diversified index funds as a core strategy that removes daily trading decisions.

- Seek External Perspectives – Consult qualified financial advisors or mentors who can provide objective views on your investment behavior and identify blind spots.