You're Losing Money Without Knowing It — Here's How to Stop

Have you ever felt like your salary disappears faster than it arrives? You're not alone. Across India, millions of people are losing money without knowing through hidden financial leaks that silently drain their savings. From forgotten subscriptions to bank charges you never noticed, these small losses add up to thousands—even lakhs—over time. In this guide, you'll discover exactly where your money is vanishing and learn practical, beginner-friendly strategies to plug these financial leaks and build real wealth.

What Does “Losing Money Without Knowing” Actually Mean?

Losing money without knowing refers to financial losses that happen quietly, often without your immediate awareness. Unlike obvious expenses like rent or groceries, these are hidden costs that chip away at your savings without triggering alarm bells.

Common examples include automatic subscription renewals you forgot about, minimum balance penalties from your bank account, unused demat account charges, high credit card interest from paying only the minimum due, and lifestyle inflation where spending increases as income rises.

According to a recent study, urban Indians under 30 spend an average of ₹2,800 to ₹3,000 monthly on subscriptions, with 42% admitting they continue paying for at least one service they no longer use. One chartered accountant calculated that just four popular subscriptions—Netflix, Amazon Prime, Disney+ Hotstar, and Spotify—cost approximately ₹1,850 per month or ₹22,200 annually. If invested at 12% annual returns instead, this amount would grow to over ₹4.3 lakh in a decade.

Why Losing Money Without Knowing Matters for Your Financial Future

These seemingly small leaks create massive long-term damage through the compound effect. When you lose ₹2,000 monthly to hidden expenses, that's ₹24,000 annually—money that could instead grow exponentially through investments.

India's retail inflation stood at 1.55% in July 2025 and rose slightly to 2.07% in August 2025, remaining well below the RBI's 4% target. While controlled inflation is positive news, it still erodes purchasing power over time. This makes protecting your money from unnecessary leaks even more critical.

Financial security depends on three pillars: earning money, keeping money, and growing money. Most people focus only on earning but ignore the keeping part. Building an emergency fund covering 3-6 months of expenses provides crucial protection against unexpected costs like medical emergencies, job loss, or urgent home repairs. Without this buffer, a single emergency can derail years of financial progress.

Real-Life Example: The Hidden Cost of Ignoring Small Leaks

Meet Mayesha, a 28-year-old content creator from Delhi. Last month, she discovered ₹2,115 had mysteriously vanished from her bank account. The breakdown revealed multiple hidden charges: ₹623 for exceeding ATM withdrawal limits, ₹450 in minimum balance penalties, ₹382 from UPI merchant payments, ₹510 in credit card fees, and ₹150 for cheque-related services.

Like most millennials, Mayesha had ignored the terms and conditions, assuming digital banking was cost-free. Annually, these charges would drain ₹25,380 from her savings—money that could fund an emergency corpus or investment portfolio instead.

The Biggest Hidden Money Leaks Draining Your Wallet

Forgotten Subscription Services

Subscription fatigue is real. From streaming platforms like Netflix, Hotstar, and Amazon Prime to music services like Spotify and Gaana, gym memberships, cloud storage, online courses, and food delivery memberships—these auto-renewing charges accumulate silently.

A survey found that more than half of Americans pay for subscriptions they forgot they had signed up for. In India, the average person maintains 4-6 active subscriptions, with monthly costs ranging from ₹99 to ₹3,000 depending on the service. Since payments are auto-debited, the slow leak goes unnoticed until you actively track it.

How to stop this leak: Review your bank and credit card statements monthly to identify all recurring charges. Cancel services you haven't used in 30 days. Use subscription tracking apps or create a simple spreadsheet noting service names, costs, and renewal dates. Set calendar reminders 3 days before renewal dates to decide whether to continue. Consider sharing family plans with trusted friends or relatives to split costs.

Bank Account Hidden Charges

Banks impose various fees that many customers never notice until they review statements carefully. These include ATM withdrawal fees after exceeding free transaction limits (increased to ₹23 per transaction from May 2025), minimum balance non-maintenance charges ranging from ₹100 to ₹600 depending on your bank and location, UPI merchant payment fees of 1.1% on wallet-based transactions above ₹2,000, debit and credit card annual maintenance charges, and cheque book and demand draft charges.

For example, if your bank requires a ₹10,000 minimum average balance and you maintain only ₹7,000, the shortfall of ₹3,000 could result in penalties of ₹175 to ₹500 monthly, depending on your bank's policy.

How to stop this leak: Switch to zero-balance savings accounts offered by many banks. Plan ATM withdrawals to stay within free transaction limits (typically 5 free withdrawals from own bank, 2-3 from other banks in metro cities). Use UPI direct bank transfers instead of wallet-based payments for merchant transactions. Set up automatic alerts for low balance warnings. Review your bank's fee schedule annually and switch if you find better options.

Credit Card Mistakes That Cost You Thousands

Credit cards can be wealth-building tools or debt traps, depending on usage. Common mistakes include paying only the minimum amount due (which attracts 36-48% annual interest on remaining balance), cash withdrawals using credit cards (attracting immediate interest plus 3.5% withdrawal fee), missing payment due dates (incurring late fees of ₹100-₹1,200 plus interest), and maintaining high credit utilization above 30% of limit (damaging credit score).

Paying just the minimum due creates a dangerous debt spiral. If you have a ₹50,000 outstanding balance and pay only the minimum ₹1,000, the remaining ₹49,000 accumulates interest at rates as high as 49.36% annually for some cards.

How to stop this leak: Always pay the full outstanding amount before the due date. Set up automatic payments or standing instructions to avoid missing deadlines. Never use credit cards for cash withdrawals—maintain an emergency fund instead. If you can't pay the full amount, convert large purchases into EMIs at lower interest rates rather than carrying forward balances. Review your credit card statement monthly for unauthorized or incorrect charges and dispute them immediately.

Inactive Demat and Trading Account Charges

If you've opened a demat account but haven't traded for 12 months consecutively, stockbrokers must classify it as dormant according to NSE guidelines. While dormant, no trades can be executed until reactivation is completed.

Some stockbrokers charge annual maintenance fees (AMC) on demat accounts ranging from ₹300 to ₹500 annually, regardless of whether you're trading. These charges are recovered when you reactivate the account or deducted automatically if the account remains active.

How to stop this leak: Make at least one transaction annually in any segment (cash, futures, options, commodities) to prevent your account from becoming dormant. If you no longer need the account, formally close it rather than leaving it inactive. Consider Basic Services Demat Accounts (BSDA) if your holdings value is under ₹2,00,000—these have zero or minimal AMC. Choose brokers offering first-year free AMC or lifetime low-cost maintenance.

Lifestyle Inflation: The Silent Wealth Killer

Lifestyle inflation occurs when spending increases in line with income growth. A salary hike triggers upgrades: bigger apartments, newer cars, frequent dining out, premium subscriptions, and increased online shopping. While earning ₹60,000 monthly instead of ₹40,000 sounds like progress, if expenses rise from ₹35,000 to ₹58,000, you're actually saving less.

“Even professionals earning substantial salaries are left with limited disposable income. As their income grows, so do their expenses, often faster than the income itself,” explains Abhishek Kumar, SEBI-registered investment advisor and founder of SahajMoney.

Young adults who suddenly earn salaries after receiving pocket money as students are particularly vulnerable. The comfort of app-based cab services, food delivery, online shopping, and subscription services increases purchase frequency and overall spending.

How to stop this leak: Follow the 50/30/20 budgeting rule: allocate 50% to needs (housing, transportation, essentials), 30% to wants (entertainment, lifestyle), and 20% to savings and investments. When you receive a raise or bonus, immediately increase your SIP or savings by at least 50% of the increment before lifestyle expenses adjust upward. Set a personal spending cap lower than your credit limit. Track expenses weekly using budgeting apps to identify creeping lifestyle costs. Build “fun money” into your budget for treats without guilt, but stay within limits.

Impulse Buying and Emotional Spending

Impulse buying means making spontaneous purchases without prior planning or thoughtful consideration. Research indicates that 40-80% of all purchases come from impulse spending, with impulses causing 40% of consumers to spend more than planned in physical stores.

Shopping delivers a dopamine hit that instantly lifts mood, providing temporary emotional relief during stress, boredom, sadness, or social pressure. However, these positive feelings quickly give way to guilt or regret. The average person can spend over ₹2,200 annually on impulse purchases.

Common triggers include peer pressure and FOMO (fear of missing out), emotional states like stress or anxiety, marketing tactics like limited-time offers and product placement, and easy digital payment methods that reduce the psychological pain of spending.

How to stop this leak: Follow the 24-hour rule: wait at least 24 hours before making any unplanned purchase over ₹500. This delay helps distinguish genuine needs from temporary wants. Shop with a written list and stick to it. Remove saved payment information from online shopping apps to add friction to impulse purchases. Use cash or debit cards instead of credit cards for discretionary shopping—it's psychologically harder to hand over physical cash. Unsubscribe from promotional emails and muting shopping app notifications reduces exposure to tempting offers. When feeling emotional, swap shopping for healthier alternatives like walking, calling a friend, or exercising.

Poor Tax Planning Leading to Unnecessary Outflows

Waiting until March to start tax planning leads to rushed, suboptimal decisions. Common mistakes include not maximizing available deductions under sections 80C, 80D, 24(b), and 80CCD(1B), choosing the wrong tax regime (old with deductions vs. new with lower rates), buying unsuitable investment-cum-insurance policies in panic, ignoring tax implications on investment returns, and not verifying tax returns within 30 days of filing.

For example, if you're a salaried employee, your EPF contribution and children's tuition fees may already exhaust the ₹1.5 lakh limit under Section 80C. Making additional tax-saving investments without checking could lock money unnecessarily in low-return products.

How to stop this leak: Start tax planning at the beginning of the financial year in April, not at the end in March. Calculate your existing tax-saving investments (EPF contributions, tuition fees, home loan principal repayment) before making new investments. Compare tax liability under both old and new tax regimes using online calculators before choosing. Link tax-saving investments to financial goals—invest in ELSS if you need equity exposure for long-term goals, PPF for safe retirement corpus, or NPS for additional pension benefits. Understand tax implications at all stages: investment, returns, and withdrawal. Maintain organized records of investment proofs, receipts, and Form 16. E-verify your ITR immediately after filing to make it valid.

Not Investing and Missing Out on Compound Growth

Many people keep savings in low-interest savings accounts or fixed deposits earning 3-6% annually, barely beating inflation. Meanwhile, inflation in India typically runs between 4-7%, meaning your money's purchasing power decreases even while sitting in the bank.

For example, ₹100 kept in a savings account earning 3% interest becomes ₹103 after one year. But if inflation is 5%, goods worth ₹100 now cost ₹105, so your ₹103 actually buys less than before. Your real return (return minus inflation) is negative 2%.

Historically, Indian equity markets have delivered 12-14% average annualized returns over 30-year periods, significantly outpacing inflation and creating real wealth. The power of compounding means that ₹5,000 invested monthly at 8% annual returns grows to approximately ₹12,95,283 over 40 years.

How to stop this leak: Start investing immediately, even with small amounts like ₹500 monthly. Time in the market is more valuable than timing the market. Begin a Systematic Investment Plan (SIP) in diversified mutual funds to benefit from rupee cost averaging and disciplined investing. Diversify across equity mutual funds for growth, debt funds for stability, and gold for hedge against uncertainty. Reinvest dividends and returns to maximize compounding effect. Increase SIP amounts annually using step-up SIP facility as your income grows. Link investments to specific goals (child's education, retirement, house down payment) to maintain discipline.

Strategies to Stop Losing Money and Build Financial Security

Conduct a Monthly Financial Audit

Set aside one hour monthly to review all bank statements, credit card statements, and investment accounts. Highlight any charges you don't recognize or subscriptions you're not using. Track net worth monthly (assets minus liabilities) to monitor progress.

Create and Follow a Realistic Budget

Use the 50/30/20 rule as a starting framework and adjust based on your situation. Track every expense for at least one month to understand spending patterns. Use budgeting apps that automatically categorize expenses or maintain a simple spreadsheet.

Build an Emergency Fund First

Before aggressive investing, accumulate 3-6 months of living expenses in a high-interest savings account or liquid fund. This prevents forced withdrawal from long-term investments during emergencies and protects you from high-interest debt during crises.

Automate Your Savings and Investments

Set up automatic transfers on salary day to move money into savings, SIPs, and goal-based accounts before you have a chance to spend it. Automating removes the temptation to skip investments and ensures consistent progress regardless of motivation levels.

Develop Smart Credit Card Habits

Treat credit cards as convenient payment tools, not as extra income. Set up automatic full payment on the due date. Review statements immediately when received to catch errors early. Keep credit utilization below 30% of limit to maintain good credit score.

Invest for Long-Term Wealth Creation

Start SIPs in diversified equity mutual funds for goals beyond 5 years. Understand that market volatility is normal in the short term but smooths out over longer periods. Resist the urge to stop SIPs during market downturns—those are actually the best times to buy more units at lower prices.

Educate Yourself Continuously

Financial literacy is not taught in schools, so self-education is essential. Follow reputable personal finance blogs, YouTube channels, and podcasts. Learn about different investment options, tax planning, and wealth creation strategies. As Warren Buffett said, “My wealth has come from a combination of living in America, some lucky genes, and compounding”—demonstrating that knowledge combined with time creates extraordinary results.

Pro Tips and Common Mistakes to Avoid

Common Beginner Mistakes:

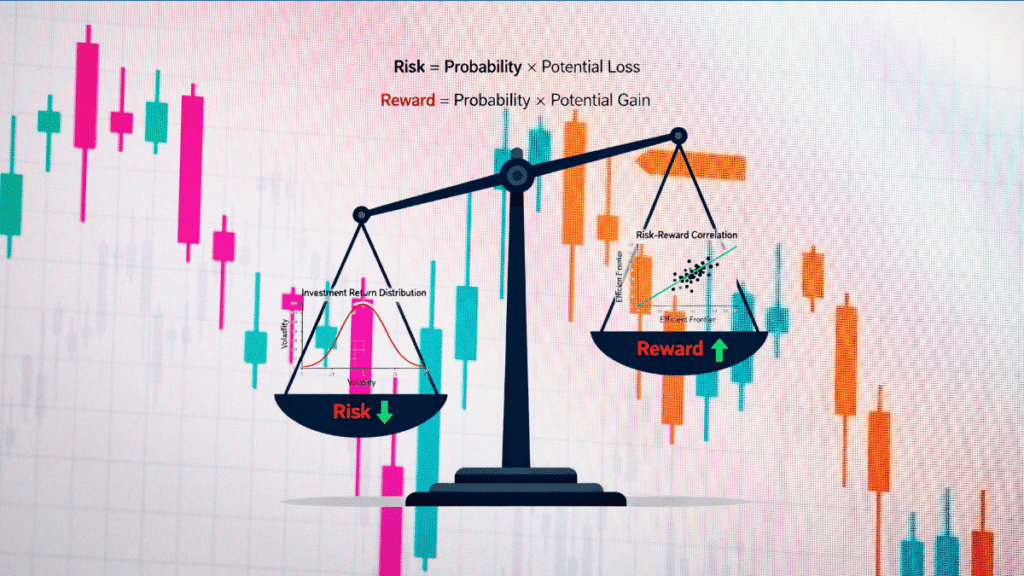

Chasing returns without understanding risk—high returns always come with higher risk. Investing in products you don't understand—stick to simple, transparent options initially. Withdrawing investments for non-emergencies—this breaks compounding and delays goal achievement. Comparing yourself to others—your financial journey is unique to your income, goals, and situation. Buying insurance for tax savings—buy term insurance only for protection, invest separately for returns.

Expert Tips:

Pay yourself first by automatically transferring savings before paying any other bills. Review and rebalance your investment portfolio annually to maintain desired asset allocation. Take advantage of employer matching in PF contributions—it's free money that boosts returns. Maintain good credit scores (750+) to access loans at lower interest rates when genuinely needed. Seek professional financial advice for complex situations like tax planning, estate planning, or large investments.

Related Topics You Can Explore

- Read also: Ultimate GST Compliance Checklist 2025 Month-by-Month Guide

- Read also: How to Start SIP with ₹1000 – Complete Beginner’s Guide

FAQs About Losing Money Without Knowing

Q1. How much money do people lose to hidden charges and subscriptions annually?

A1. Urban Indians under 30 spend approximately ₹33,600-₹36,000 annually on subscriptions alone, with 42% continuing at least one unused service. Bank charges, credit card interest, and other hidden fees can add another ₹15,000-₹30,000 annually depending on financial habits.

Q2. What is the biggest financial leak for most people?

A2. For most Indians, credit card interest from paying minimum dues is the costliest leak, charging 36-48% annually. Second is lifestyle inflation where spending increases with income without proportional savings growth.

Q3. How can I identify all my hidden subscriptions?

A3. Review 6 months of bank and credit card statements, highlighting all recurring charges. Use subscription tracking apps like Truebill or create a spreadsheet listing service names, monthly costs, and renewal dates. Check email for subscription confirmation receipts.

Q4. Is paying the minimum credit card amount really that bad?

A4. Yes, extremely bad. The remaining balance attracts 36-48% annual interest, creating a debt trap that becomes harder to escape over time. Always pay the full outstanding amount or convert large purchases to EMIs at lower rates.

Q5. How much should I save as an emergency fund?

A5. Financial experts recommend 3-6 months of essential living expenses. If you have ₹30,000 monthly essential expenses, your emergency fund should be ₹90,000-₹1,80,000. Self-employed individuals or those with irregular income should aim for 6-12 months.

Q6. Can small investments really make a difference?

A6. Absolutely. Thanks to compounding, even ₹2,000 invested monthly at 12% annual returns grows to approximately ₹20 lakhs in 20 years. Starting early matters more than starting big. SIP inflows in India touched an all-time high of ₹28,464 crore in July 2025, showing millions of Indians believe in disciplined small investments.

Conclusion

Losing money without knowing happens to everyone, but awareness transforms financial outcomes. Those forgotten subscriptions, hidden bank charges, credit card interest, lifestyle inflation, and missed investment opportunities collectively drain lakhs from your lifetime wealth. The good news is that plugging these leaks doesn't require earning more—it requires spending smarter.

Start today with one small action: review this month's bank statement and identify three unnecessary expenses to eliminate. Redirect that money into an emergency fund or SIP investment. As you build this habit of conscious money management, you'll notice your savings grow, financial stress decrease, and long-term goals become achievable.

Remember, financial security isn't about how much you earn—it's about how much you keep and grow. Every rupee you save from these hidden leaks becomes seed capital for your wealth-building journey. Take control of your finances now, and your future self will thank you for the financial freedom you've created.